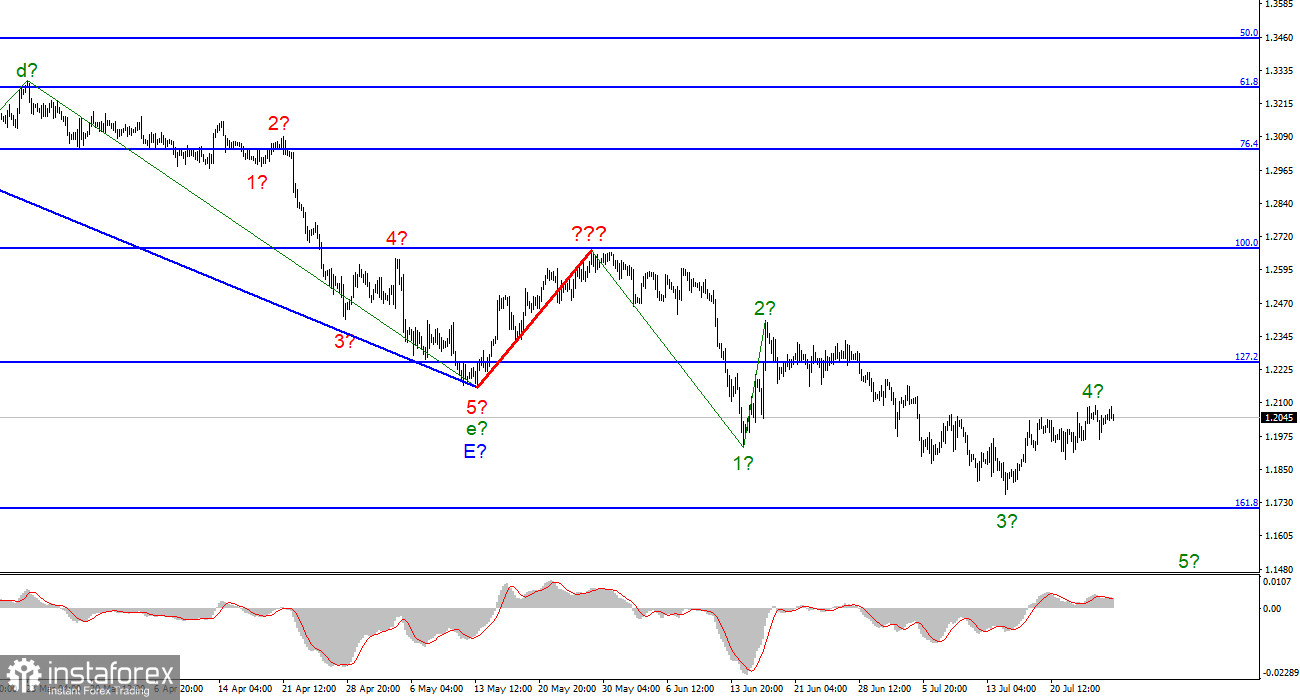

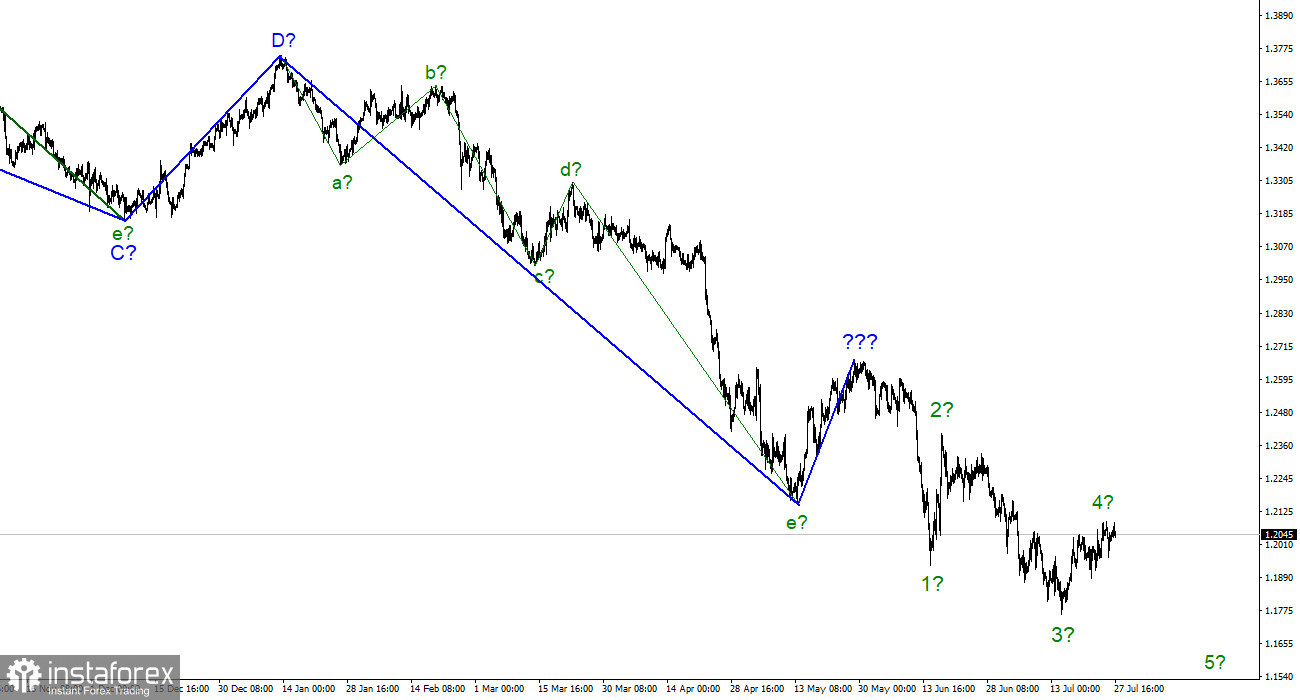

For the pound/dollar instrument, the wave marking at present looks very complex but does not require revisions. The upward wave formed between May 13 and May 27 does not fit into the broader wave image, although it can still be regarded as corrective as part of the downward trend segment. Thus, now we can state for sure that the building of the upward correction phase of the trend is canceled, and the downward section of the trend will assume a longer and more complex form. I am not a huge proponent of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be far more practical to recognize rare corrective waves, after which new impulse structures would be built. At present, we have completed waves 1, 2, and 3. Thus, we can infer that the instrument is now building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound are slightly different in that for the euro, the downward component of the trend has an impulse form (for now). But the ascending and descending waves alternate fairly equally. I foresee a further collapse in the British dollar in the following days.

Why is the pound growing?

The exchange rate of the pound/dollar instrument increased by 15 basis points on July 27. It is little, and even the euro currency has added more. Nevertheless, the euro has already completed the construction of an upward correction wave, whereas the pound has not. Due to substantial market moves based on the conclusions of the FOMC meeting, wave markings may become more complicated and even require revisions. However, I do not view this scenario as the main and most probable one yet. The central bank meeting happens once every six weeks; the rest of the time, the market works on other aspects and analysis methods. Thus, I do not want to disregard the wave marking, which even now looks quite good. Based on this, I can assume that the rise of the British yesterday and today is just a protracted wave 4, which will be built for a couple of days longer than a comparable wave for the euro/dollar instrument. Nothing is wrong with this since the euro and the pound are not forced to display the same movements daily.

