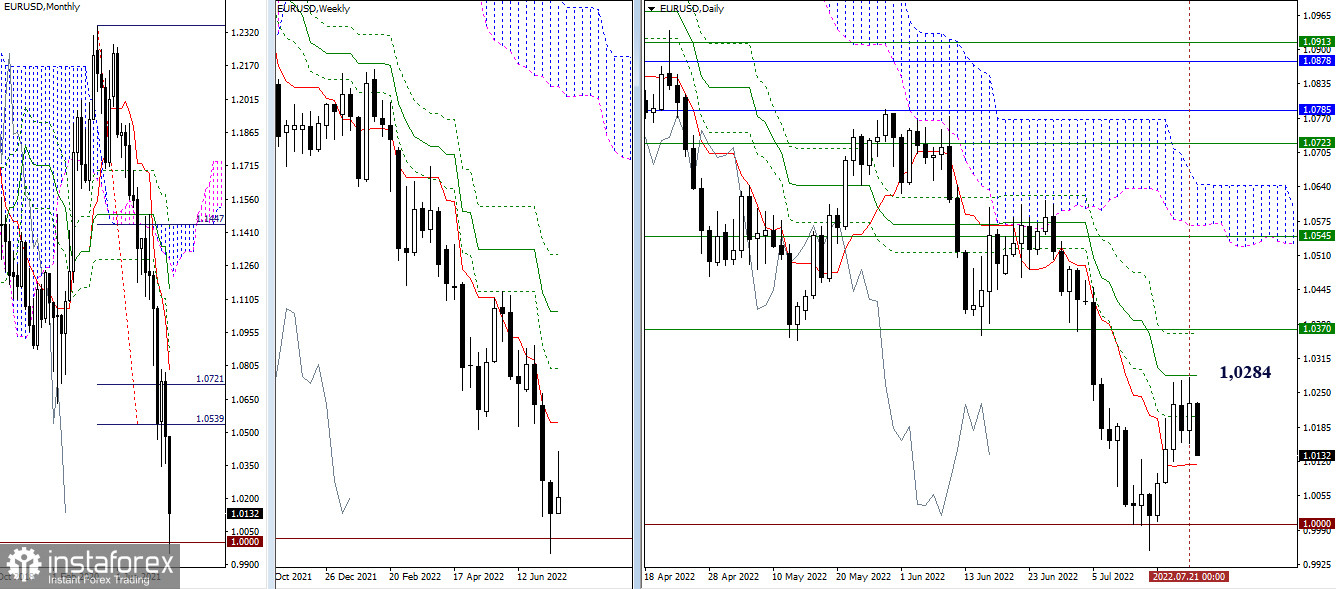

EUR/USD

Higher time frames

Yesterday, the pair was firm below the daily medium-term trend (1.0284). It remains to be seen whether bears will return to the market today, with targets at 1.0115 (daily short-term trend), 1.0000 (key psychological level), and 0.9952 (extreme low), or the pair will consolidate and bullish sentiment will prevail. In the latter case, the price may liquidate the daily death cross (1.0284 – 1.0362) and break through short-term weekly resistance (1.0370).

