Bitcoin continues its upward movement against the backdrop of positive and expected news from the Fed. On July 28, the cryptocurrency reached the upper limit of the key resistance level of $24.2k. The successful break of this area opens the way to $26k. However, the coin stalled at this level and bounced back to the local support zone at $24k. The failed $24.5k retest was affected by falling trading volumes, which has not been typical for Bitcoin in the past few days.

Despite the local decline, a local upward trend has formed on the daily timeframe of the cryptocurrency. The asset formed two confident green candles in a row, which indicates the growing strength of buyers. The main driving force behind the upward movement of the cryptocurrency was positive fundamental news, as well as an active phase of accumulation after a period of historical capitulation. These two factors contributed to the technical strength of Bitcoin and also gave global reasons to invest in cryptocurrencies.

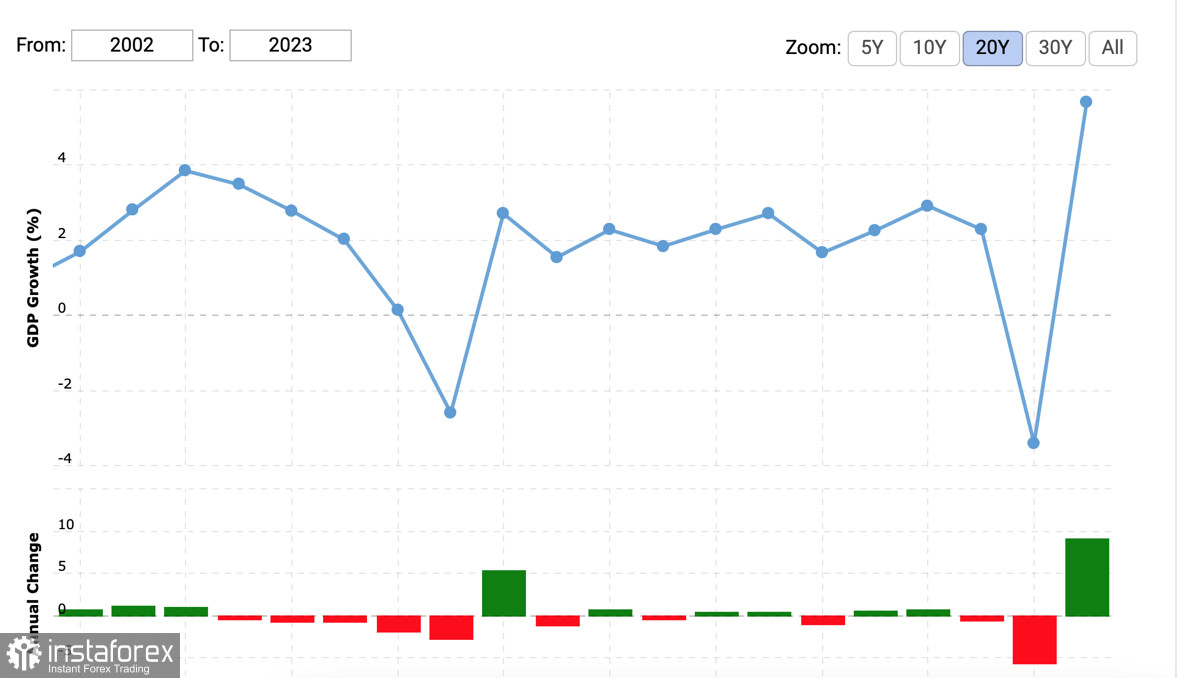

Bitcoin conquered the level of $24k amid the publication of US GDP reports. According to the forecast of Fed Chairman Jerome Powell, the US economy is not in recession. However, in the second quarter, US GDP fell by 0.9% after falling 1.6% in the first quarter of 2022. At the same time, expectations were at the level of 0.5%, and therefore such a sharp increase in the fall of the US economy was unexpected for the market. However, for the cryptocurrency market, this surprise may have positive aspects that allow digital assets to continue growing this fall.

