At the start of today's European trading session, major dollar currency pairs are trading in tight ranges. Traders are avoiding large deals ahead of the publication of the Fed's decision on interest rates.

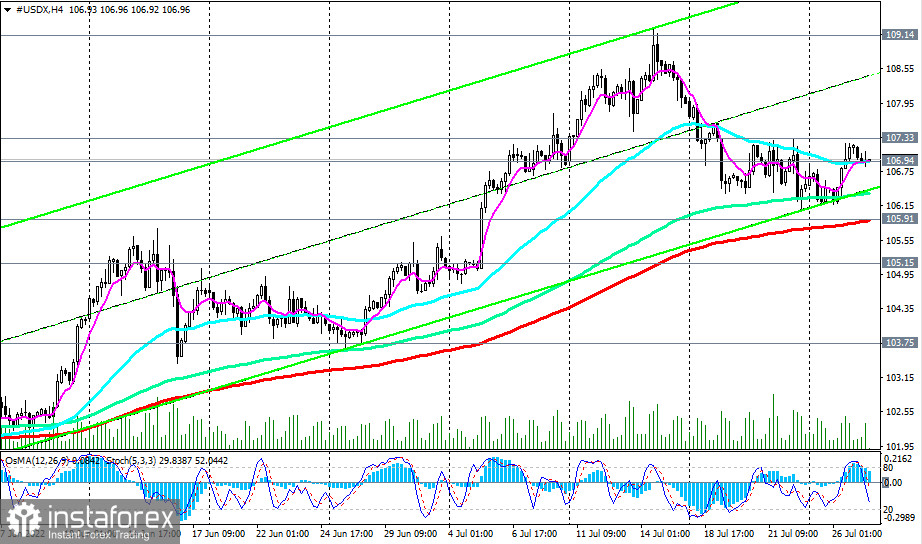

At the same time, the dollar index (DXY), due to the decline in Asia, is slightly below the closing price of yesterday's successful trading day for the dollar. As of this writing, DXY futures are trading near 106.90, 14 points below Tuesday's close.

However, today the dollar may get a new impetus to growth.

Market participants expect the US central bank to accelerate the cycle of monetary policy tightening. It is widely expected that, at this meeting, the rate will be raised again immediately by 0.75%, to 2.50%.

At the beginning of the month, Fed Board of Governors member Christopher Waller announced the need to raise interest rates by 75 percentage points in July and 50 percentage points in September, after which interest rate hike could be reduced to 25 percentage points. In his opinion, inflation is a tax on economic activity, and the higher it is, the more it suppresses it.

Federal Reserve Bank of St. Louis President James Bullard supported his colleague and a more aggressive tightening of the Fed's monetary policy, noting the desirability of a key interest rate level of 3.5% this year.

Now it is 1.75%, the interest rate will most likely rise at least twice by the end of the year, and the higher it is, the more expensive the dollar will be, and the more profitable long-term investments in it will be.

However, today's Fed decision may be tougher than markets expect. Theoretically, this should have an even more stimulating effect on the dollar (in normal economic conditions, an increase in the interest rate usually leads to a strengthening national currency). Most likely, this will happen. But everything can go according to a different scenario. Investors may find that the Fed cannot cope with rising inflation.

This, coupled with another tightening of monetary conditions, may lead to another round of sales of US assets and, ultimately, to a decrease in demand for the dollar from foreign investors, as the funding currency of the US stock market.

Therefore, after a sharp rise in dollar quotes (immediately after today's Fed meeting), a wave of downward correction may soon follow.

Much will also depend on the rhetoric of the accompanying statements by the Fed leadership. The Fed press conference will begin 30 minutes after the publication of the decision on interest rates (at 18:30 GMT), which will be of the greatest interest to investors.

Any unexpected statements by Fed Chairman Jerome Powell on monetary policy will cause an increase in volatility in dollar quotes and in the US stock market.

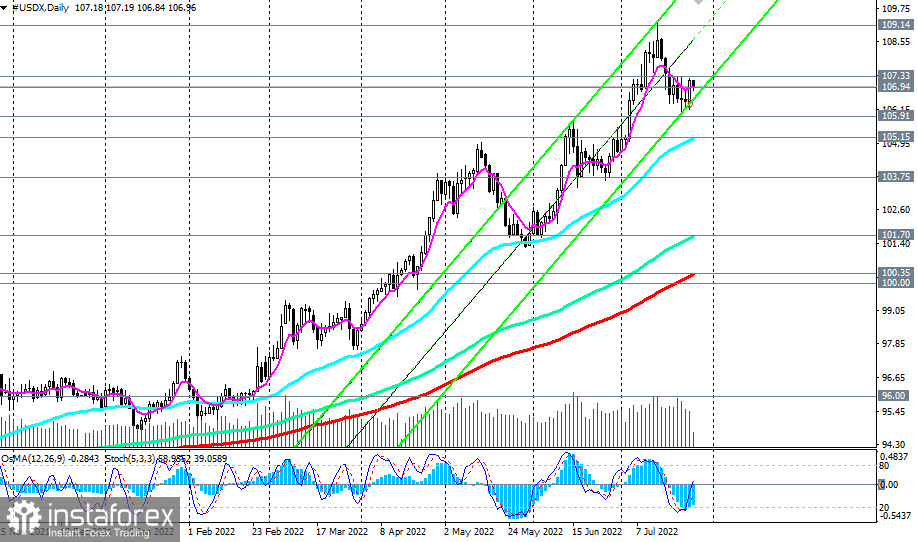

As for the dollar and its index, given the strong bullish momentum and the long-term DXY upward trend, the breakdown of the local resistance level of 109.00 will be a signal to increase long positions in DXY futures "with the prospect of growth towards multi-year highs of 121.29 and 129.05, reached, respectively, in June 2001 and in November 1985. Earlier signals to buy DXY futures will correspond to the breakdown of the local resistance levels of 107.00, 108.00.

Support levels: 106.94, 106.00, 105.91, 105.00, 105.15, 104.00, 103.75, 103.00, 102.00, 101.70, 100.35, 100.00

Resistance levels: 107.00, 107.33, 108.00, 109.00