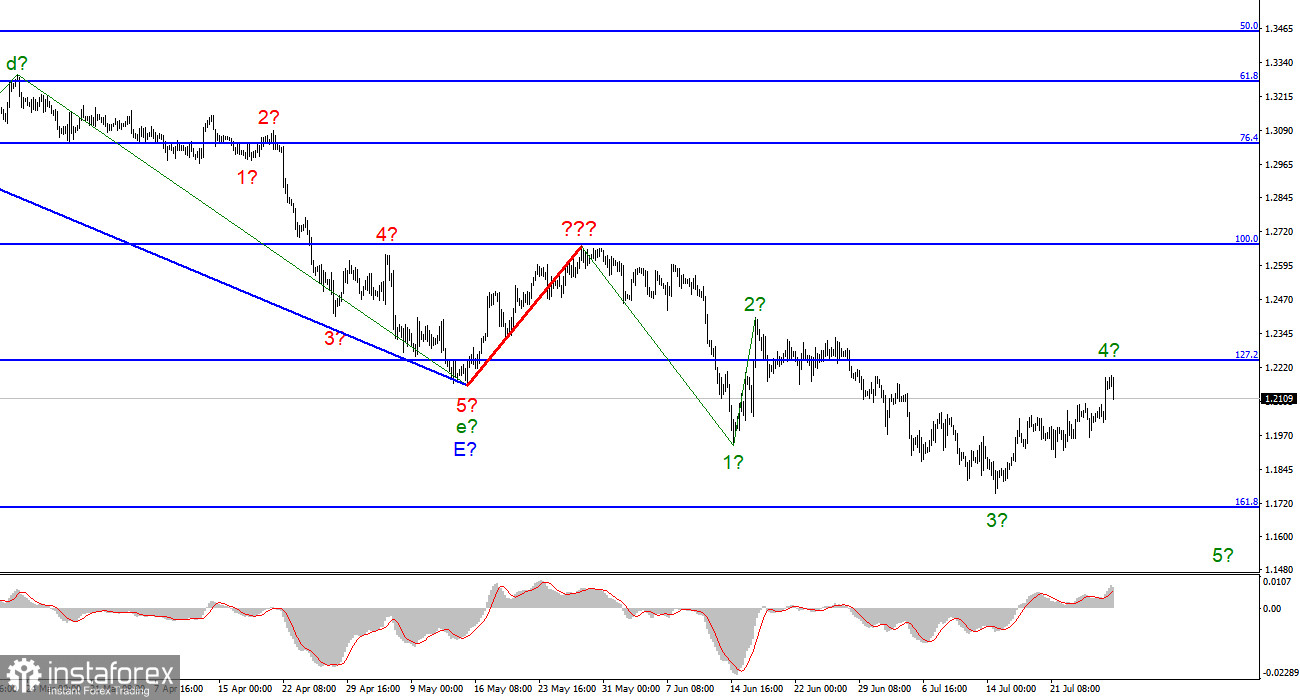

For the pound/dollar instrument, the wave marking at the moment looks quite difficult but does not require adjustments. The upward wave built between May 13 and May 27 does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, we can say that the construction of the upward correction section of the trend is canceled, and the downward section of the trend will take a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a greatly lengthening trend area. It would be much more practical to identify rare corrective waves, after which new impulse structures will be built. We have completed waves 1, 2, and 3, so we can assume that the instrument is now building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost equally. I expect a new decline in the British dollar in the coming days.

The pound does not want to go down again.

