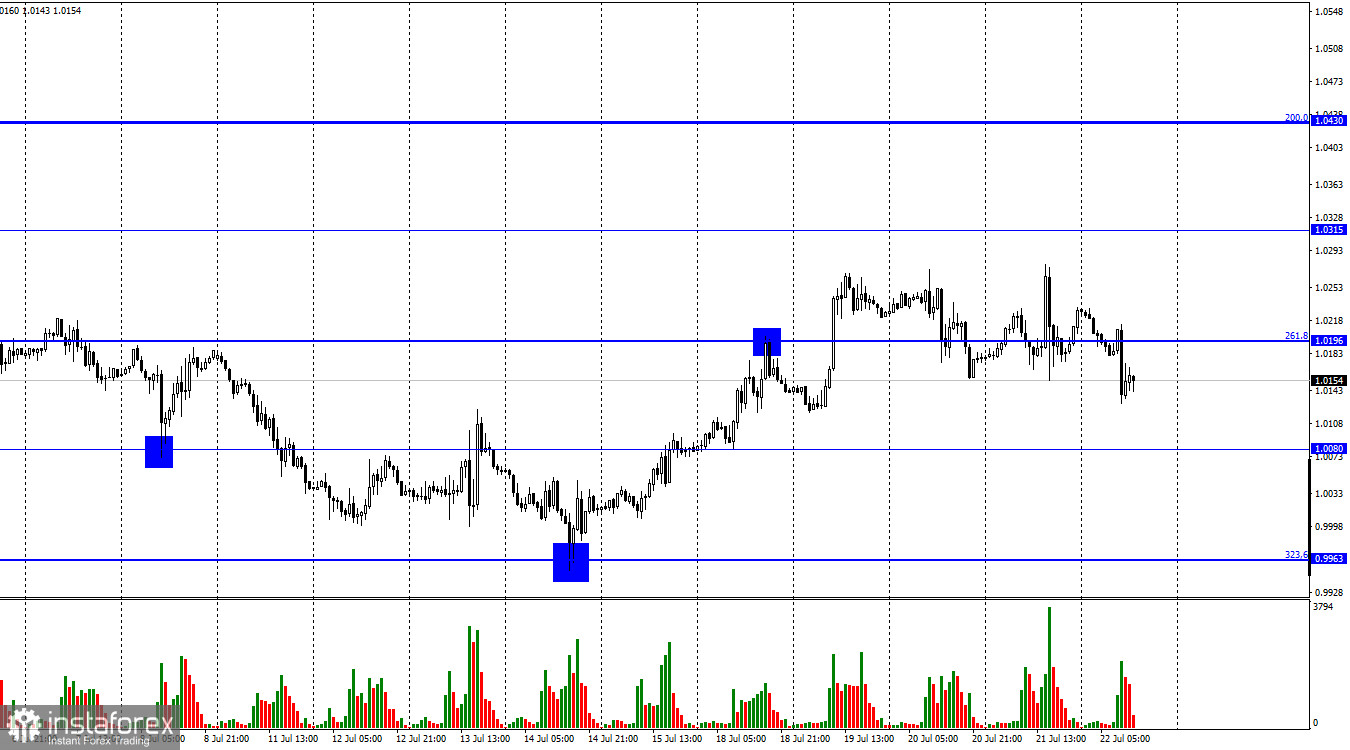

Good afternoon, dear traders! Yesterday, the EUR/USD pair performed an upward reversal to 1.0315. Shortly after, it dropped sharply to the Fibo level of 261.8% - 1.0196. On Friday morning, it dipped below 1.0196. So, traders are expecting the pair to tumble to 1.0080. After the ECB raised the interest rate by 0.50%, the euro lost momentum. Let's discuss in detail yesterday's ECB meeting and its results. The regulator decided to raise the key rate by 0.50% to curb soaring inflation. Consumer prices accelerated to 8.6% in June. Christine Lagarde noted that there had been a slowdown in economic expansion in recent months. These two statements somewhat contradict each other. In order to cap inflation, the ECB will have to hike the key rate more than once. However, how to do this if economic growth began to slow down even before the first rate increase in the last 11 years.

As a reminder, GDP in the first quarter was only 0.3%. It means that after one or two rate hikes, the economy may dwindle even more. This is what the ECB wants to avoid. In this case, it is impossible to raise the interest rate further. The central bank has almost no room for maneuver. If the regulator hikes the key rate, a recession may begin. The ECB will have to decide how to tighten monetary policy and avoid a recession. There are also other negative factors. The Services PMI Index dropped to 50.6), the Manufacturing PMI tumbled to 49.6, and the Composite PMI totaled 49.4. All three indexes lost several points compared to the previous month. Two out of three indexes fell below the 50.0 level, which signals a recession. So, it is hardly surprising that the euro has lost steam over the past two days.

