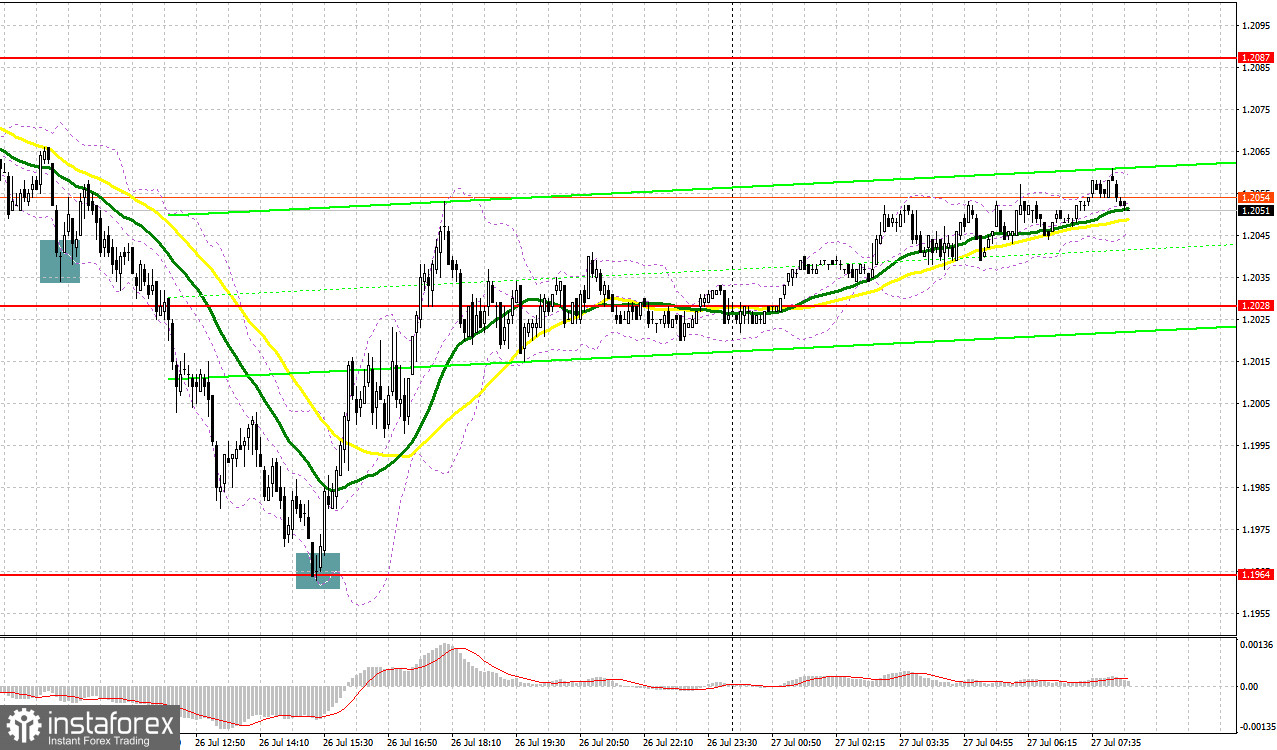

Yesterday was a very profitable trading day despite its poor start. Let's take a look at the 5-minute chart and see what happened. I paid attention to the 1.2039 level in my morning forecast and advised making decisions from it. A decline and forming a false breakout at this level and a rather vigorous growth, which showed about 20 points of profit, ended rather quickly. After the second update at 1.2039, the bears stepped over this level without any problems, which only raised pressure on the pair and led to a large sell-off to the 1.1997 area, compelling us to fix losses from the morning purchase. I waited for a test of the level of 1.1964 in the afternoon and a false breakout there, which I mentioned in my forecast, which resulted in creating a signal to buy the pound and to its recovery by more than 90 points. This made it possible to compensate for losses and earn.

When to go long on GBP/USD:

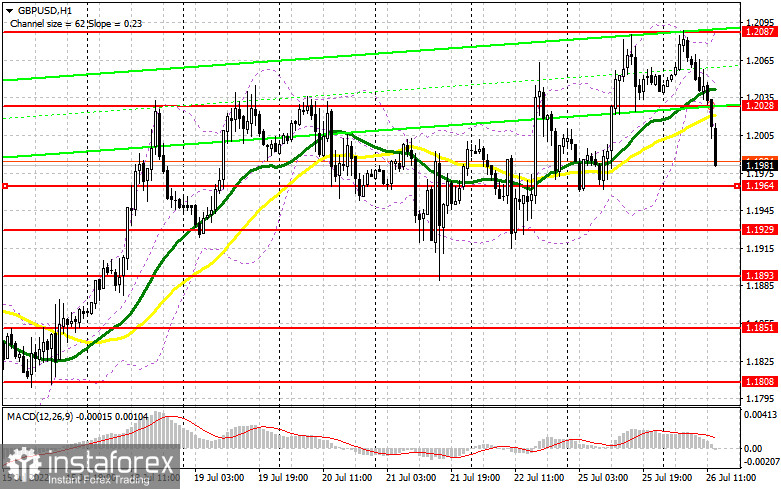

Today there is nothing that could affect the pound's direction and allow it to return to weekly highs. However, a breakthrough will be entirely and completely dependent on the decisions and forecasts of the Federal Reserve. If the policy is tighter than forecast, demand for the dollar will return and we will see another major sell-off in the pair. If everything remains within the expectations of economists, and the rates themselves are raised by only 0.75%, buyers of risky assets will most likely return to the market. The market will miss the report on the retail price index from the BRC in the UK, which keeps the chances for the growth of the pound in the first half of the day. The best scenario for buying would be a false breakout around 1.2035, where the moving averages are, playing on the bulls' side. In this case, you can count on a return to the weekly high of 1.2087, which has already been tested several times - the third update of this resistance can be fatal for the bears. A breakthrough of this level opens the way to a high of 1.2119. A breakthrough of 1.2119 and a reverse downward test will create a more powerful upward momentum, which will provide a buy signal in hopes of a jump to 1.2160. A similar breakthrough of this level will open the prospect of reaching 1.2207, where I recommend taking profits.

