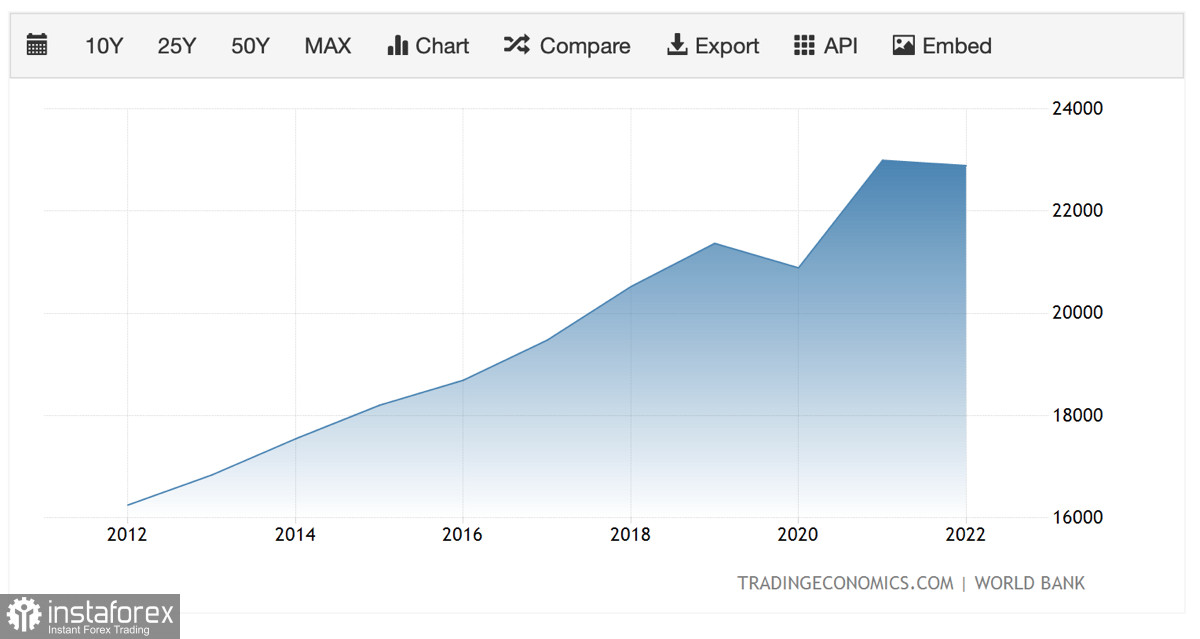

Bitcoin continues to hold the level of $21k, despite the gathering clouds ahead of expectations from the Fed meeting. At the moment, the cryptocurrency fell to the support level of $20.6k, where it met fierce resistance from buyers. As a result, the sellers retreated, and the price of BTC/USD consolidated above $22k. Despite the local positive, the cryptocurrency market continues to stand still, while network activity and trading volumes are declining.

