Bitcoin rose instantly from the level of $21,000 to $23,500, and ether updated monthly highs and adjusted slightly from the level of $1,670 after yesterday's Federal Reserve System meeting, which, according to my expectation, was supposed to help the cryptocurrency market regain positions, which did occur.

The increase happened after investors began to evaluate the cycle of more rate hikes more positively than the Fed's own June predictions, which, according to Federal Reserve Chairman Jerome Powell, are the best current indicator of how officials view future monetary policy.

Investors are now betting that the cost of borrowing will peak at 3.3 percent this year before the Fed begins a small reduction in 2023. Officials forecast in June that rates will be 3.4% by the end of the year and 3.8% by December 2023. All of this has a significant impact on the technical picture of trading instruments, but before we discuss that, I'd like to touch on a few points from yesterday's interview with the executive director of Ripple, who discussed the potential outcomes of the lawsuit between Ripple and the US Securities and Exchange Commission.

Remember that in December 2020, the SEC filed a lawsuit against Ripple Labs, Garlinghouse, and co-founder Chris Larsen, alleging that the sale of XRP constituted an unregistered securities offering. Since Ripple disagreed with the SEC, it has been involved in a dispute with the securities regulator. Previously, it substantially impacted the XRP price, but it no longer concerns investors as much. Everyone is awaiting the ultimate verdict, which will either save the company or render the token worthless.

During an interview, Ripple CEO Brad Garlinghouse was asked what would occur if he did not receive a favorable ruling and XRP was classified as a security. The head of Ripple soon emphasized that XRP will only be regarded as security in the United States in these circumstances to minimize the impact on investors and holders of XRP. He elaborated: "The Securities and Exchange Commission's authority is limited to the United States. The token has been lost since the beginning of the crypto-winter season." Garlinghouse added that investors could not trade XRP on most platforms in the United States. Shortly after the SEC initiated a lawsuit against Ripple, Coinbase, for instance, ceased trading XRP. "Will anything change even if Ripple loses the lawsuit? I doubt it. Ripple continues to grow rapidly, and the company's possibilities are enormous," Garlinghouse reported.The CEO of Ripple emphasized that he is certain of success against the securities regulator because the law and all the facts are on their side. The executive director of Ripple added, "I believe the SEC has gone too far, and they are now at a loss as to what to do."

In April of this year, Ripple's legal counsel, Stuart Alderoty, tweeted: "It appears that a decision will be made in 2023, and each day that passes harms US Americans, who have been victims of Securities and Exchange Commission fraud. On the day the case was filed, the $15 billion market capitalization of XRP was destroyed, harming the people the SEC is meant to safeguard."

Regarding the technical possibilities of XRP, there is now little to discuss, as the coin is trading below one dollar at 0.30 cents in a narrow side channel. Let's examine the primary bitcoin trading tools in greater detail.

Regarding bitcoin's technical prospects, the balance of power has shifted in favor of purchasers. In the case of a collapse in the trading instrument, speculators will defend the $22,720 support level, which is crucial. Its collapse and consolidation below this range will cause the trading instrument to return to the lows, between $22,180 and $21,430, reaching as low as $20,700. If the demand for bitcoin resumes, it will be necessary to break above $ 23,480 to establish an upward trend. Fixing higher will drive the trading instrument to its highs of $24,280 and $25,700.

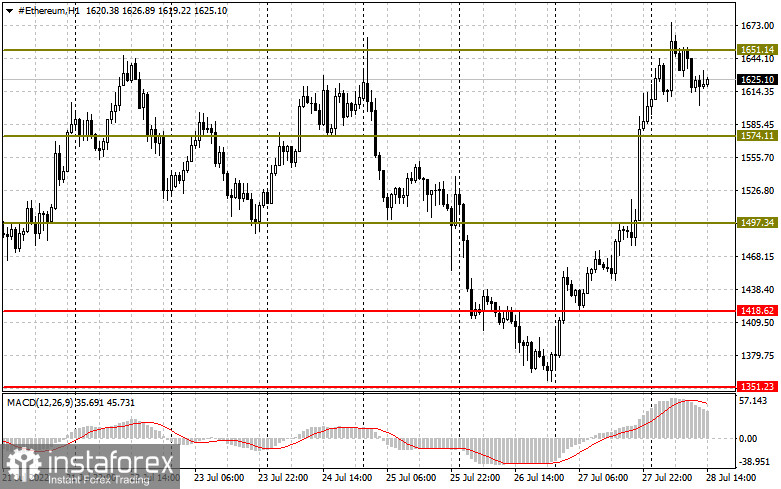

In the event of a return of pressure, Ether buyers should demonstrate themselves in the region of $1,575, as a breach below this level would soon send the trading instrument to a low of $1,500. If we are talking about a genuine decline in the ether, then the next stop is only achievable between $1,420 and $1,350. When the $1,650 resistance is broken, it will be possible to discuss the continuance of ether's growth. Only if growth surpasses this level can we anticipate a faster acceleration with the repeat of the highs: $1,740 and $1,830, as well as the possibility of constructing a medium-term upward trend at $1,910.