Stocks retreated as traders assessed the outlook for corporate earnings and Federal Reserve policy amid the looming threat of a recession.

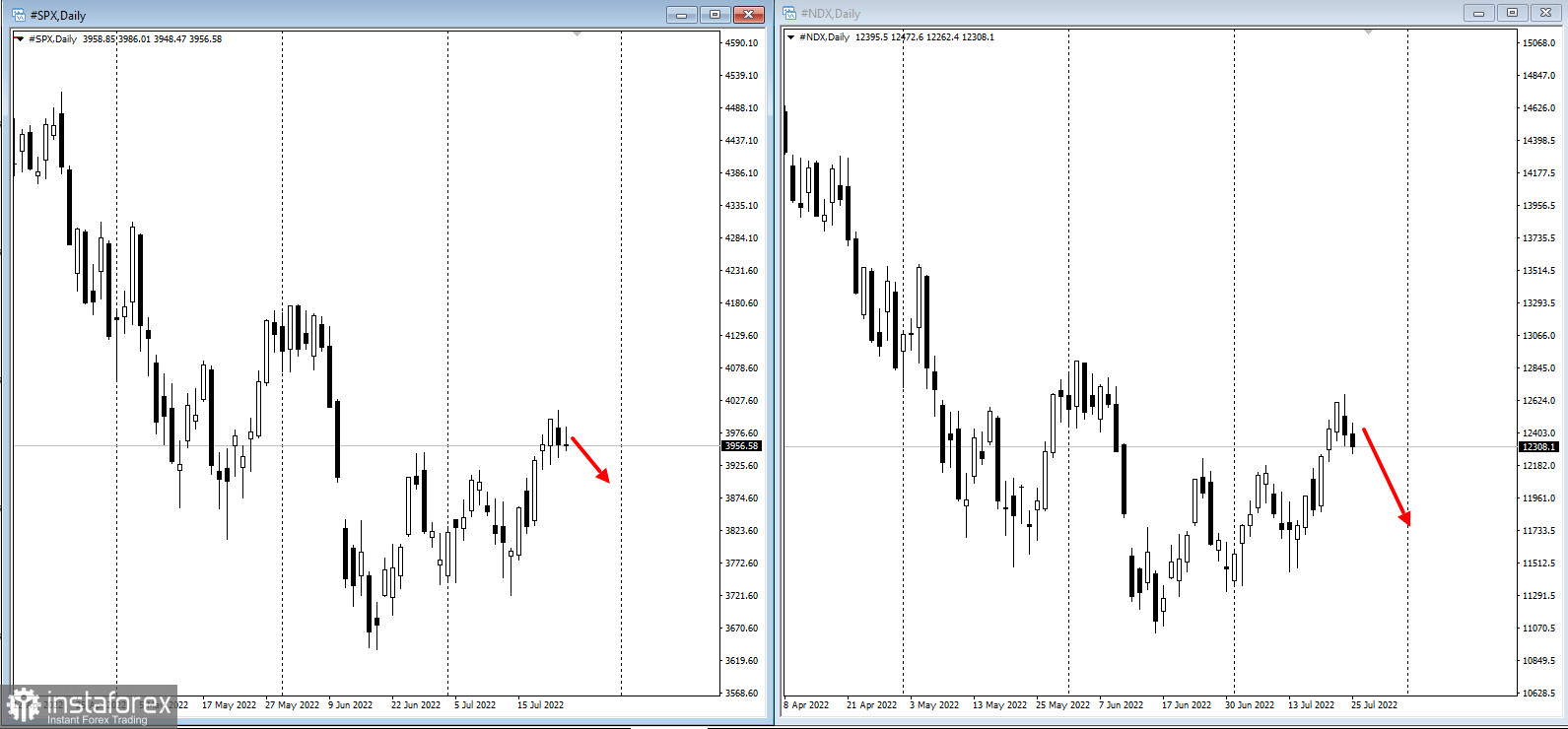

The S&P 500 index stayed flat, while the technology-heavy Nasdaq 100 underperformed. Treasury 10-year yields topped 2.8% and a dollar gauge slipped.

