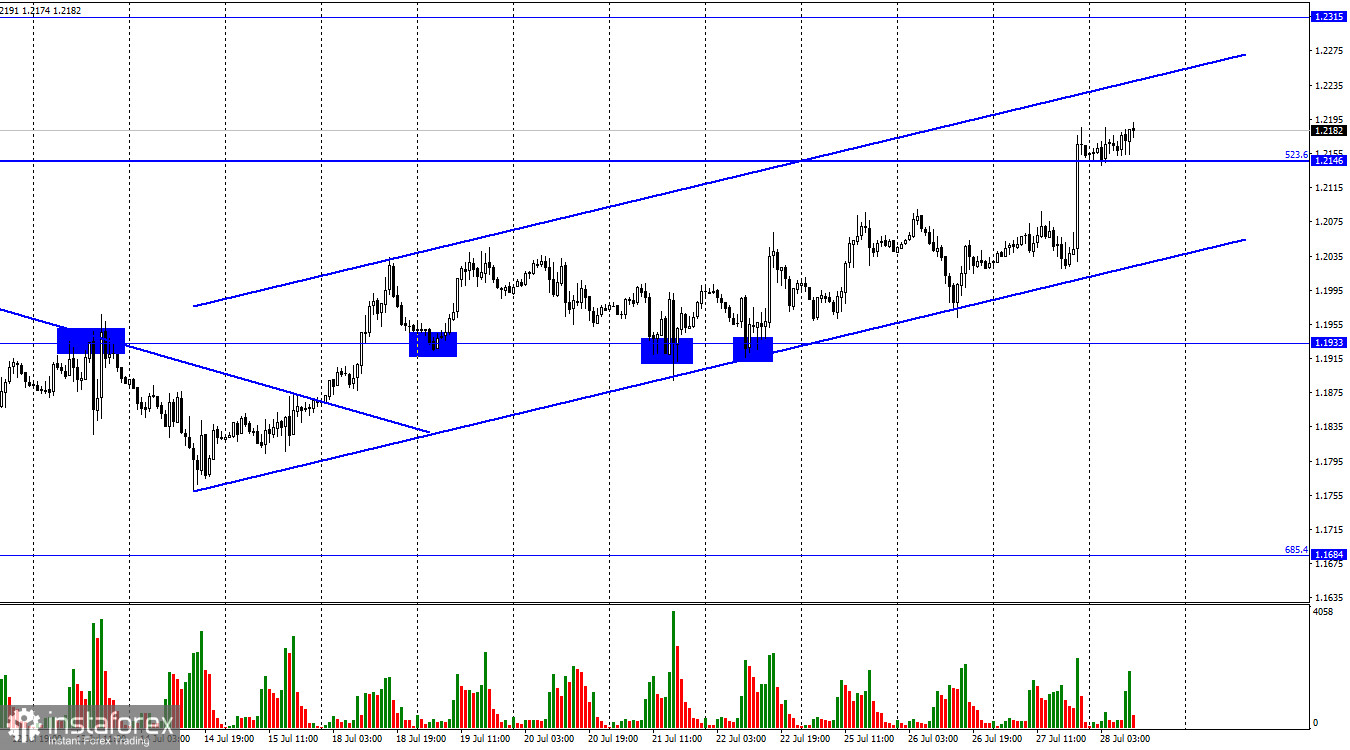

According to the hourly chart, the GBP/USD pair continues the growth inside the upward trend corridor on Wednesday and has secured above the corrective level of 523.6% (1.2146). Thus, the growth of the British dollar quotes can be continued in the direction of the next level of 1.2315. Fixing the pair's rate below the level of 523.6% will work in favor of the US currency, and some fall in the direction of the lower line of the corridor. From my point of view, the reaction of traders to the pound and the euro to yesterday's results of the Fed meeting is not the same. The British dollar continues to grow (albeit weakly) even on Thursday, and at the same time, it has been growing in general for several weeks. The euro currency has been trading horizontally for more than a week and has already started a weak fall. The euro still looks weaker than the pound sterling, but it's quite difficult for me to say why the Briton is gaining strength now. Yesterday's meeting results and Jerome Powell's speech should have caused almost the same reaction from traders. However, it should be remembered that now the meetings of the ECB and the Fed are behind us, but the meeting of the Bank of England will be held next week. And the interest rate will likely be raised again. This time it may even be by 0.50%. As in the case of the Fed rate, I am waiting for the British dollar's growth at the British regulator's meeting. But last night showed us that the reaction of traders can be absolutely anything. And the fall of the dollar on Wednesday evening does not mean that now the dollar will no longer grow in 2022. Therefore, I recommend not to overestimate the significance of the Fed meeting. It is an important event, but just one event. Jerome Powell's speech also turned out to be "hawkish" because he hinted at a possible rate hike in September by the same 0.75% if inflation does not show a significant slowdown. It means that the regulator is ready to make any sacrifices to reduce inflation to 2%, and the recession of the American economy, according to Powell, is not threatened.

