Bitcoin has been trading above $20k for over a week now and is gradually realizing bullish momentum towards a key resistance zone in the $23.9k–$24.2k area. The asset managed to form several important support zones that hold the price during increased selling pressure. Over the weekend, we observed a local weakening of the BTC price amid a drop in buying activity. Weekend trading volume fell below $25 billion, which provoked a local advantage of the bears.

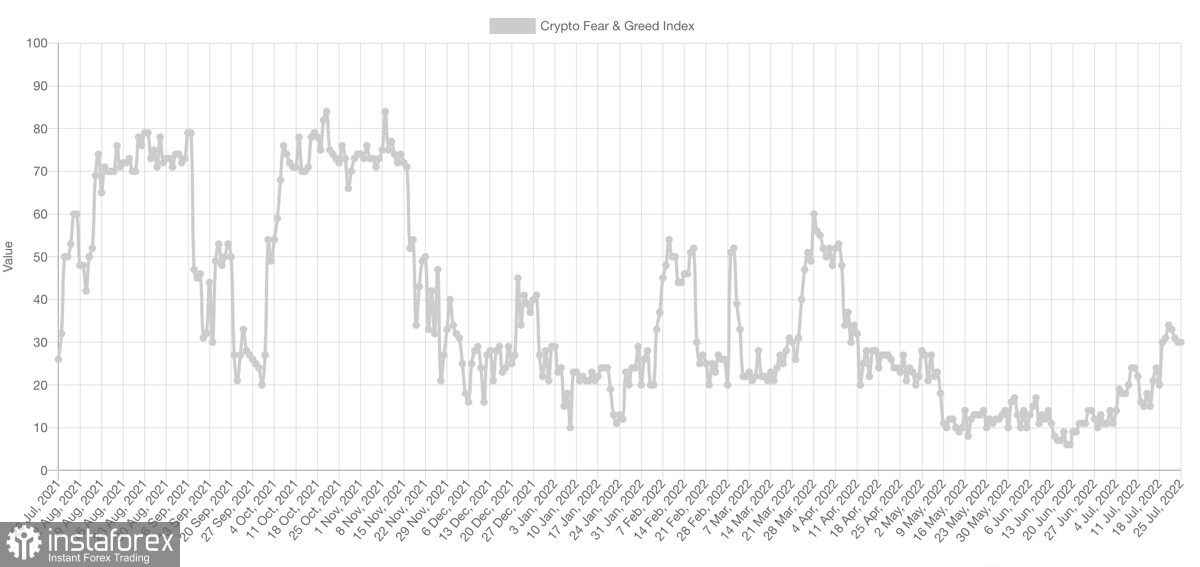

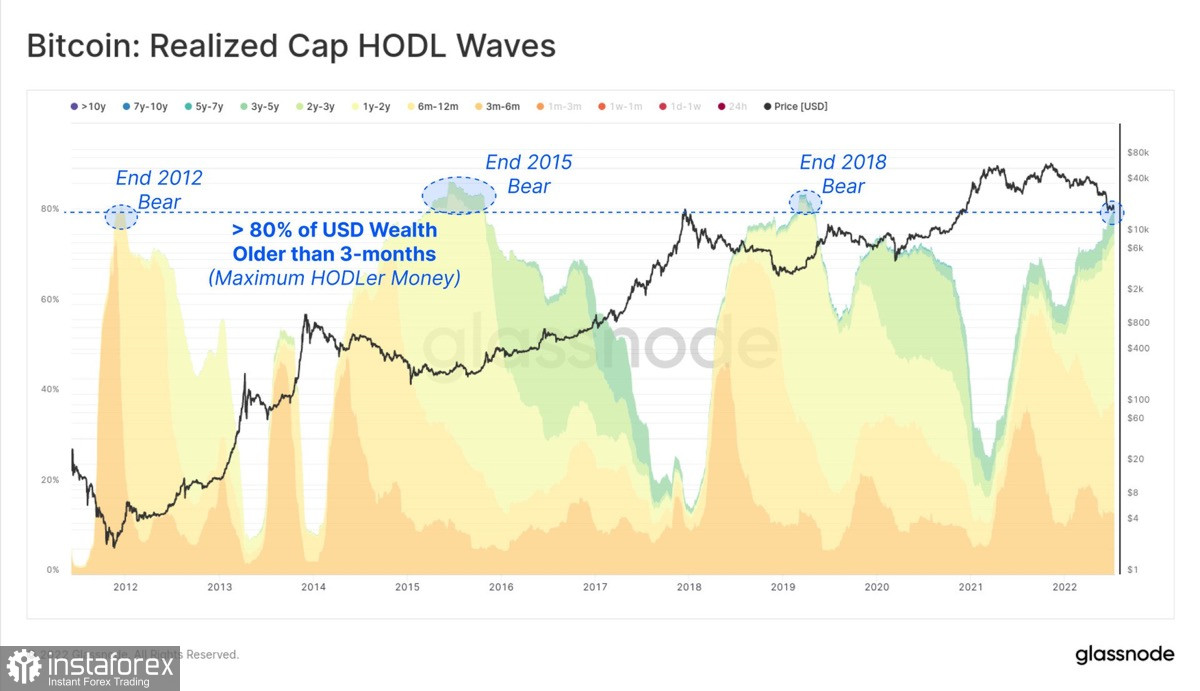

However, even despite a temporary decrease in buying activity, Bitcoin maintains a key support zone at $21.5k. Key metrics point to the growing popularity of Bitcoin. The total number of unique addresses in the BTC network has crossed the 1 billion mark. There is also an increase in activity of large and small investors. The fear and greed index has reached 30, which is a positive result considering the latest metrics. Glassnode experts also state that more than 80% of BTC investments have not moved for more than three months, which historically points to the bottom of a bear market.

Former BitMEX CEO Arthur Hayes agrees with this opinion, who believes that ultimately the difficult economic situation in Europe and Japan will force the Fed to print dollars again to buy bonds of these countries. It will trigger another Bitcoin bull market and accelerate its adoption as a means of payment. Hayes calls the upward movement of the cryptocurrency to $24k the liquidation of shorts and the cleansing of the market. Despite the formation of a local bottom, the entrepreneur does not rule out a further fall in Bitcoin and a retest of the $17.7k level.

The downward movement of Bitcoin in the near future is likely for two reasons: overly aggressive policy of the Fed and raising the key rate by 100 basis points. Either the capitulation of miners following from the policy of the regulator, or the capitulation of miners, provoked by the deterioration of the situation on the energy market. However, according to the current situation in the Bitcoin market, when buyers retreated locally and allowed sellers to dictate terms, the price barely broke through the $22.7k level. It suggests that, despite the local pauses from the bulls, the potential Bitcoin downward movement has been exhausted.

