Since July 13, Bitcoin and Ether have experienced a moderate correction. As long as the technical correction remains under the control of purchasers, it is not viable to assert that there is a significant risk of a greater decline. We will discuss the additional strategy below. I want to say a few things regarding Tesla and its current relationship with Bitcoin.

Let me remind you that Tesla invested $ 1.5 billion in bitcoin at the beginning of the year. The producer of electric vehicles stated that he anticipated long-term promise in bitcoin. The corporation has already sold three-quarters of its assets; perhaps the potential was not long-term, or the money was needed fast - we cannot say.

According to the report, as of the end of the second quarter, the corporation had converted nearly 75% of its bitcoin assets into fiat currency. The total transaction amount was $ 936 million.

Elon Musk, the CEO, is quite fond of pushing numerous tokens and alternative cryptocurrencies. When his company acquired a large amount of bitcoin last year, he was doing the same thing. Musk frequently tweets about various digital currencies that have substantial reactions to this. Many analysts have determined that the so-called "crypto winter" has arrived, as the price of bitcoin has dropped by half in the past four months, and Tesla appears to have decided that cash is now much more important than digital.

The fair market value of Tesla's bitcoin holdings reached $ 2.48 billion in the first quarter of 2021 and was approximately $2 billion by year's end. The corporation did not disclose its selling price. It is important to note that the sales took place during the second quarter when the price of bitcoin fluctuated between $46,000 and $19,000.

Due to the transaction, Tesla's total bitcoin losses are now projected to be over $460 million, according to experts.

In an interview, Musk stated, "We sold a portion of our bitcoin holdings since we did not know when the COVID limitations in China would be lifted, so we needed to optimize our cash position and build up our cache." This should not be interpreted as a verdict on the bitcoin market; funds were required. He added that Tesla is open to expanding its cryptocurrency holdings in the future.

When Tesla acquired bitcoin for a substantial amount in the first quarter of 2021, the firm cited the diversity of income and expenses as the reason. As the exchange rate soared, the corporation rapidly sold 10 percent of its shares, generating a profit of $ 101 million. Then it was revealed that Tesla would sell automobiles for bitcoins, but after some time, Elon Musk stated that Tesla would no longer accept cryptocurrency payments owing to the negative environmental effects of cryptocurrency mining, adding that the company would not sell bitcoins. After more than a year, around 15% of the purchase price remains on Tesla's financial sheet. We talk one thing yet act differently.

Regarding the technical outlook for bitcoin, the balance of power has shifted slightly toward sellers. In the case of a further decrease in the trading instrument, speculators will defend the $22,185 support level, which plays a crucial role. Its collapse and consolidation beneath this range will cause the trading instrument to return to the lows: $21,400 and $20,700, and from there to $19,960 and $19,230. If the demand for bitcoin resumes, it will be necessary to break above $ 23,070 to establish an upward trend. Fixing higher will drive the trading instrument to a maximum of $23,600, which is extremely near to the level of $24,280. A further-off objective will be the $25,780 region.

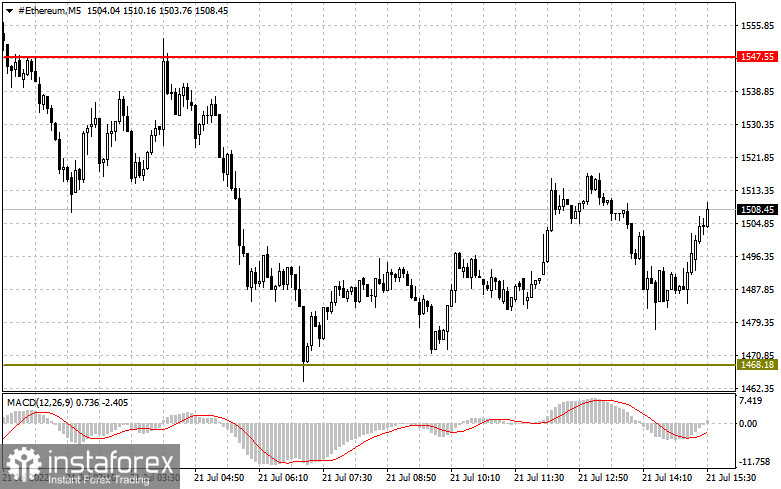

Buyers of ether are now concentrating on the $1,540 resistance. Only after growth above this level can we anticipate a sharper surge with the repeat of the highs of $1,630 and $1,740, as well as the possibility of constructing a medium-term upward trend. A return to $1,740 and consolidation on that level will spur new purchases to update the $1,830 resistance, for which a fierce battle will resume. In the event of ETH pressure, bulls will attempt to defend $1,460. At the breakdown of this range, it is prudent to anticipate purchases between $1,390 and $1,320.