Against a poor economic calendar ahead of the outcome of the Fed meeting this week, even medium-sized news are of interest, increasing volatility in the market.

The report of the research group CESifo published on Monday pointed to another deterioration in the business climate and business sentiment in Germany. The German IFO business climate index fell to 88.6 in July against the expected 90.5; the current economic assessment index fell to 97.7 from 99.3 in June, also worse than the forecast of 98.2. The IFO index of economic expectations, which reflects the forecasts of companies for the next six months, fell sharply to 80.3 in July (from 85.8 in June and against the forecast of 83.0).

This report by the German research institute Ifo, based on a survey of 9,000 firms in the manufacturing, services, trade and construction sectors, reflecting the current level of business sentiment in Germany, attracts close attention, as it is a leading indicator of current conditions and expectations in the business sector of this country, whose economy is the locomotive of the entire European economy.

Positive economic growth in Germany is bullish for the EUR, and a low reading is negative. And such a frankly weak Ifo report suggests that Germany, and the entire eurozone economy, is on the verge of a recession, under pressure from high energy prices and geopolitical uncertainty related to the situation in Ukraine.

According to Ifo economists, German companies expect a significant deterioration in business activity in the coming months.

Nevertheless, the euro is still resisting pressure from negative macro statistics and high inflation in the eurozone. As follows from a recent report by Eurostat, annual inflation in the euro area in June amounted to 8.6%.

In response to the acceleration of inflation in the region, the ECB raised the interest rate in July, the first time in the last 11 years. Last week, the bank raised interest rates by 50 bps against the 25 bps expected. Now, the ECB leaders expect an increase in short and long-term inflation expectations in the euro area and a further tightening of monetary conditions. Inflation in 2022 is expected at 7.3% against a 6.0% estimate three months ago. And GDP growth in 2022 is expected at 2.8% against 2.9% predicted three months ago, and in 2023 at 1.5% against 2.3%.

Increasing pressure from energy prices, tightening monetary policy, and weakening household purchasing power are holding back the growth of the European economy. Amid renewed concerns about an impending recession in the bloc, the euro failed to strengthen significantly after the July ECB meeting.

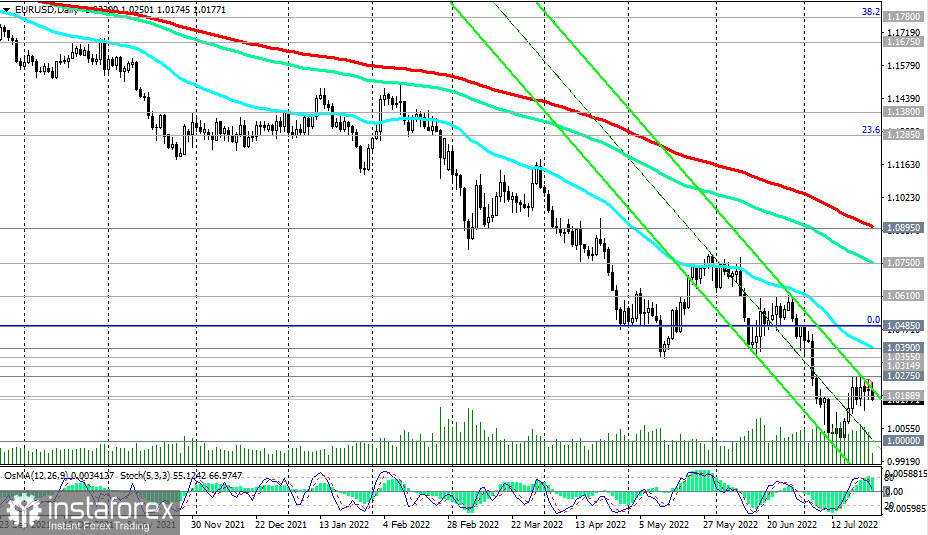

After rising from the parity level, the EUR/USD pair failed to develop a stable upward trend and overcome the local resistance level of 1.0275.

Today, EUR/USD is declining, trading near 1.0180 as of this writing, testing the important short-term support at 1.0189 for a break.

At the same time, the dollar index (DXY) resumed growth today. Given the strong bullish momentum and the long-term upward trend in DXY, a breakdown of the local resistance level of 109.00 will be a signal to increase long positions in DXY futures with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and November 1985.

Thus, there is every reason to believe that EUR/USD will soon test the 1.0000 level again, especially if tomorrow's Fed decision regarding its monetary policy does not disappoint market participants. Also of great importance will be the press conference following the Fed meeting, which will begin on Wednesday at 18:30 GMT. In its course, a surge in volatility is possible not only in the quotes of the dollar, the EUR/USD pair but also in the entire financial market.

If market participants think Fed Chairman Jerome Powell's speech tomorrow is tough, this will most likely be followed by a strengthening of the dollar and, accordingly, a fall in EUR/USD. And conversely, if the tone of Powell's statements turns out to be soft, then this will have a negative impact on the dollar, which may provoke an increase in EUR/USD. So far, we are leaning towards the first scenario.