An important factor that positively affects the attitude of investors towards Bitcoin is the situation around Ethereum and the altcoin market. One of the creators of ETH, Vitalik Buterin, said that Ethereum will reach a speed of 100,000 transactions per second while gradually moving to the PoS algorithm. The final merger is scheduled for mid-September, but analysts believe that due to the need to switch the DeFi segment of ETH to PoS, the process will be delayed until October.

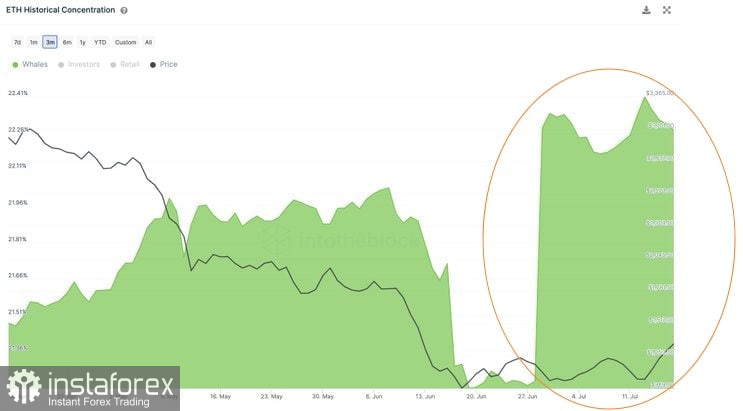

The transition to PoS is accompanied by active investment activity of large and retail investors. On July 19, a record purchase of ETH/USD in the futures market for seven months was recorded. In addition, the activity of institutional investors in relation to ETH has increased since the beginning of July. As a result, the altcoin market perked up, and according to data from Glassnode, altcoin outflows from centralized exchanges hit a 13-month high. In addition, Ethereum is on the verge of a bullish breakout of the May 15 downard trend line.

The situation around ETH improves the overall market sentiment and positively affects Bitcoin. Meanwhile, the main cryptocurrency began a new working week with a fall of 4% and a breakdown of the $22k level. The nearest support level will be $21.5k. There is a decline in the RSI and the stochastic oscillator on the daily timeframe, indicating increased selling and growing pressure on the price. At the same time, the MACD remains bullish, which is why a divergence has formed. It means that the decline is short-term, and BTC/USD quotes will stabilize in the near future. It will likely happen near the $21.5k support zone. With this in mind, BTC will need a serious reason to make a downward breakout of the $20k level and continue moving towards the local bottom.