The AUD/USD pair approached the key resistance level of 0.7000 today, which corresponds to the upper line of the Bollinger Bands indicator on the daily chart. However, conflicting fundamentals prevented AUD/USD bulls from testing this price barrier.

On the one hand, anti-risk sentiment has intensified in the market, amid the worsening energy crisis in Europe, rising tensions between China and the United States, as well as the next wave of COVID testing in large metropolitan areas of China.

On the other hand, dollar bulls are waiting for the July Federal Reserve meeting, the results of which will be announced on Wednesday evening. Most likely, the members of the US central bank will not decide on a 100-point interest rate hike, limiting themselves to a 75-point option. The fact that there is a rate hike is a hawkish factor itself, but, as you know, "appetite comes at mealtime": after the release of the report on the growth of the consumer price index in the United States, the market was actively talking about the fact that the central bank would have to implement a more aggressive scenario to tighten monetary policy. Amid these assumptions, the head of the San Francisco Federal Reserve, Mary Daly, said that she supports the idea of increasing the rate by 100 basis points at once. However, the surge in volatility associated with the strengthening of hawkish expectations quickly faded away. At least two representatives of the Fed (who have the right to vote on the Committee) – Christopher Waller and James Bullard – were skeptical about this proposal.

In addition, a rather weak macroeconomic report was published in America, which put additional pressure on the greenback. We are talking about an indicator of US consumer confidence. The indicator came out at 95.7 points, with a forecast of growth to 98 points. This is the weakest result since January 2021. It is also noteworthy that this index has been declining for the third consecutive month, which may indicate a certain trend.

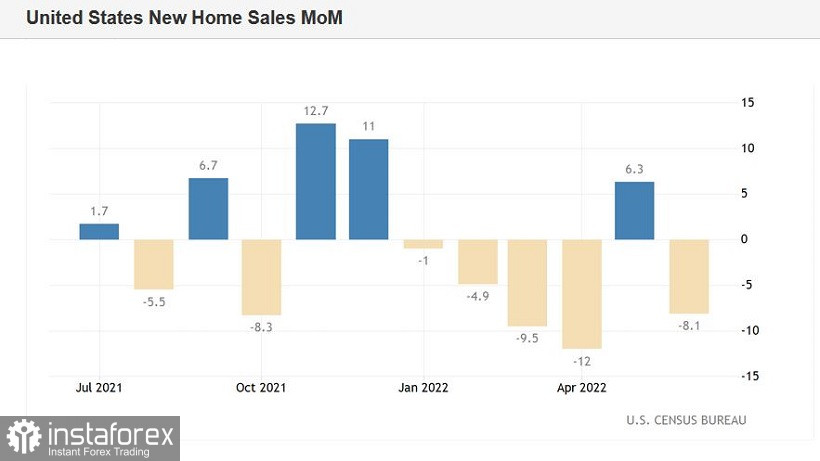

In other words, traders' growing doubts that the US central bank will decide on a 100-point rate hike, as well as a disappointing report on the growth of consumer confidence in the US, put pressure on the greenback. The American housing market completed the negative picture: according to the latest data, sales of new homes decreased by 8.1% in June.

The fundamental factors made it possible for AUD/USD traders not to rush to conclusions regarding the resumption of the downward trend.

However, the prospects for an upward movement look vague. After all, we must not forget that the US currency is kept afloat due to increased risk flight, amid the worsening energy crisis in Europe, the "Taiwan issue" and the next COVID wave in China. So, the price of gas on the stock exchange in Europe has already broken the mark of $2,200 per thousand cubic meters. The cost of "blue fuel" is growing amid Gazprom's announced reduction in gas supplies through the Nord Stream.

Tensions between Beijing and Washington are growing. According to media reports, China has sent a warning to the White House in connection with the upcoming visit of the Speaker of the House of Representatives, Nancy Pelosi, to Taiwan, without ruling out a military response. Later, an official statement of the Ministry of Defense of the People's Republic of China was published, according to which the Chinese army "will take all measures to stop external interference." However, despite such belligerent signals, the American side (so far) has not announced the cancellation of Pelosi's visit to the island. That is, the issue essentially hung in the air, exerting background pressure on risky assets.

Well, in the end, market participants are concerned about the situation with the spread of coronavirus in China, which adheres to a policy of "zero tolerance" for COVID. In particular, the Shanghai authorities ordered residents of nine districts of the city to undergo tests for coronavirus during July 26-28. Literally in June, the 25-million megacity canceled a two-month lockdown, the consequences of which were felt not only within China, but also outside of it. According to the results of mass testing, the Chinese authorities may again close the country's largest city to a "quarantine lock".

All these factors support the US currency, which is in demand as a protective instrument.

Thus, the prevailing fundamental background does not contribute to the strengthening of the corrective growth of AUD/USD or to the resumption of the downward trend. Especially ahead of the announcement of the results of the Fed's July meeting. In addition, key data on inflation growth in Australia will be published during Wednesday's Asian session. According to preliminary forecasts, the consumer price index will jump to 6.2% year-on-year in the second quarter. If the indicator comes out at least at the forecast level (not to mention the green zone), AUD/USD bulls will get a reason to develop the upward movement.

But! Do not forget that the Fed will announce its verdict on Wednesday evening, which can easily "redraw" the fundamental picture of the pair. Such a scenario cannot be ruled out, amid a record increase in American inflation.

Therefore, despite the existing prerequisites for further growth of AUD/USD, it is advisable for the pair to take a wait-and-see position - at least until the announcement of the results of the July meeting of the members of the US central bank.