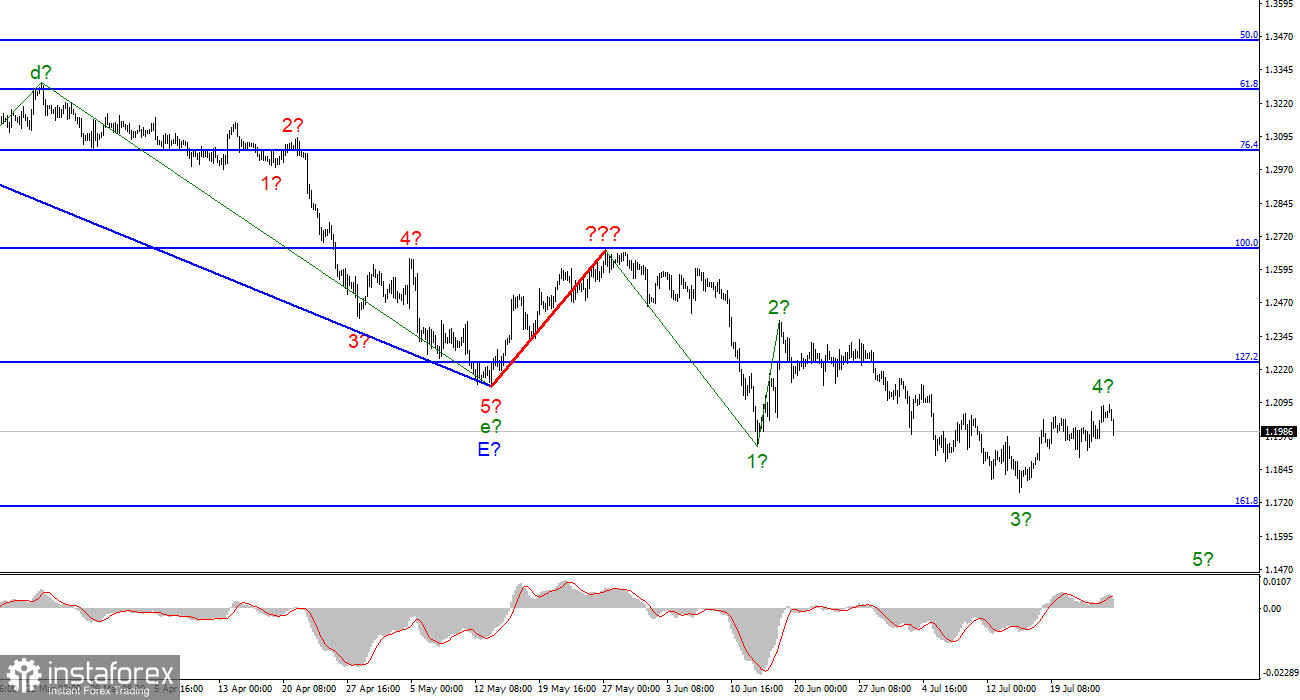

The wave marking for the pound/dollar instrument required clarifications, which were made. The upward wave constructed between May 13 and May 27 does not currently fit into the overall wave picture, but it can still be regarded as a segment of the downward trend. Thus, we can now definitively state that the building of the upward correction phase of the trend has been canceled, and the downward component of the trend will have a longer and more complex shape. I am not a huge fan of continually complicating the wave marking when dealing with a trend zone that is significantly elongating. I believe it would be far more efficient to recognize rare corrective waves, following which new impulse structures can be constructed. We have completed waves 1, 2, and 3. Thus, we can presume that the instrument is currently constructing wave 4. (which may also be completed already). Euro wave patterns differ slightly from the pound in that the euro's downward trend segment has an impulsive form (for now). However, the ascending and descending waves occur roughly equally frequently. After wave 4, I anticipate a new fall in the British population.

The pound awaits the outcome of the election and the FOMC and BoE meetings.

The pound and dollar exchange rates declined by 65 basis points on July 26. The current downturn is not yet substantial enough to be considered the commencement of a new downward wave. Allow me to remind you that the euro has dropped 100 points today. Nevertheless, given that the euro and the pound tend to move practically identically, I anticipate that the construction of a downward wave for the euro will coincide with the construction of a downward wave for the pound. The market will become familiar with the findings of the Fed meeting tomorrow evening, and a hike in the interest rate may enhance demand for the US currency. We need to maintain the integrity of two wave markings simultaneously.

