The euro-dollar pair continues to trade within the 1.0130-1.0270 price range in anticipation of the announcement of the results of the July Federal Reserve meeting. But if the pair showed an upward dynamic on Monday, getting closer to the upper boundary of the range, but today the situation is mirrored. The single currency was again under pressure amid a rapid rise in gas prices. The cost of natural gas has already exceeded the mark of $ 2,000 per thousand cubic meters, and this fact provoked serious nervousness in the markets. This fundamental factor made it possible for the EUR/USD bears to turn the pair 180 degrees and decline to the lower limit of the above price range. But if we ignore intraday price fluctuations, we will see that the pair is actually marking time, waiting for the verdict of the US Federal Reserve. Therefore, it is impossible to talk about the resumption of the downward trend now: EUR/USD bears seized the initiative, but at the same time remained within the established price echelon, in which they have been trading for the second week.

In general, the situation for the euro is the worst. By and large, EUR/USD bulls have only one chance to strengthen their positions – this is the weakening of the greenback following the results of the Fed's July meeting. If we exclude this scenario, then the resumption of the downward trend is only a matter of time.

In other words, under the current conditions, a corrective growth of the pair is possible only if the US dollar index decreases. The single currency, in fact, has lost its fundamental trump cards, while the gas issue serves as a heavy anchor for EUR/USD. The European Central Bank has not become an ally for the euro, despite a 50-point rate hike. Traders doubt that the central bank will continue to tighten monetary policy at an aggressive pace, although some ECB members (in particular, the head of the central bank of Latvia, Martins Kazaks) advocate the implementation of this scenario. But here we again return to the notorious gas issue, which is of a system-forming nature.

Yesterday Gazprom announced the shutdown of another turbine at the compression station responsible for pumping through the Nord Stream gas pipeline. Due to this circumstance, the capacity of the node will decrease to 33 million cubic meters from July 27. This is only 20% of the throughput capacity. For comparison, we can say that today the daily capacity of the node is about 70 million cubic meters. Against this background, the prices of blue fuel shot up, exceeding the 2,000 mark, for the first time since March.

It also became known that representatives of the EU countries in general have reached a political agreement to reduce gas consumption. According to German media, the plan proposed by the European Commission provides for a voluntary reduction of national consumption by 15% in the period from August 1, 2022 to March 31, 2023." This plan implies the possibility of some exceptions, given the negative reaction of a number of EU countries. But in general, an agreement on this issue has been reached.

Amid a reduction in supplies from the Russian Federation, as well as self-restraint on the part of the EU, the cost of not only gas, but also energy is increasing in Europe. Energy prices in the eurozone rose by almost 42% in June. German electricity contracts for next year's delivery reached the highest quotes in the history of auctions: the price jumped by 13% to 325 euros per MW-hour on Monday. A similar situation has developed in France.

According to a number of media reports, the largest industrial energy consumers in Europe have already warned the authorities that with the arrival of cold weather, some plants will stop due to an acute shortage of fuel, as well as due to the emergency measures introduced to limit its use.

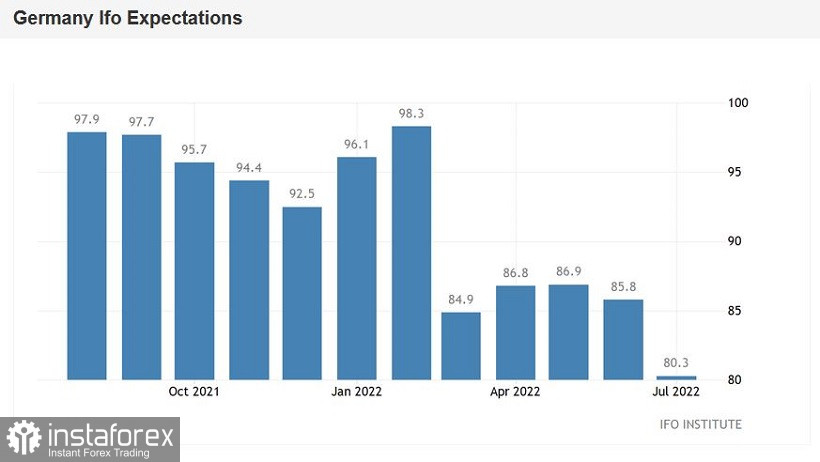

Here it is necessary to recall yesterday's reports from the IFO Institute, which came out in the "red zone". The indices fell to two-year lows: representatives of German companies expect "a significant deterioration in business activity in the coming months." The IFO also warned that Germany is on the verge of recession due to rising energy prices and gas shortages.

In turn, the dollar is strengthening its position amid increasing geopolitical tensions. The focus is on Taiwan again, in the context of the possible consequences of Nancy Pelosi's August visit to the island. The Ministry of Defense of China announced that the PRC army "will not sit idly by in the event of a visit by the speaker of the US House of Representatives to Taiwan." According to representatives of the defense department, the military will take measures "to prevent external interference." In addition, the Ministry of Defense reported that a possible visit would seriously violate the principle of "one China", harm the relations between China and the United States in the military sphere, and also lead to an aggravation of the situation in the Taiwan Strait. Beijing's rhetoric regarding the "Taiwan case" is consistently tightening, while the White House is not yet seeking to reduce the degree of intensity.

Thus, the prevailing fundamental background for the EUR/USD pair indicates the priority of the downward movement. The "dark horse" here is the Fed, which may weaken the position of the US currency on Wednesday. But if we exclude this scenario, there are all prerequisites for retesting the parity zone in the medium term. Therefore, in the current conditions, one can either consider short positions on corrective pullbacks (with targets of 1.0100 and 1.0050), or take a wait-and-see position before the announcement of the results of the July Fed meeting. Longs look risky anyway.