The FOMC policy meeting that is closing today is unlikely to make a negative impact on the crypto market. Yes, the rate hike has been priced in by market participants. However, traders and investors will hardly find out something news that could dent demand for risky assets. Digital tokens have considerably lost in value for half a year and they are now trading at attractive low prices. Geopolitics has taken a back seat. The anti-Russian sanctions have been to no avail. Thus, Western countries, including European ones, should think about how to save their domestic economies but not disable others. Such fundamentals will benefit the whole crypto market and bitcoin in particular.

Following the latest rate hike at the ECB policy meeting, Christine Lagarde announced at the press conference that it was too early to turn off the printing press for long. In case of an emergency, the regulator will resume its monetary stimulus. Indeed, everyone fears that the crisis of living costs due to soaring inflation will be accompanied by an economic crisis. This is also bullish for the crypto market. As soon as the US central bank decides to put the cycle of rate hikes on pausefor a while, the crypto market is sure to perk up. By the way, the US Fed might decide this way in the nearest time. The ongoing struggle with high inflation in the US that has been printing new historic highs will bear its fruit sooner or later. At this particular moment, analysts say that the crypto market has already bottomed out. The question is to find a new portion of cheap money thatwill be printed out shortly after.

The International Monetary Fund stated recently that the bear crypto market made no impact on global financial stability. In its report the Prospects of global economic development, the IMF acknowledged that the crypto market had gone through a dramatic sell-off but added that it did not damage the global financial system. Apparently, the reason is the weak integration of the crypto market into the overall financial system. This is what authorities around the world are fighting for.Remarkably, the market capitalization of the flagship cryptocurrency plummeted by almost 70% from the historic peak of $69,000 conquered in November 2021. Other digital tokens incurred heavier losses. None of them could have avoided sell-offs this year.

Obviously, the crypto winter has been the toughest for crypto hedge funds and other investmentcompanies. So far, the secondary effect on the broader financial system is still limited. The crypto winter ended up with a collapse of the Terra blockchain and its native stablecoin which, in turn, entailed the bankruptcy of the hedge fund Three Arrows Capital. Shortly after, Crypto Lender Celsius followed suit and also declared bankruptcy. A lot of failed companies acted beyond acceptable rules. Their bankruptcies highlighted risky methods of running a business and management. As a result, the market is flooded with debt worth billions of dollars.

In this context, regulators in various countries, including the Bank of England and the Federal Reserve, questioned the idea of stablecoins as such. The monetary authorities shared the viewpoint that stablecoins have to follow strict regulations. Fed Vice President Lael Brainard said recently that the collapse of Terra reminds us of the classical story of numerous companies. There is no guarantee that advanced technologies protect investors from the same risks in the future.

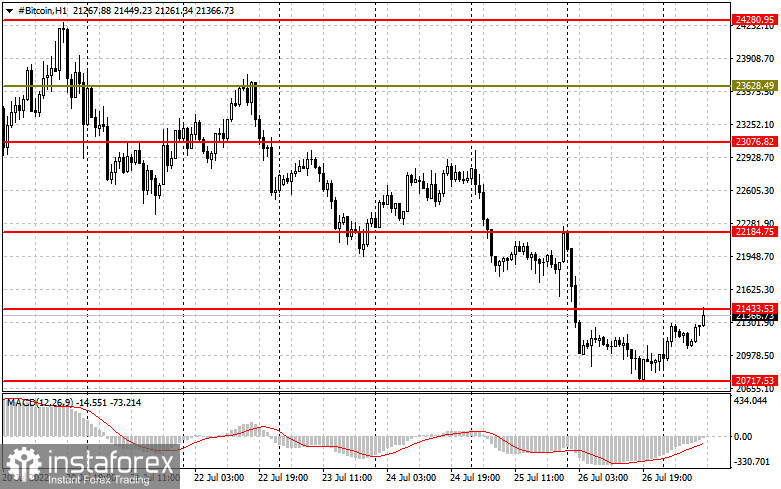

Let's discuss the technical outlook for bitcoin. The balance of trading forces has shifted towardbuyers. Nevertheless, the crypto bulls will hardly hold the upper hand before the US Fed unveils its policy decision. In case of a further decline, speculators will defend the nearest important support of $20,720. If it is broken and the price settles below this level, the token will drop to $19,960 and $19,320 and even lower to $18,625. If demand for bitcoin grows, the price has to climb above the nearest resistance at $21,430 and $22,184 to encourage a further uptrend. If the price manages to consolidate above, the door will be open to $23,070 and $23,600 and higher to $24,280. A more distant target is seen at $25,780.

The buyers of Ethereum should assert strength at about $1,420 in case the token remains underpressure. If this level is broken, the trading instrument will tumble to yesterday's low at $1,350 and even lower to $1,275. Larger support is identified at $1,190. We could speak about Ethereum's growth provided that the price rebounds to $1,490. Only after the price grows above this level, we could expect a spike to higher highs at $1,540 and $1,650. Then, we could predict a medium-term uptrend with the target at $1,740. If the price settles there, traders will open more buy positions aiming to update higher resistance at $1,830. This target is worth fighting for.