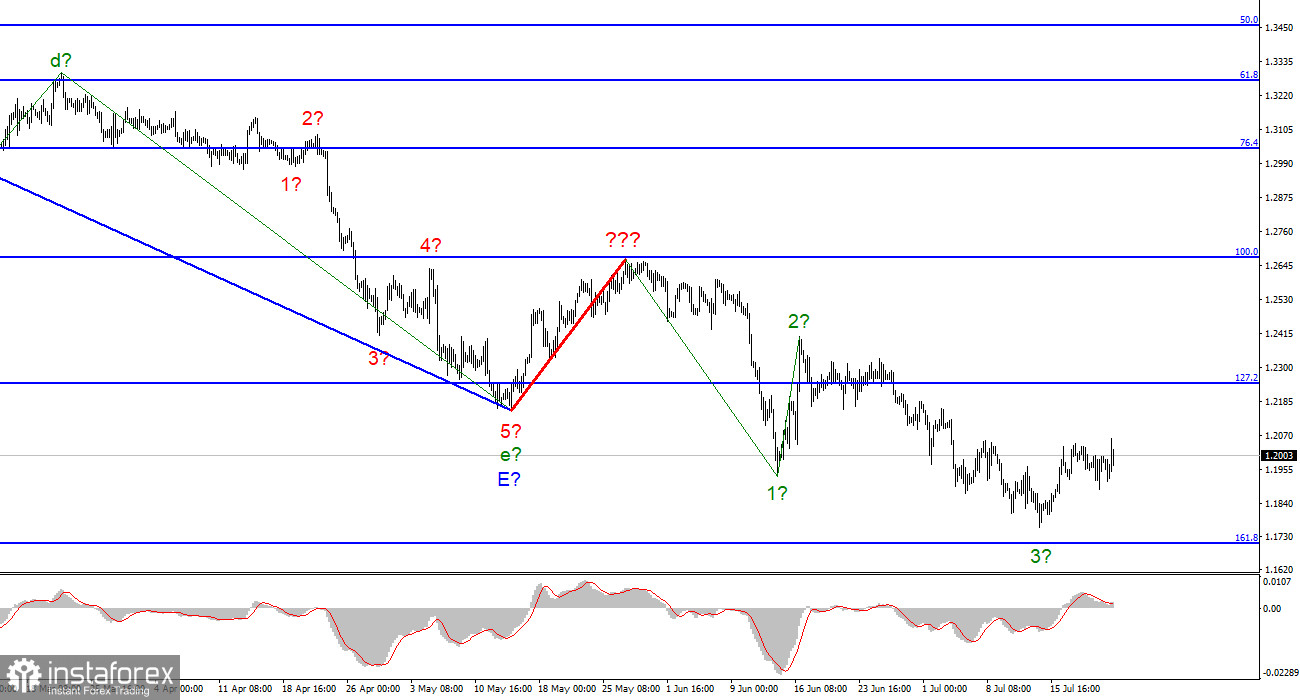

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I'm not a big fan of continually complicating the wave marking when dealing with a highly elongating trend zone. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. Now that waves 1, 2, and 3 have been finished, we can infer that the instrument is constructing wave 4. The wave patterns of the euro and the pound differ slightly in that the euro's downward trend section has an impulsive form. However, the ascending and descending waves occur roughly equally frequently. After wave 4, I anticipate a new fall in the British population.

The British political instability is a further impediment to the pound's growth.

The exchange rate of the pound/dollar instrument climbed by only 10 basis points on July 23, although the daily amplitude was at least 75 points. Yesterday, I talked about the fragility of American statistics. The British version was slightly better, but it raised concerns about the economy's future. Many nations throughout the globe are on the cusp of recession, and the United Kingdom is no different. In addition, a new political crisis has emerged in Britain. And it began with the fact that Boris Johnson was ultimately compelled to resign despite the opposition's efforts. It necessitated the departure of nearly all ministers, but when Johnson's direct subordinates refused to work with him, it was evident that he must be replaced as prime minister.

