The dollar collapsed, and how it finishes Thursday's session will depend on its further dynamics. The aggressive mood of the Federal Reserve did not materialize, and market players seem to have begun to take into account the passage of the peak of inflation and rate hikes. The fact that the US central bank did not raise the rate by 1 percentage point gave rise to hopes that at subsequent meetings its growth would gradually come to naught. At the next meeting, as markets expect, it may be raised by 50 basis points.

But these are just expectations, what will happen next, time and macroeconomic indicators will show. There is no recession in the country, according to Fed Chairman Jerome Powell, there is only a slowdown in economic growth. Today's GDP should confirm or refute Powell's comments.

Meanwhile, in order to reduce inflation, it is necessary to further slow down the growth of the economy to a level below its potential. There may also be some deterioration in conditions in the labor market. Restoring price stability is now an absolute priority for the Fed.

In the coming months, members of the central bank will "look for convincing evidence of lower inflation and its direction towards the 2% target. Further decisions on the rate, as Powell noted, will depend on incoming statistics on economic activity, inflation, and the labor market. As policy tightens further and inflation slows, the pace of rate hikes may also slow down.

Less hawkish comments sent the dollar index down 0.70% to 106.46. However, the indicator attempts to recover some of the losses. Support for the rising wedge is at 106.45. A close of the day below would be a significant technical event, signaling deeper losses and could potentially lead to an initial long-term break of 102.50. Resistance is found at 107.45 and 108.00.

The dollar's decline helped the EUR/USD pair recover the previous day's losses, but despite the overnight rise and the Asian toga rise, the EUR/USD pair did not move up out of the range. At the same time, the weakening of the dollar amid a less hawkish Fed meeting is offset by geopolitical fears and fears of a recession in Europe itself. Multi-day resistance around 1.0275 remains strong. Only a sustained breakthrough above 1.0360 could revive euro bulls somewhat. EUR/USD support is located at 1.0100 and 1.0000.

The euro will continue to be under pressure, long-term lows are still there, as the EU, unlike the US, is definitely in recession.

Further signs of a slowdown in US GDP are likely to further reinforce the view that the peak of the rate hike cycle is months away. This will potentially deprive the dollar of momentum for growth. If so, then the lowest level of decline in EUR/USD can be achieved, but here it is necessary to take into account both internal indicators and the difficulties of the euro, which abound.

The eurozone is headed for an economic downturn as Russia cuts gas supplies. With Nord Stream 1 running at only 20% capacity, Germany won't be able to replenish its storage before the cold weather hits. German industry is likely to operate well below its real capacity and growth will reverse in the winter months. The extent of the damage will determine how low the euro falls. Downward pressure on EUR/USD is easing from the dollar, but the euro has no internal reasons for growth, on the contrary, there are serious and possibly long-term factors contributing to the euro's depreciation.

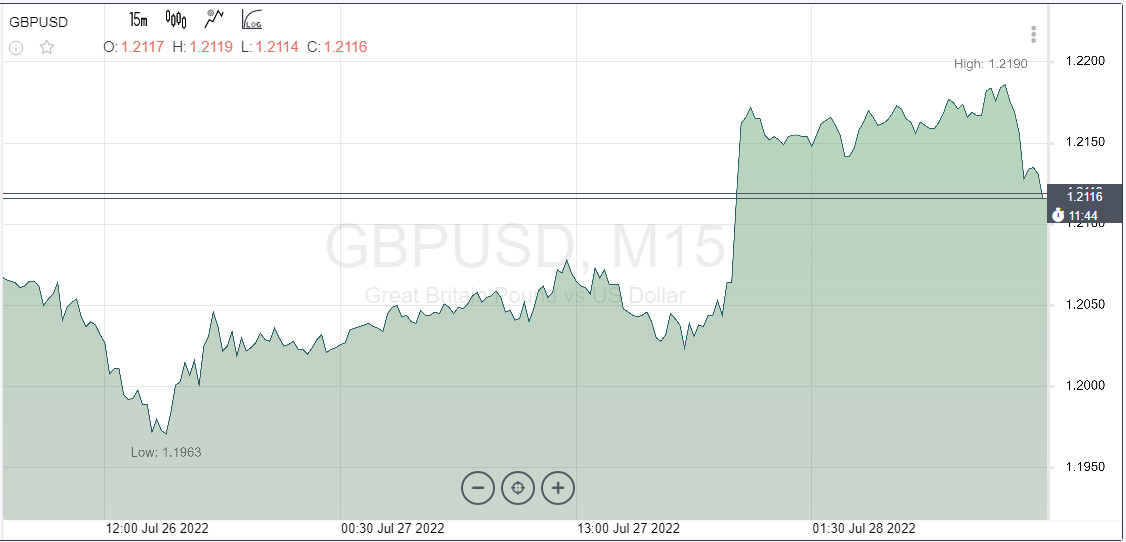

The GBP/USD jumped more than a cent overnight to 1.2200, but this morning there is a slow slide down. The lack of domestic news and data ahead of next week's Bank of England policy update leaves the pound exposed to broader risk trends.

The pound is a high beta currency, which means that pairs such as GBP/USD and GBP/EUR are positively correlated with stock markets. The pound can only be supported if positive investor sentiment continues in the coming weeks.

The pound's sensitivity to the global stock market has increased, about 35% of currency fluctuations can be explained by changes in the stock index, Bank of America strategists comment.

GBP/USD, like other pairs with the dollar, is waiting for the US GDP report. Cautious sentiments limited the quote's growth.

Market consensus is for a 0.4% increase after a 1.6% contraction in the first quarter. Weaker-than-expected data could put pressure on the dollar. At the same time, losses may become insignificant if investors continue to bet on defensive assets.

Strong data on the US economy is able to revive hawkish expectations regarding the Fed rate and resume bearish pressure on GBP/USD.

The pound has missed bullish momentum and needs to correct lower before triggering the next upward trend, analysts say.

The main support level is 1.2125, if it fails, additional losses are possible in the direction of 1.2100 and further to 1.2070.

As long as the value of 1.2070 remains intact, bulls' interest in the pound should remain. Resistance levels are located at 1.2200, 1.2250, 1.2300.