If the GBP/USD falls and there are no bulls at 1.2035, the pressure on the pound will increase, but the main movement in this case will depend on the Fed's decisions. If this happens, I recommend postponing long positions until 1.2001. I advise you to buy there only on a false breakout. You can open long positions on GBP/USD immediately for a rebound from 1.1964, or even lower - in the area of 1.1929, counting on correcting 30-35 points within the day.

When to go short on GBP/USD:

Bears coped with their task yesterday, which led to a rather significant decline in the pair. But, as we can see on the chart, the bulls took advantage of this and bought the entire movement. As I noted above, further movement and a breakthrough of local highs now depends on the Fed. Surely today the bears will have to make every effort again not to release the GBP/USD above 1.2087. The optimal scenario for opening short positions would be a false breakout after weak statistics on the UK, which will most likely turn out to be such. This will bring back pressure on the pound with the goal of moving to the intermediate support of 1.2035, formed on the basis of yesterday. A breakthrough and reverse test from below 1.2035 will provide an entry point for selling with a fall to 1.2001, where I recommend partially taking profits. A more distant target will be the 1.1694 area, but this is already in the worst case scenario and with increased aggressiveness on the Fed's part regarding monetary policy.

In case GBP/USD grows and the bears are not active at 1.2087 in the first half of the day, the bulls will regain control of the situation. In this case, I advise you not to rush into short positions. Only a false breakout around the new high at 1.2119 will provide an entry point to short positions, counting on the pair to bounce downward. In case traders are not active there, another upward spurt may occur. With this option, I advise you to postpone shorts to 1.2160 and 1.2207, where you can sell GBP/USD immediately for a rebound, based on a rebound of the pair down by 30-35 points within the day.

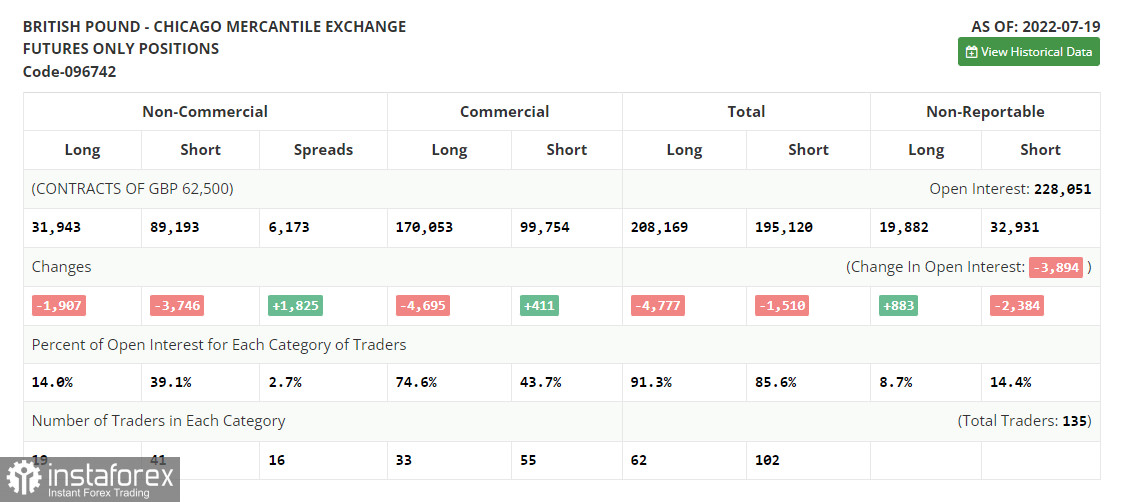

COT report:

The Commitment of Traders (COT) report for July 19 showed that both short and long positions decreased, but the former turned out to be slightly smaller, which led to a slight decrease in the negative value of the delta. It is clear that the bulls have bought back the yearly lows in the pound and are now trying in every possible way to show that the UK economy is not so bad and that the Bank of England's actions in relation to interest rates make sense. The pound's succeeding growth will depend on the Federal Reserve's decisions taken in the middle of this week. Obviously, the central bank will immediately raise interest rates by 0.75%, which may lead to the strengthening of the dollar, but on the condition that the central bank will continue to adhere to such an aggressive policy. If not, then the chance for the pound's succeeding growth will increase, as the BoE meeting will take place in August, at which interest rates may also be raised. However, it is not rational to expect that the pound bull market will last for a very long time, given the crisis in the cost of living in the UK and the economy gradually sliding into recession. The COT report indicated that long non-commercial positions decreased by 1,907 to 31,943, while short non-commercial positions decreased by 3,746 to 89,193, which led to a decrease in the negative value of the non-commercial net position to -57,250 from the level of -59,089. The weekly closing price increased and amounted to 1.2013 against 1.1915.

I recommend to read:

Indicator signals:

Moving averages

Trading is carried out in the area of 30 and 50-day moving averages, which indicates the sideways nature of the market.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

In case of growth, the area of 1.2075 will act as resistance. If the pair goes down, the lower border of the indicator around 1.2001 will act as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.