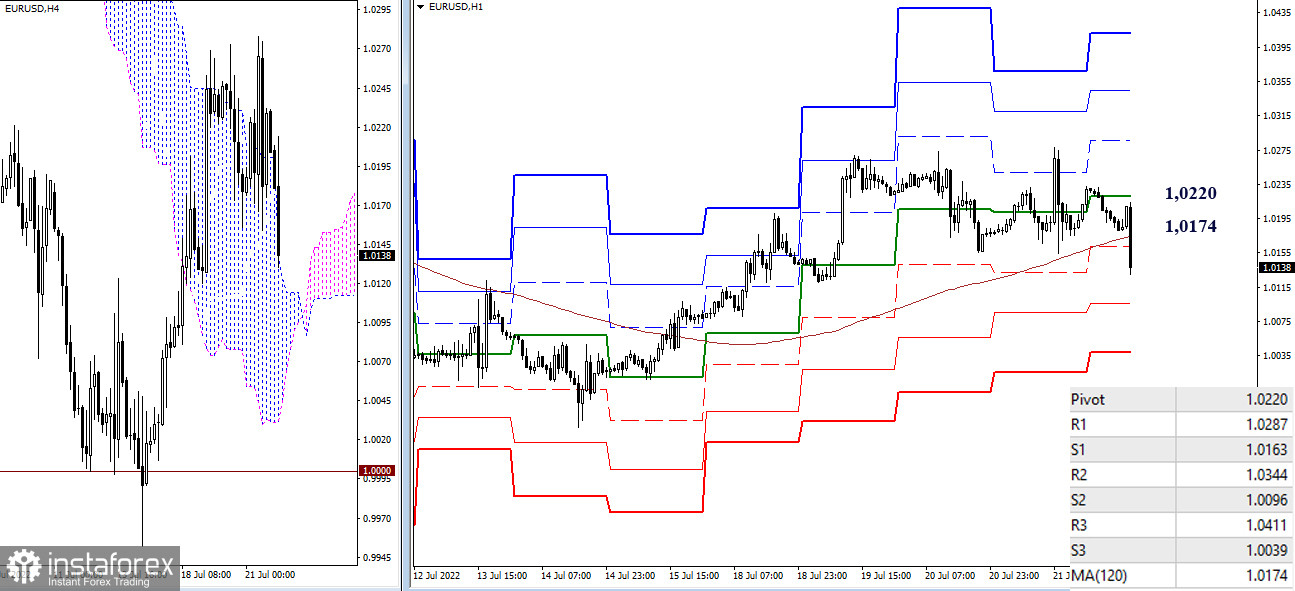

H4 – H1

In lower time frames, bears are trying to break through the weekly long-term trend (1.0174). If they manage, bearish sentiment will grow. Other intraday bearish targets are seen at Pivot levels of 1.0096 (S2) and 1.0039 (S3). To stay in control over the market, bulls should return above 1.0174 (weekly long-term trend) and 1.0220 (central Pivot level of the day).

