Financial markets clearly overdid it, reacting to Jerome Powell's announcement that the federal funds rate would reach a long-term neutral level of 2.5%. The very thing that does not stimulate, but does not constrain the economy. Investors considered the Fed's mission to slow inflation accomplished, and then only a modest tightening of monetary policy is required from the Central Bank. A sort of dovish shift that allowed EURUSD to soar above 1.02. In fact, everything was different. The bulls overdid it and very soon broke their foreheads.

The Fed chairman's speech at the end of the July FOMC meeting had nothing to do with "dovish" rhetoric. On the contrary, Jerome Powell advised paying attention to the forecasts of the Federal Open Market Committee, according to which, the federal funds rate should rise to 3.4% by the end of 2022 and to 3.8% in 2023. As for the September meeting, the Central Bank's verdict on how much to raise it, by 75.50 or 25 bps, will depend on the new data. There are several releases on inflation and employment ahead at once, so the Fed has room for maneuver.

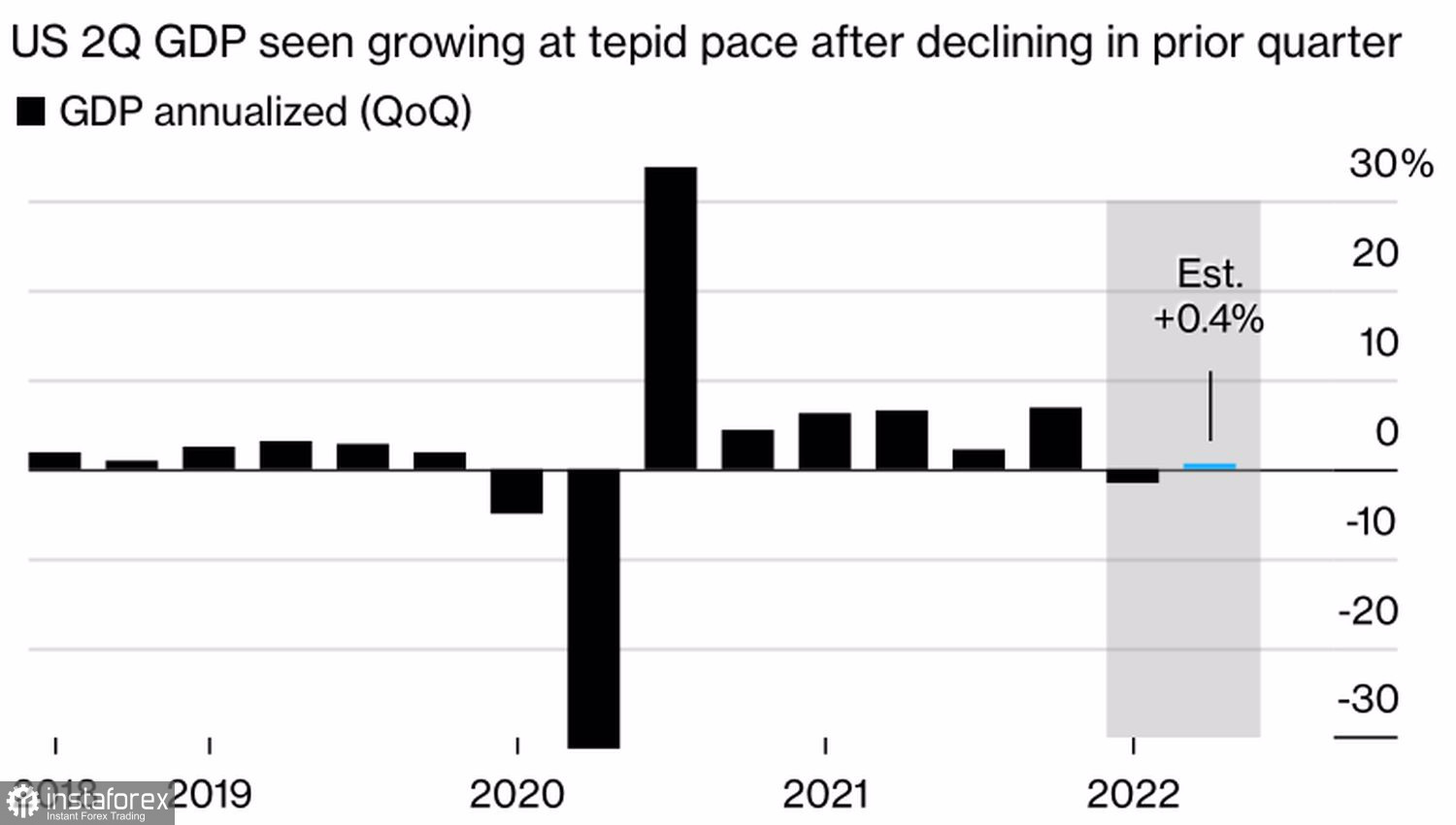

Markets have taken wishful thinking. They are seriously counting on lower borrowing costs next year after bringing them up to 3.3% this year. The main argument in favor of this point of view is the recession in which the United States, judging by the leading indicator from the Atlanta Fed, is already in. It doesn't matter that Bloomberg's median forecast assumes GDP expansion in the second quarter by 0.4%. The fact could be worse, right?