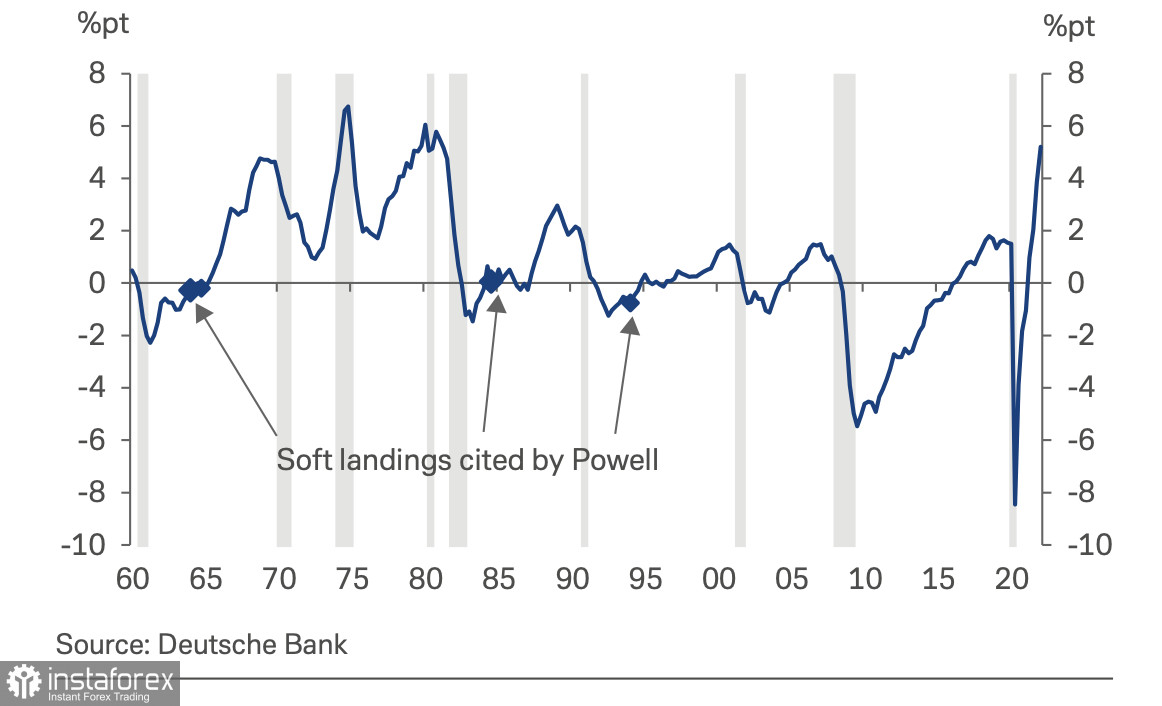

All this is happening against the background of two fundamental events that will determine the future direction for the cryptocurrency and stock market. The Fed meeting on July 27–28 is assumed to carry out the decision of the regulator to raise the key rate in the range of 75 to 100 bps. In addition, department officials will voice their positions on the overall situation with the US economy and the inflation rate. Judging by the growing optimism and the retention of the $20.6k support zone, the market is ready for a further rate hike. This is a positive signal indicating a gradual preparation for a price reversal.

On July 28, reports on US GDP growth for the second quarter will be published. Recall that in the first quarter of 2022, the economic indicator decreased by 1.6%. If the downward trend continues, we can expect the onset of a recession. And despite all the assurances of the US Treasury Secretary, leading analytical publications predict the entry of the United States economy into a state of recession. Despite the general deterioration of the economic situation, Bitcoin and stock indices can benefit from pessimistic forecasts.

Deutsche Bank experts report that stock markets are beginning to recover due to weak reporting by leading companies for the second quarter of 2022. The bank's analysts also report that the publication of weak reports from Google, Amazon and data on US GDP growth may provoke further increase in interest in company shares. The growth of consumer activity after the sale and weak reporting was observed earlier, and therefore it is likely that in the coming weeks, the stock market and company shares will rise in price due to increased demand.

The activation of investors in relation to high-risk assets will have a positive impact on Bitcoin, which maintains a high level of correlation with leading indices. According to the latest research, the correlation between BTC and NASDAQ is at its highest in the last two months. At the same time, a high level of correlation with the S&P 500 index remains, which indicates an increasing likelihood of an upward movement of Bitcoin following stock indices. The cryptocurrency has experienced the biggest sell-off in its history, and the stabilization of the situation has a positive effect on the use of BTC as a risk hedge against economic instability.

It is also important to note that the current rate of accumulation of BTC coins by the main investor audiences will eventually lead to a gradual increase in the scarcity of the asset. With a looming recession and the need to stimulate the economy, the Fed will be forced to start the printing press. In such a situation, USD or EUR will be at a disadvantage, and Bitcoin can try itself as a reserve vehicle.

The current week will determine the further direction of the cryptocurrency price movement. And judging by the growing interest in the shares of companies, Bitcoin is getting more and more fundamental factors that indicate the growth of quotes. The DXY index formed the first confident bullish candle in the last 11 days, but continues to be in consolidation. The asset failed to break the resistance level at 107, which gives high-risk assets additional time to realize bullish momentum. DXY technical indicators signal a drop in interest in the index. The stochastic oscillator is implementing another bearish crossover, while the RSI and MACD continue to slowly decline.

Bitcoin continues to stabilize and hold key support areas. Due to this, the investment attractiveness of the cryptocurrency and its functionality are growing. The asset is approaching the stage of recovery, when the ability of BTC to maintain capital during market and economic turmoil becomes relevant again. The mood towards the cryptocurrency is positive, but the stock market will play a key role in maintaining the bullish mood.