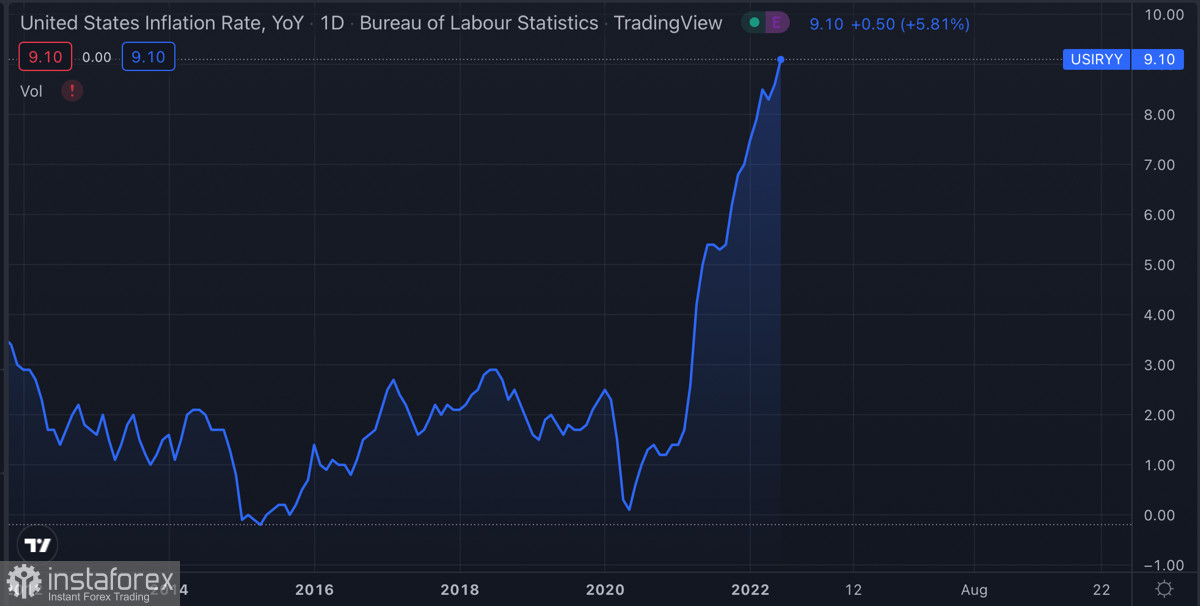

The policy of the Fed and the statements of Powell are based on statistics and forecasts. In two months, we have twice seen the failure of this approach. In mid-June, inflation hit a new record, prompting the largest capitulation in Bitcoin history. And this is despite Powell's statements that the Fed controls and effectively influences the CPI index. Now the US GDP has given the markets an unexpected and unpleasant surprise.

All these facts indicate that the Fed did not control the situation with inflation, and the predictive approach to determining the further strategy for raising the key rate did not justify itself. As a result, the US economy is in recession, as reported by the National Bureau of Economic Research. Experts note a significant reduction in economic activity for several months.

For Bitcoin, this is a positive outcome, as the Fed cannot turn a blind eye to the negative dynamics in the US economy. This will force the authority to reconsider its monetary policy. If the current trend continues, we will likely see the first easing of monetary policy in late August or early autumn. Bitcoin has historically reacted positively to monetary policy easing, and therefore we can expect an attempt at a protracted upward movement.

However, if we are talking about the current situation, then fundamentally, it negatively affects Bitcoin quotes. The failed $24.5k retest and low trading volumes are a direct consequence of the current economic situation in most of the world and massive BTC sales from Asian markets and miners. Despite this, Bitcoin and the cryptocurrency market continue the recovery phase and are slowly but surely moving upward. Problems with liquidity and overall economic activity have not yet significantly affected BTC/USD quotes, but fundamentally the economic downturn is observed in low trading activity.