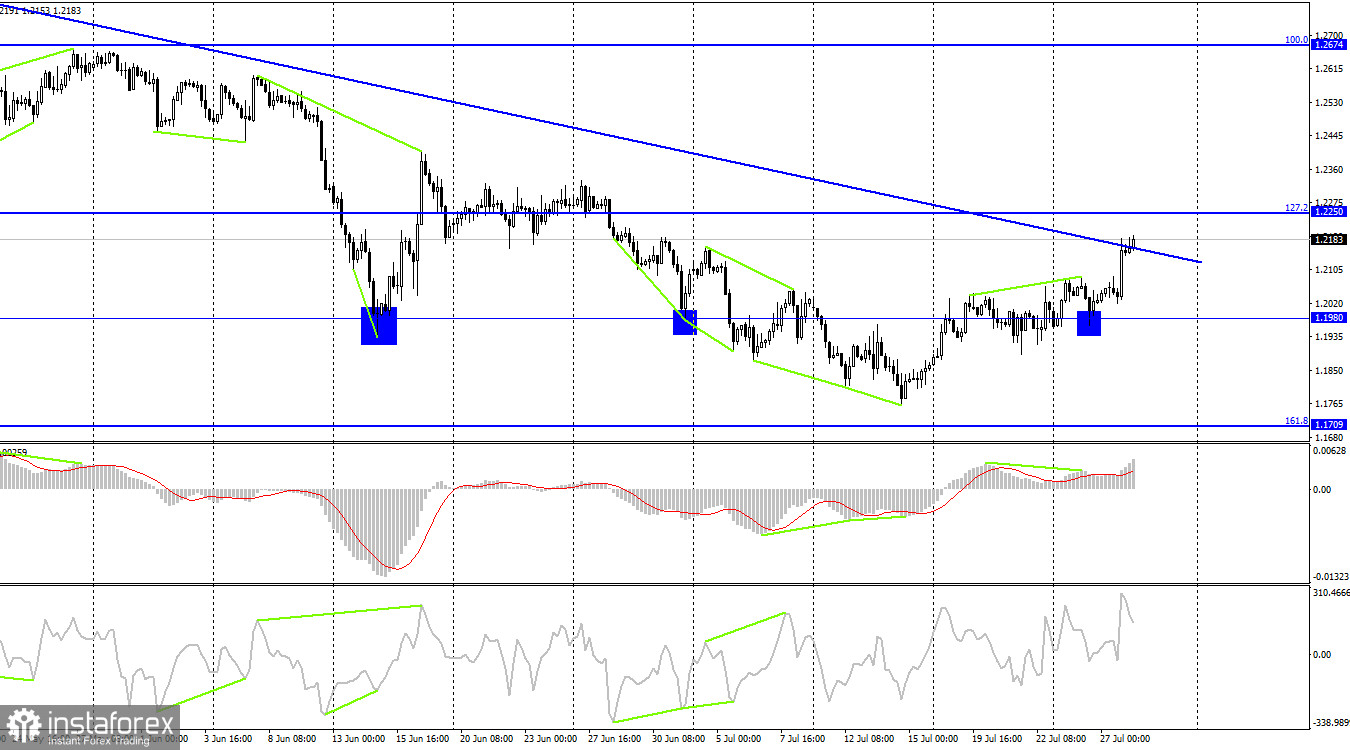

On the 4-hour chart, the pair reversed in favor of the British after rebounding from the level of 1.1980. Thus, the growth process has resumed in the direction of the downward trend line, which still keeps the current mood of traders "bearish." Fixing the pair's rate above this line will significantly increase the probability of further growth of the British dollar in the direction of the Fibo level of 127.2% (1.2250). Rebound – may work in favor of the beginning of a new fall of the pair.