The exchange rate of the pound/dollar instrument decreased by ten basis points on July 28 but rose by 125 the day before. Because of this, wave 4 has become even more complicated, but it still fits into the current wave pattern since the wave structure is no longer pulsed. I have already said in the review on the euro currency that the decline in the US currency looks quite strange, given the increase in the FOMC rate by 75 basis points. However, today the market received another important report, which showed that perhaps he was not so wrong when he sold the dollar on the tightening of the Fed's monetary policy. The report on GDP for the second quarter in the US showed a drop of 0.9% q/q after it decreased by 1.6% q/q last quarter. Market expectations were 0.5-0.6%. Thus, the real value was not just worse but significantly worse than expected. The demand for the US dollar, which began to recover today, immediately sank, but you should not make premature conclusions about this either. Many people are already ready for the American recession, they have been talking about it continuously for the last few months, and the British and European economies are also unlikely to avoid this unpleasant phenomenon. If the American economy had been shrinking for several quarters in a row, and the European and British economies were doing fine at that time, then the dollar could feel market pressure. But in Europe, the economy's growth rate is minimal, and in the UK – slightly higher than the minimum. And it should be remembered that the Fed raises rates much faster and stronger than the Bank of England or the ECB. Therefore, I see nothing surprising in the fact that the American economy has begun to shrink. An effective fight against inflation involves certain sacrifices for economic growth.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a further decline. Thus, I advise now selling the instrument with targets near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down." There is still a possibility of building an upward wave, but I still believe that the pound will not take the initiative and move differently than a European for a long time.

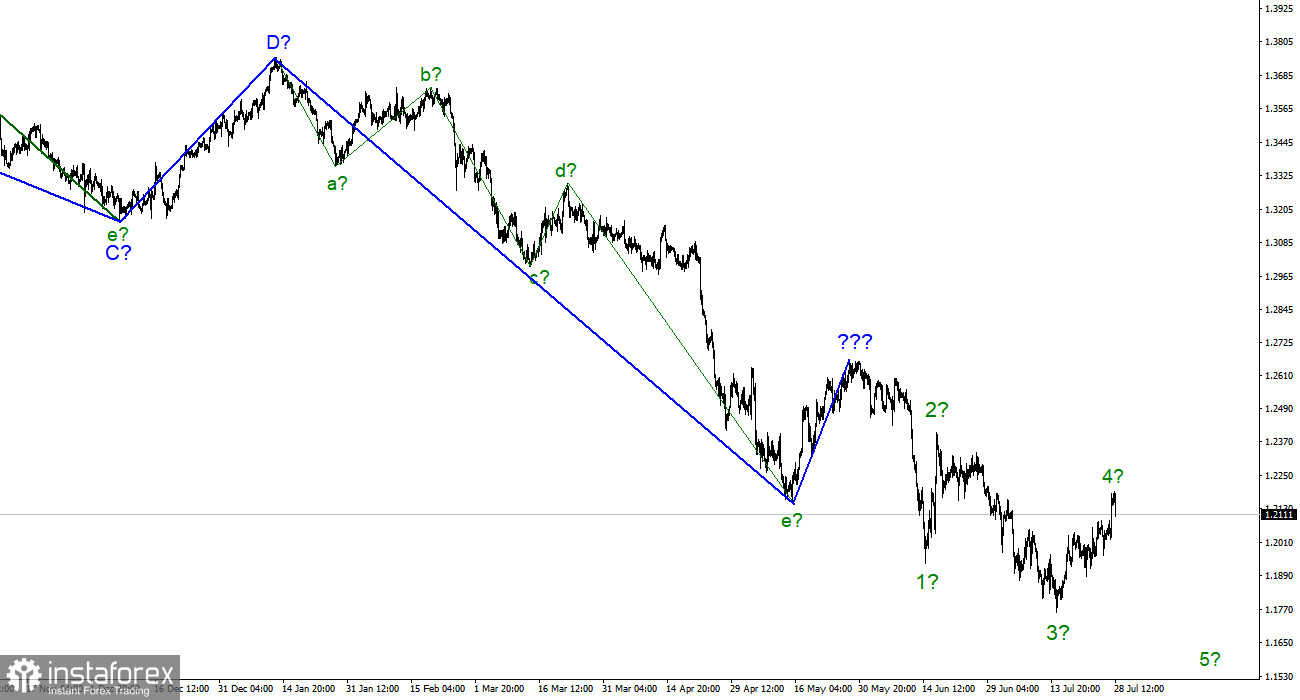

The picture is similar to the euro/dollar instrument at the higher wave scale. The same ascending wave that does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.