The euro-dollar pair was trading in the range of 1.0130-1.0270 last week, alternately starting from the boundaries of this price range.

Bulls were unable to develop an upward momentum, despite the European Central Bank's unexpected rate hike of 50 basis points. Two days before the July meeting, journalists from the Reuters news agency published a corresponding insider, essentially warning the markets about a more hawkish decision by the ECB. Therefore, the "surprise effect" did not work - traders reacted minimally to the very fact of a 50-point hike. Whereas the subsequent rhetoric of ECB President Christine Lagarde disappointed market participants. Lagarde rather vaguely outlined the prospects for tightening monetary policy, saying that further rate hikes would depend on incoming data. As a result, EUR/USD bulls could not even approach the borders of the third figure, while for the development of the upward movement it is necessary not only to overcome the resistance level of 1.0300, but also to settle above it. Bears, in turn, need to settle below the 1.0100 target in order to reclaim the parity zone. In other words, both bulls and bears of the pair need to leave the 1.0130-1.0270 range, within which they traded during the past week.

The upcoming five-day trading week is full of events for the EUR/USD pair. For example, German IFO reports will be published on Monday. The indicator of business environment conditions should demonstrate negative dynamics, putting pressure on the euro. The indicator of economic expectations is most likely to show a similar result. It should be recalled here that weak PMI indices were published last week, which turned out to be in the red zone. Weak reports from the IFO can complement the fundamental picture accordingly.

The most important macroeconomic statistics will be published in the United States on Tuesday. First of all, we are talking about the indicator of US consumer confidence. In June, it showed the weakest growth since February 2021. The July result may also turn out to be disappointing: the index should reach 96 points. In this case, it will be possible to talk about a certain trend (a three-month downward trend). Data on the volume of home sales in the primary US market will also be released on Tuesday. Here, on the contrary, positive dynamics is expected.

The most important day of the week for the EUR/USD pair is Wednesday. The results of the July Fed meeting will be announced on this day. The main intrigue of this meeting lies in the pace of monetary policy tightening. No one doubts that the Fed will raise the interest rate, the only question is by what amount. After the release of the report on the growth of the US consumer price index, rumors appeared on the market that the central bank might decide on a 100-point hike. This idea was voiced by the head of the Fed Bank of San Francisco Mary Daly. The Bank of Canada also added fuel to the fire, which unexpectedly raised the rate by 100 points in July (contrary to forecasts of a 75-point increase).

At the same time, some Fed members (Christopher Waller and James Bullard) were skeptical of this proposal, while supporting the idea of increasing the rate by 75 points. Nevertheless, the intrigue in this matter persists. The consumer price index, which has already exceeded 9 percent, speaks in favor of an unlikely, but still hypothetically possible scenario of a 100-point hike. This scenario is opposed by the core PCE index, which has been slowing its growth for the third consecutive month. In general, some experts (in particular, Nomura Securities International and Citigroup) do not rule out an increase in the rate by 100 points. In this case, the dollar will receive significant support throughout the market, and paired with the euro will be able to test the parity level again.

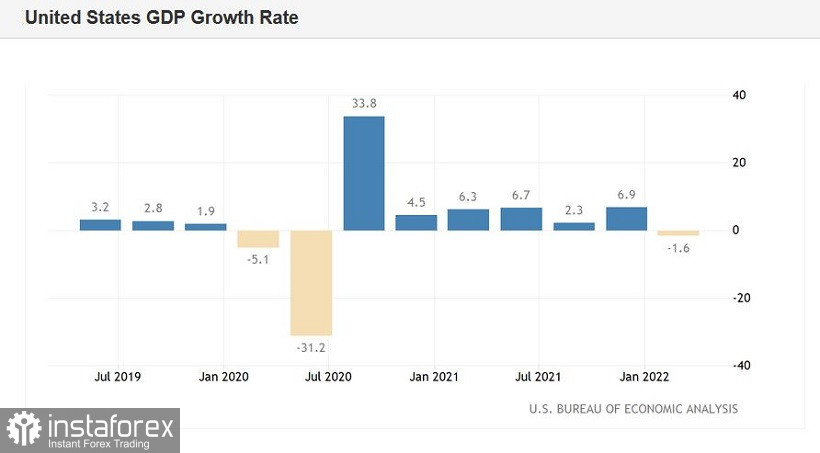

On Thursday, we will learn data on the growth of the American economy in the second quarter of this year. This release may also provoke volatility among dollar pairs. Let me remind you that in the first quarter, the volume of US GDP decreased by 1.6%. If the indicator also comes out in the negative area in the second quarter, it will indicate a technical recession. According to general forecasts, in the second quarter, the American economy will show minimal, but albeit growth, increasing by 0.4%. This report, in my opinion, is the most important event of the week after the Fed meeting.

Key data on inflation growth in the eurozone will be published on Friday. According to general forecasts, the consumer price index will again show record growth: the total CPI in annual terms should rise to 8.7% in July, the core – to 3.9% (according to other estimates – to 4.0%). In my opinion, this release can have an impact on the EUR/USD pair only if it comes out in the red zone - then the euro will weaken significantly throughout the market, given the vague results of the July ECB meeting.

Thus, a hot trading week is ahead, which will determine the vector of movement of the EUR/USD pair in the medium term. Most likely, the pair will trade in the range of 1.0130-1.0270 before the announcement of the results of the Fed meeting. Further prospects will depend on the decisions and rhetoric of the Fed representatives: either EUR/USD bears will get a reason to retest the parity level, or bulls will be able to enter and settle in the area of the 3rd figure. Short positions on upward pullbacks can be considered before the Fed meeting, but it is advisable to be out of the market immediately before the meeting.