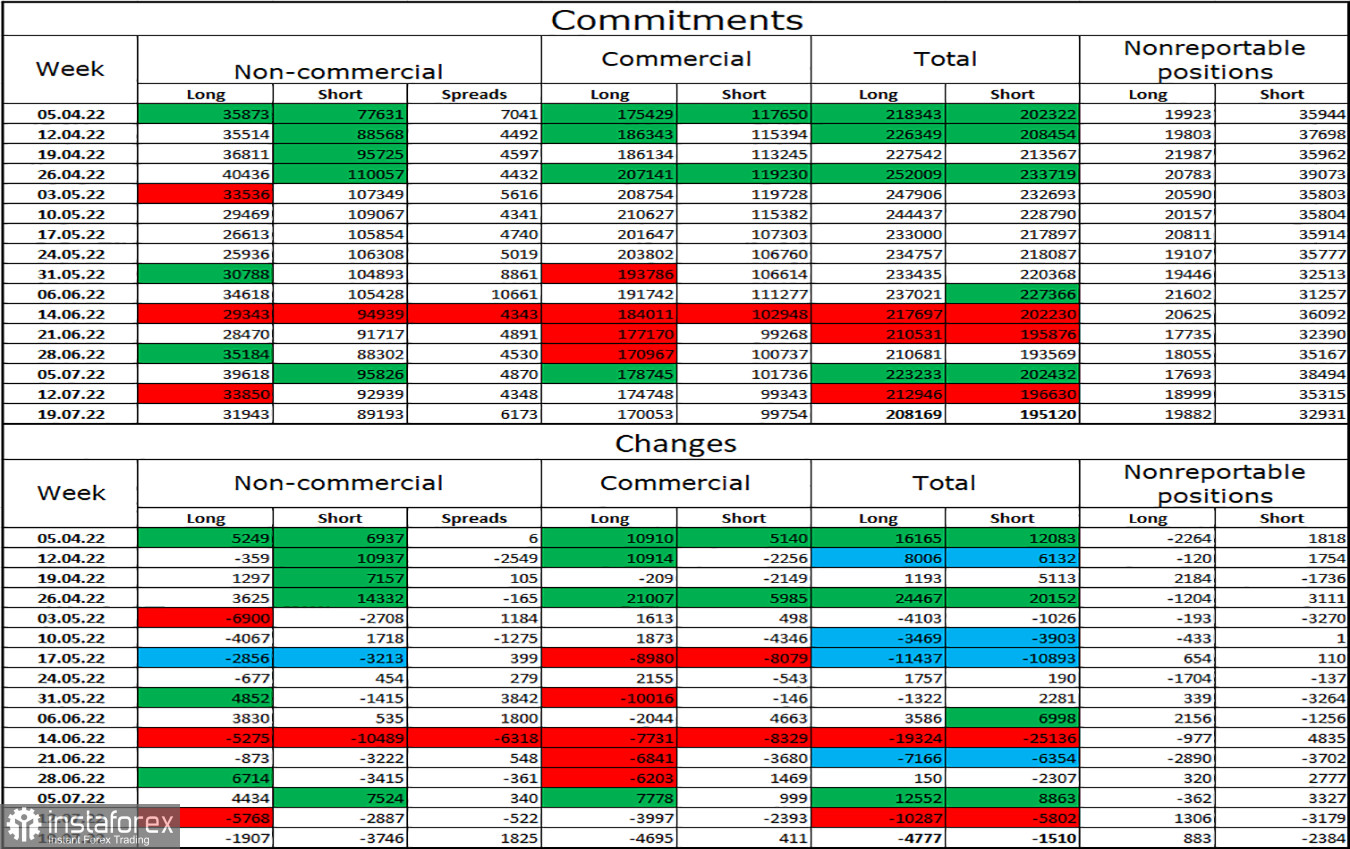

Commitments of Traders (COT) Report:

The mood of the "Non-commercial" category of traders has become a little less "bearish" over the past week. The number of long-contracts in the hands of speculators decreased by 1,907 units, and the number of short – by 3,746. Thus, the general mood of the major players remained the same – "bearish," and the number of short contracts still exceeded the number of long contracts by several times. Major players continue to get rid of the pound for the most part, and their mood has not changed much lately. So I think the pound could resume its decline over the next few weeks. The pound has certain chances for growth, but we are interested in a new trend, not a two or three-day growth, after which everything will return to normal.

News calendar for the USA and the UK:

US - GDP for the second quarter (12:30 UTC).

US - number of initial applications for unemployment benefits (12:30 UTC).

US - speech by Fed Chair Yellen (12:30 UTC).

On Thursday, the calendar of economic events in the UK is empty again. There are a few important events in the USA today, but the GDP report still cannot be missed. I believe that today the information background will have a moderate impact on the mood of traders.

GBP/USD forecast and recommendations to traders:

I recommend new sales of the British when anchoring under the ascending corridor on the hourly chart with targets of 1.1933 and 1.1684. I recommended buying the British when rebounding from the 1.1933 level on the hourly chart with a target of 1.2146. This goal has been fulfilled.