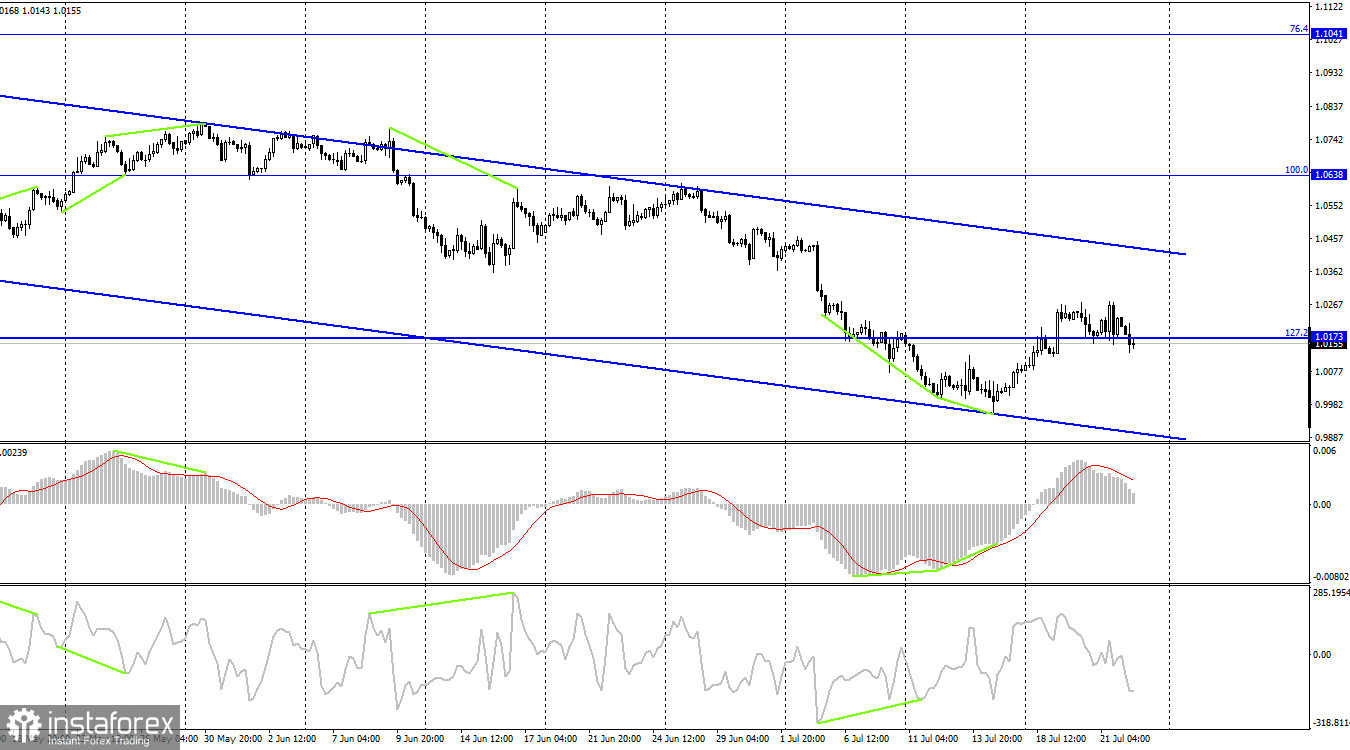

On the 4H chart, the pair performed a downward reversal, sliding below the Fibonacci correction level of 127.2% - 1.0173. The price may reach the correction level of 161.8% - 0.9581. The euro failed to grow even to the upper border of the descending channel. It means that the bearish bias prevails. The euro is likely to rebound only if it consolidates above the descending channel.