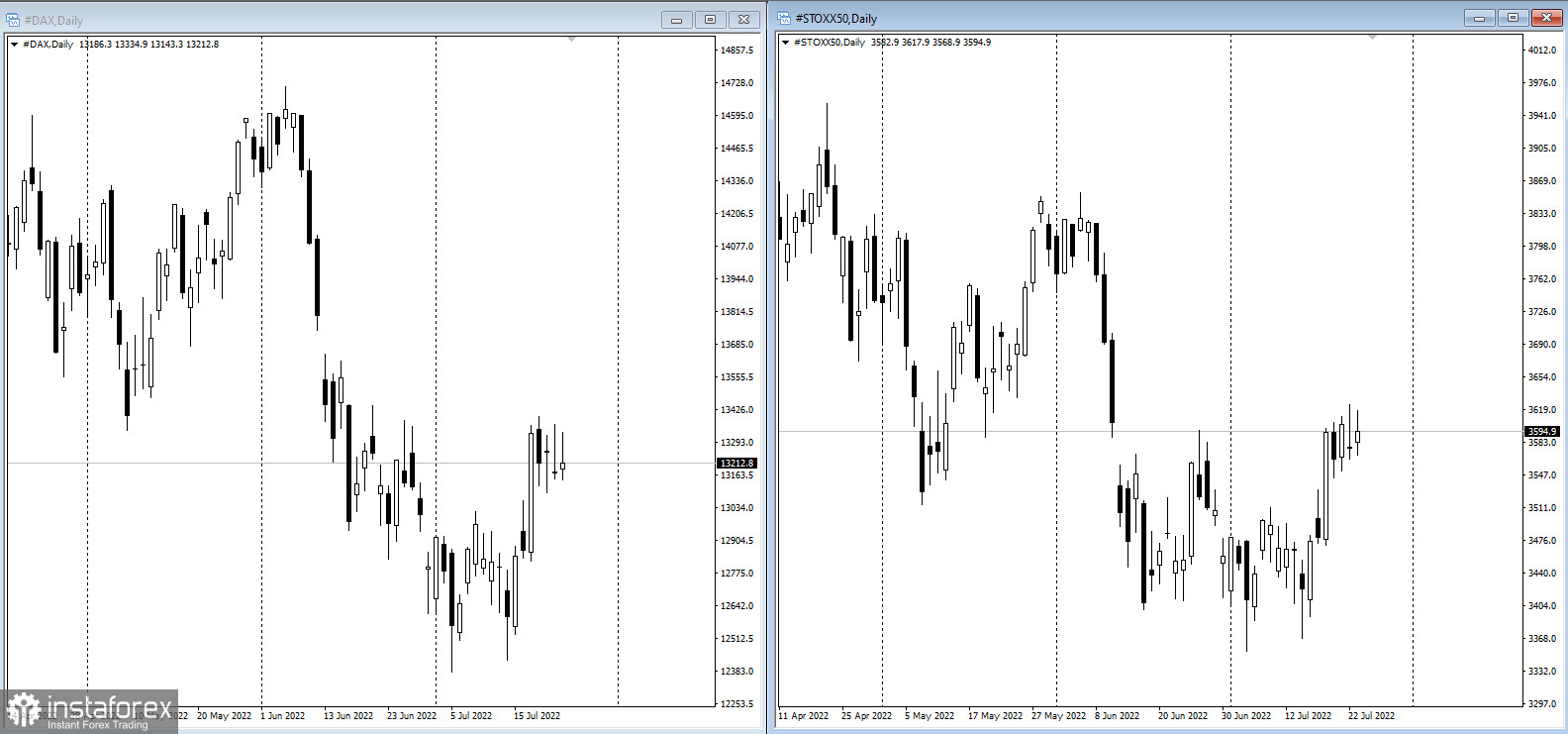

STOXX50 and DAX performed slightly better than their US counterparts. However, there are signs of a slowdown in the two-week rise, which is a correction of the big drop in the indices.

Investors are betting on another Fed hike of at least 75 basis points this week, which will probably inflict more pain on the economy as officials try to get inflation under control. The decision, along with earnings from the likes of Google's parent Alphabet Inc. and Apple Inc., will help clarify the outlook for a sustained rebound in stocks.

"We don't think that this bear market is going to end until there's some evidence of nearing a bottoming of economic data or a pivot by the Fed toward a more dovish stance," Nadia Lovell, UBS Global Wealth Management senior US equity strategist, said.

Wheat climbed as commodity markets evaluated a Russian missile strike on Odesa's sea port.

Key events to watch this week:

- Alphabet, Apple, Amazon, Microsoft, Meta earnings due this week

- Bank of Japan minutes, Tuesday

- IMF's world economic outlook update, Tuesday

- EU energy ministers emergency meeting, Tuesday

- Fed policy decision, briefing, Wednesday

- Australia CPI, Wednesday

- US GDP, Thursday

- Euro-area CPI, Friday

- US consumer income, University of Michigan consumer sentiment, Friday