Moreover, preparations are continuing in the UK for a new prime minister's penultimate round of elections. According to general opinion and according to opinion surveys, Elizabeth Truss, who is the head of the Ministry of Foreign Affairs, is in the lead. Perhaps a little increase in demand for the pound is due precisely to the fact that the market deems Truss a stronger politician than Boris Johnson and appreciates her imminent triumph. But in my opinion, this component is not powerful enough to support the British for a long period. The conclusions of the FOMC meeting will be announced this evening, while the results of the Central Bank of England meeting will be announced next Thursday. These are economic facts that are significantly more essential for the foreign exchange market than the next election of the prime minister. However, the pound needs to rush to fall because next week, the demand for it may expand, and the wave picture will get more difficult.

General conclusions

The wave pattern of the pound/dollar instrument predicts a further drop. Thus, I suggest now selling the instrument with goals near the predicted mark of 1.1708, which is equivalent to 161.8 percent Fibonacci, for each MACD signal "down." There is still a possibility of constructing an upward wave, but I still feel that a Briton will not take the initiative and move differently than a European.

At the higher wave scale, the image closely resembles the euro/dollar instrument. The same ascending wave does not conform to the present wave pattern, followed by the same three descending waves. Thus, one thing is unmistakable: the downward segment of the trend continues to develop and can reach practically any length.