Dynamics of US GDP

However, there is also an element of wishful thinking here. The latest statistics on inventories, durable goods orders, and the trade balance allowed Morgan Stanley, JP Morgan, and Goldman Sachs to raise estimates of gross domestic product. Thus, orders for durable goods in June increased by 1.9% after their growth by 0.8% MoM in May, and the US trade deficit is shrinking for the third month in a row. As a result, Morgan Stanley believes that in April-June, the US economy expanded by 1%, that is, there can be no question of any technical recession.

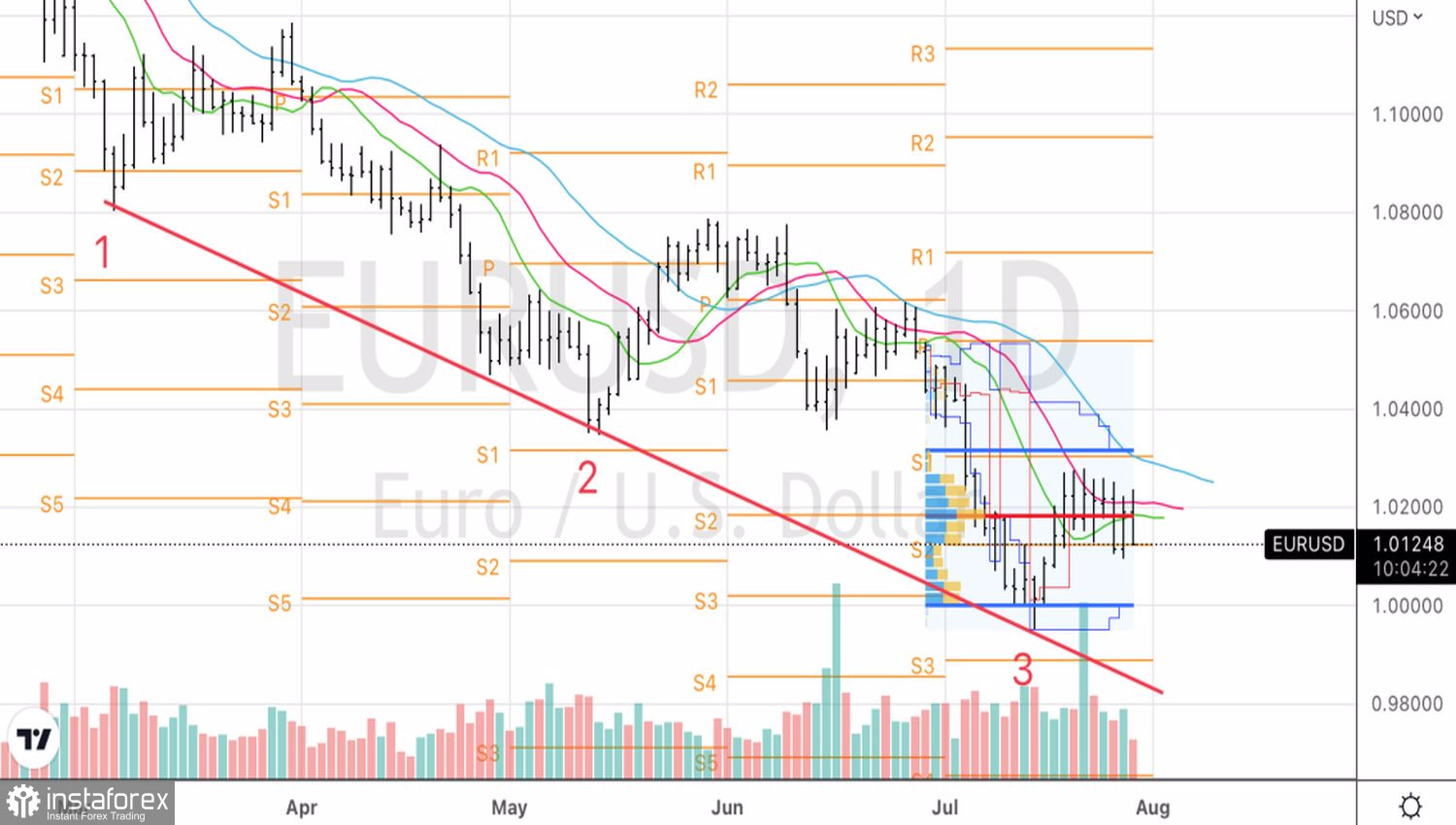

If the US labor market and GDP remain resilient after a 225 bps increase in the federal funds rate since the start of the monetary restriction cycle, why doesn't the Fed continue to act decisively? This circumstance, against the backdrop of the weakness of the European economy and the energy crisis that has enveloped the eurozone, can return the main currency pair to parity.

Technically, in the conditions of EURUSD consolidation on the daily chart, the complexity of trading increases dramatically. The return of quotes to the lower border of the channel 1.011–1.027 increases risks of a repeated assault of support at 1.01-1.011. Success in this event will allow us to talk about the restoration of the "bearish" trend and will allow forming short positions with targets at 1 and 0.985.