Former Finance Minister Rishi Sunak, who resigned due to disagreements with Johnson's policies and behavior, and Foreign Minister Liz Truss, who defeated Penny Mordaunt in the previous round, are candidates for the position of prime minister. The election for a new prime minister began a week ago. I cannot determine which candidate will be better for the British economy. Presumably, Rishi Sunak, who held the position of Finance Minister for several years. However, many observers notice his relatively rigid approach to the economy, which does not include tax cuts. And the decline in British real earnings is a significant issue. While inflation is increasing, salaries are not keeping pace. The British are not the world's poorest people, but discontent with the government's policies may lead to a call for reelection. The Conservatives may lose their majority in the House of Commons, and the Labor Party may recover from its disgraceful election loss. Consequently, the political standing of the Conservative Party following the upcoming parliamentary elections will rely on who becomes the new prime minister and what policies he pursues. From this angle, Liz Truss appears more attractive.

General observations.

The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1,1708, which corresponds to 161.8 percent Fibonacci. Now, there is a prospect of an upward wave forming, but I do not anticipate it to be robust and protracted.

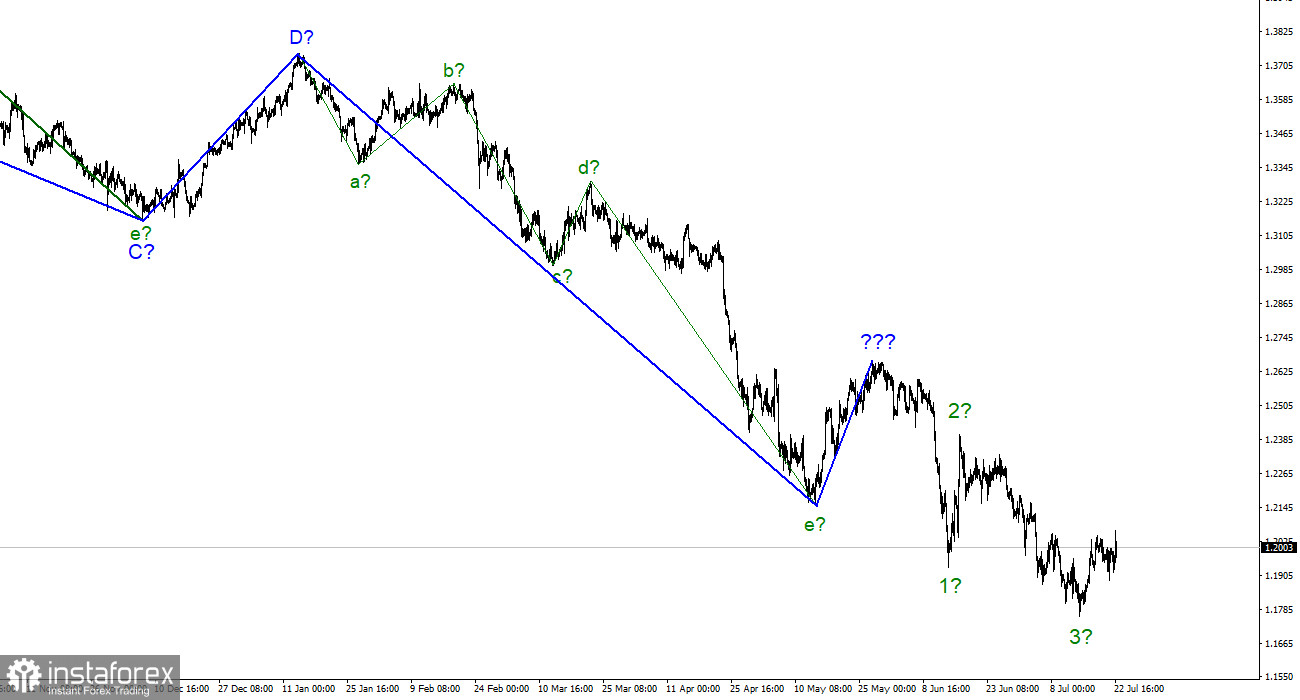

At the higher wave scale, the image closely resembles the euro/dollar instrument. The same ascending wave does not conform to the present wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach practically any length.