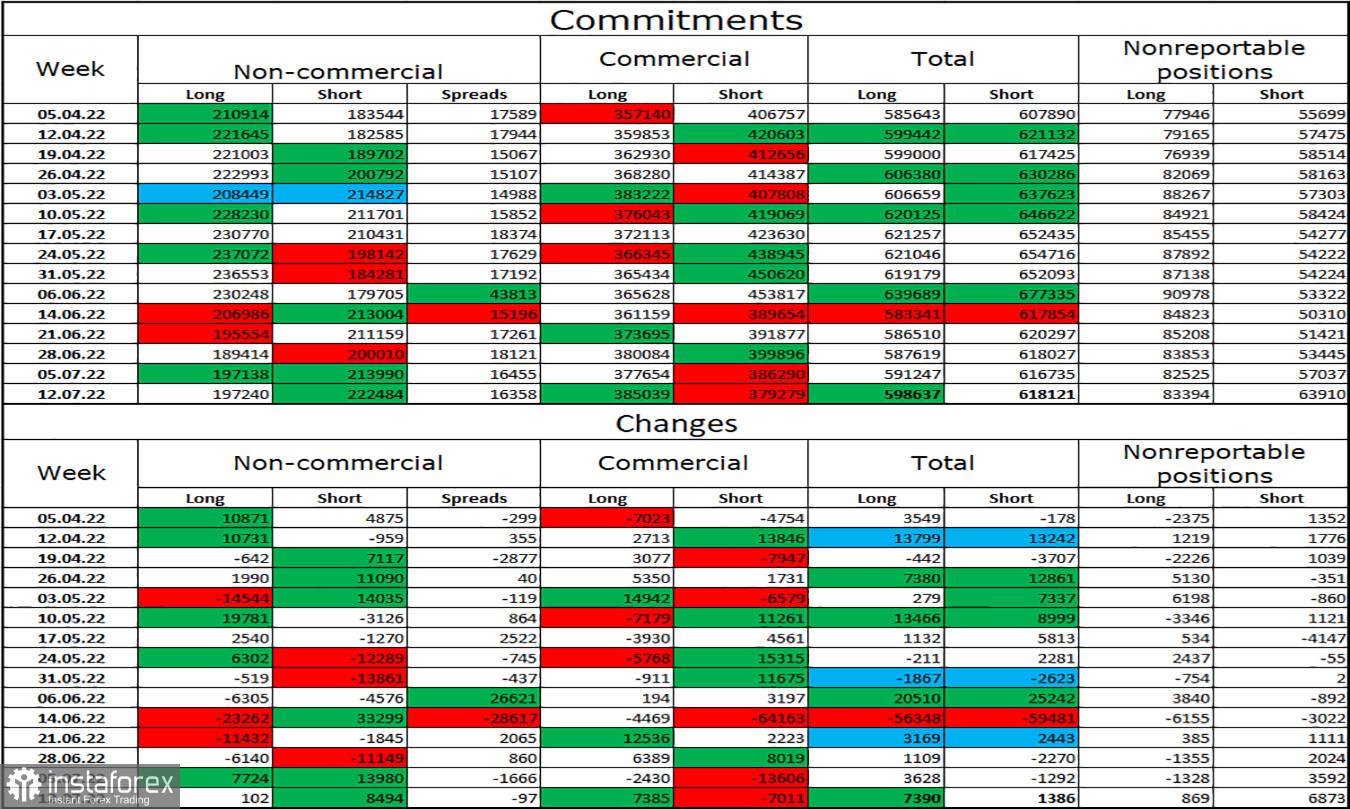

Commitments of Traders (COT):

Last week, speculators opened 102 Long contracts and 8,494 Short contracts. It means that the bearish mood has intensified again. The total number of Long contracts is now 197,000 and the total number of Short ones totals 222,000. The difference is not too big but it is not in favor of the bulls. In recent months, "Non-commercial" traders, have remained mainly bullish on the euro. Yet, it did not significantly help the euro. In the last few weeks, the likelihood of a rally has been gradually growing. However, recent COT reports have shown that a new sell-off may take place as the sentiment has changed from bullish to bearish. This is exactly what we are witnessing at this moment.

Economic calendar for US and EU:

EU – Services PMI Index (08:00 UTC).

EU– Manufacturing PMI Index (08:00 UTC).

EU – Composite PMI Index (08:00 UTC).

US – Services PMI Index (13:45 UTC).

US – Manufacturing PMI Index (13:45 UTC).

US – Composite PMI Index (13:45 UTC).

On July 22, the EU has already unveiled its economic reports. In a couple of hours, the United States is going to release the same data. However, the impact of fundamental factors on the market sentiment will be muted today.

Outlook for EUR/USD and trading recommendations:

It is better to open short positions if the pair drops below 1.0173 on the 4H chart, aiming at the target levels of 1.0080 and 0.9963. It is recommended to open short positions if the price consolidates above the downward channel on the 4H chart with the prospects of a rise to 1.0638.