***

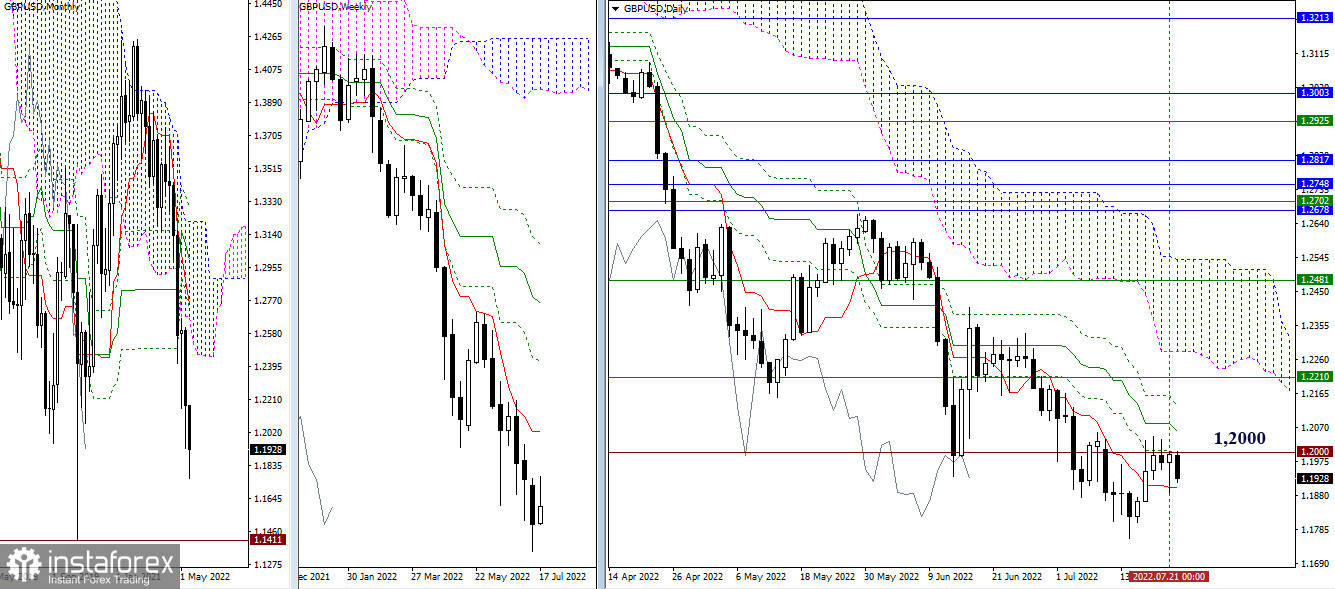

GBP/USD

Higher time frames

The pair is still consolidating below the psychological level of 1.2000. Support is now seen at 1.1920 (daily short-term trend). Bears will try to resume the downtrend (1.1759). In case of a breakout, bulls will attempt to liquidate the daily death cross (1.2059-1.2130) and break through weekly resistance at 1.2210.

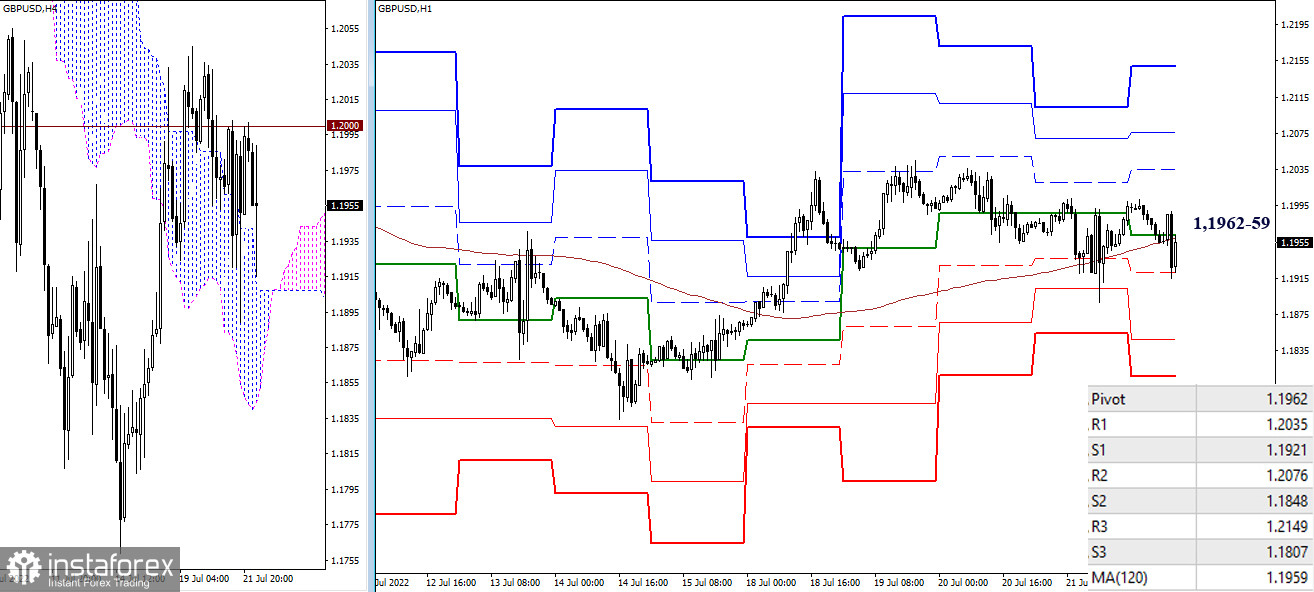

H4 – H1

In lower time frames, the pair keeps testing the key levels at around 1.1962-59 (central Pivot level + weekly long-term trend). If the price trades above the range, bullish sentiment will grow. Intraday bullish targets are seen at 1.2035 – 1.2076 – 1.2149 (classic Pivot resistance). If quotes consolidate and trade below the key levels, the focus will be on classic Pivot support (1.1921 – 1.1848 – 1.1807).

***

Technical indicators used:

Higher time frames – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun

H1 – Pivot Points (classic) + Moving Average 120 (weekly long-term trend)