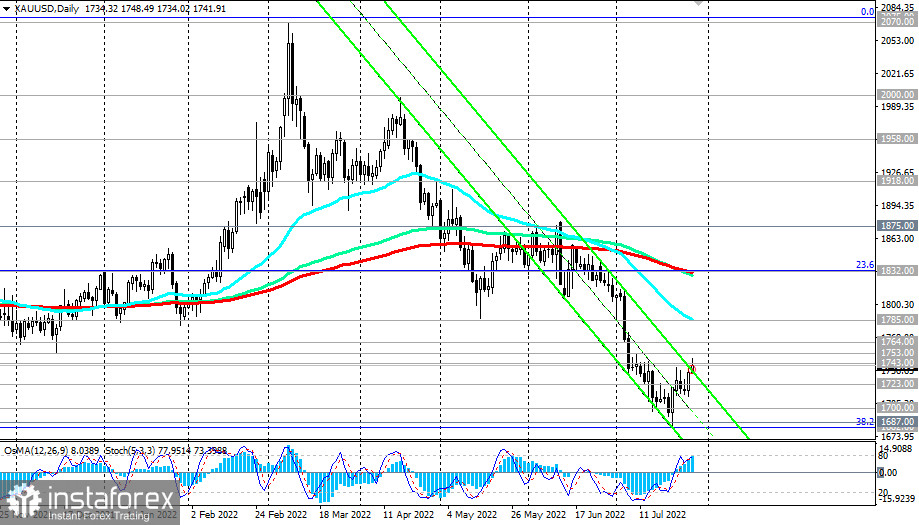

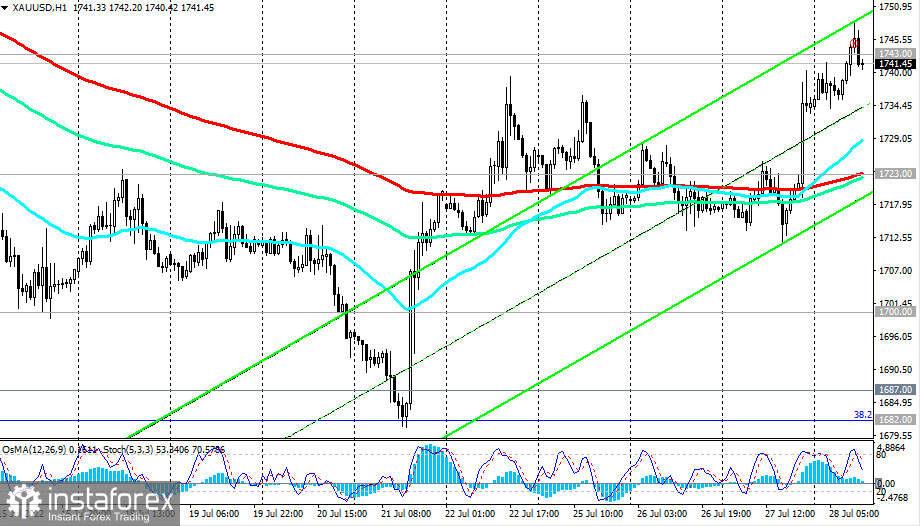

XAU/USD continues to rise today after yesterday's "jump," trying to return to the long-term bull market zone, above the resistance level of 1743.00 (144 EMA on the weekly chart).

Note that the first signal to resume purchases came at the end of last week when XAU/USD broke through the important short-term resistance level of 1723.00 (200 EMA on the 1-hour chart).

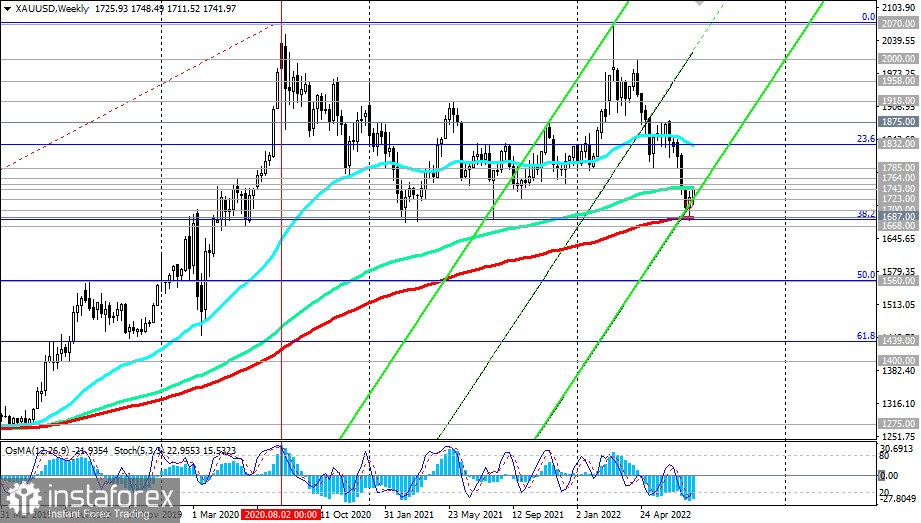

Yesterday, the pair received a new impetus to growth against the backdrop of a large-scale weakening of the dollar. Now, in order to consolidate its success, it needs to rise into the zone above the important resistance level of 1764.00 (200 EMA on the 4-hour chart). Then, after the breakdown of the resistance level of 1785.00 (50 EMA on the daily chart), the road will be open to the key resistance level of 1832.00 (200 EMA, 144 EMA on the daily chart, 50 EMA on the weekly chart, and the 23.6% Fibonacci retracement level to the growth wave from December 2015 and marks 1050.00).

Its breakdown, in turn, will finally return XAU/USD to the zone of a long-term bull market.

Gold is in active demand during geopolitical and economic uncertainty and is a defensive asset in the face of rising inflation. Now is just such a moment.

In an alternative scenario, investors will again put the Fed's policy in the first place, relegating geopolitical and inflationary risks to the background, also preferring the dollar as a protective instrument.

A breakdown of the long-term support level at 1668.00 (50 EMA on the monthly chart) may "push" XAU/USD out of the long-term bull market zone, sending it towards the support levels of 1275.00 and 1050.00, the breakdown of which will complete this process.

The first signal for the realization of this alternative scenario is the breakdown of the local support level of 1712.00.

Support levels: 1723.00, 1712.00, 1700.00, 1687.00, 1682.00, 1668.00

Resistance levels: 1743.00, 1753.00, 1764.00, 1785.00, 1800.00, 1832.00, 1875.00

Trading Tips

Sell Stop 1732.00. Stop-Loss 1754.00. Take-Profit 1723.00, 1712.00, 1700.00, 1687.00, 1682.00, 1668.00

Buy Stop 1754.00. Stop-Loss 1732.00. Take-Profit 1764.00, 1785.00, 1800.00, 1832.00, 1875.00