In addition to the Fed meeting, the pound must pass another test. Next week, the Bank of England will hold a meeting at which the interest rate will also be increased. Unknown at this time, growth should also raise demand for the pound sterling. I am inclined to lower the instrument within wave 5 at this time. It indicates that the instrument should drop by at least another 300 points. Then I anticipate constructing a corrected set of waves (at least three). And the commencement of this set's creation may coincide with the Bank of England's meeting, following which demand for the British should surge. Therefore, in terms of time, everything thus far appears fairly apparent. In practice, everything may appear slightly different, but a distinct wave pattern now accounts for the future news context. In addition, I would like to remind you that the last round of the UK's election for prime minister will soon commence, and when the results are known, the market will likely welcome them with purchases of the pound.

General conclusions

The increased complexity of the wave structure of the pound/dollar pair signals a further downturn. For each "down" MACD signal, I recommend selling the instrument with objectives at the estimated mark of 1.1708, corresponding to 161.8% Fibonacci. Currently, there is still the prospect of a rising tide, but I continue to feel that a Briton will not take the initiative and act differently than a European.

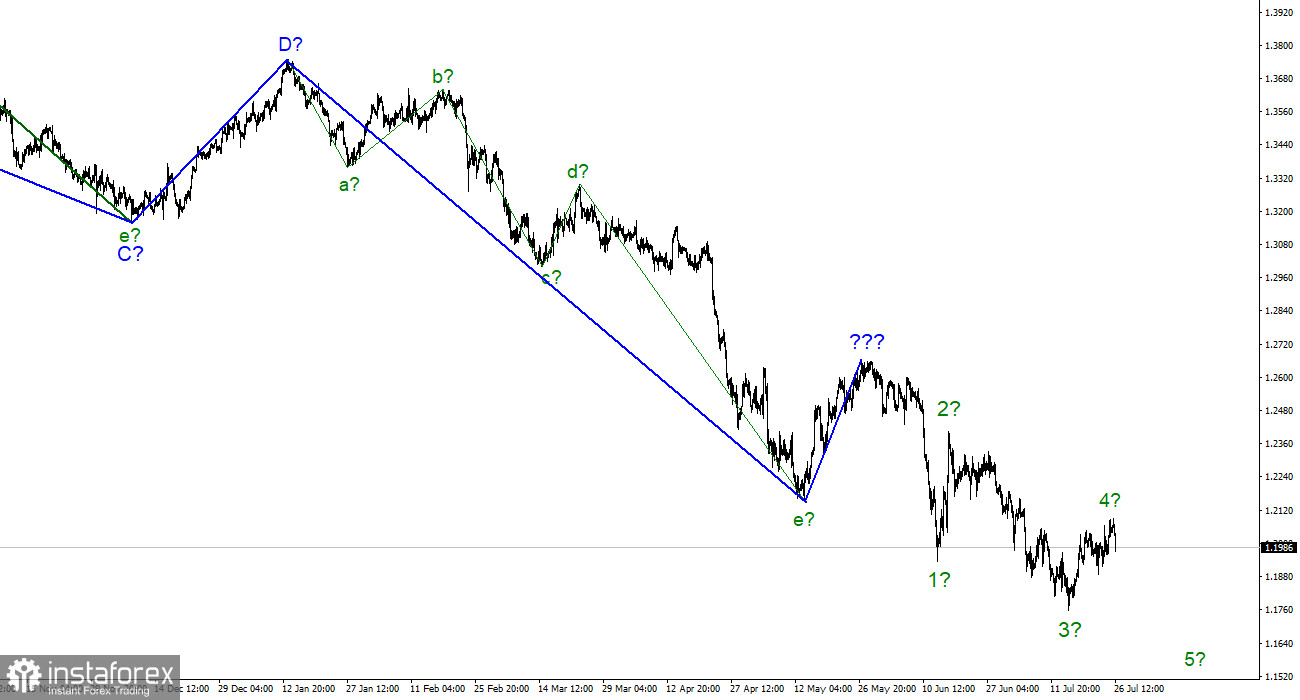

At the higher wave scale, the image closely resembles the euro/dollar instrument. The same ascending wave does not conform to the present wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach practically any length.