Today, the market and the dollar will "swing" again at 12:30, when the data on personal income/expenses of Americans will be published. However, at the same time (at 12:30 GMT), Statistics Canada will publish a report with data on Canada's gross domestic product for May.

Previous values: +0.3%, +0.7%, +0.9%, +0.2% (in January 2022). Canadian GDP is forecast to fall by -0.2%. It is already the first alarm bell for CAD after yesterday's publication of negative US GDP.

The GDP report is the broadest indicator of economic activity and the main indicator of the state of the economy, and a weak GDP report will negatively affect CAD.

In our previous reviews, we note that the annual consumer price index (CPI) rose in May to +7.7%, the highest level in 39 years, and in June exceeded this level, reaching 8.1%.

Now, if today's report on Canada's GDP also turns out to be disappointing, then the Bank of Canada, like the Fed, will face the risks of stagflation (zero growth or decline in GDP against the backdrop of high inflation). And next Friday (at 12:30 GMT), key (along with data on GDP and inflation) data from the Canadian labor market will be published. Unemployment is forecast to rise to 5.1% in July (previous value of 4.9%).

The deterioration of the situation on the labor market will significantly exacerbate the Bank of Canada's problem of curbing rising inflation while the labor market and the country's economy are slowing down.

Thus, the Canadian dollar, like the US dollar, is also in a difficult situation.

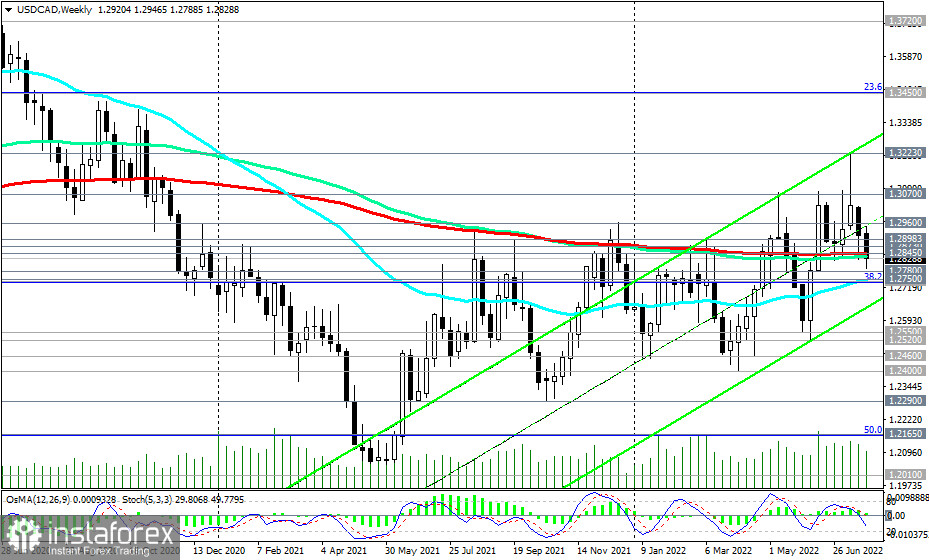

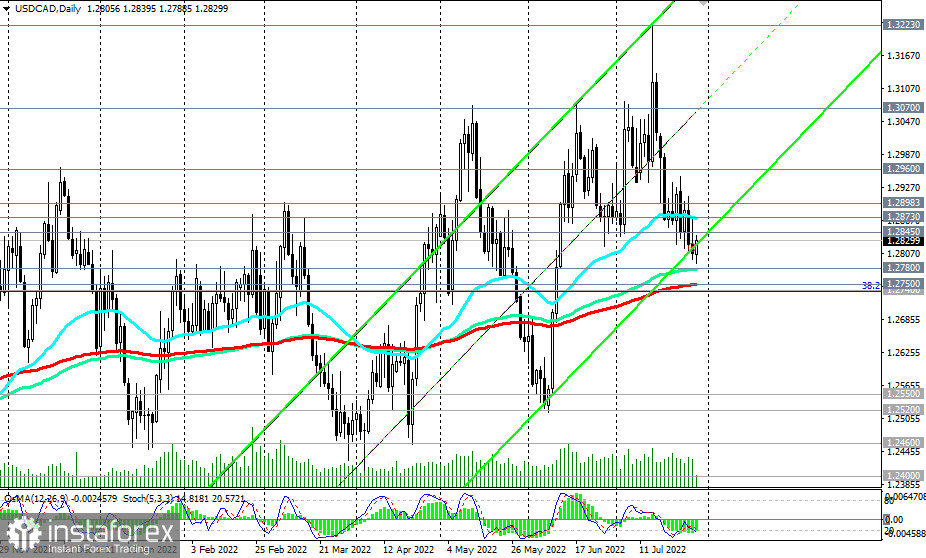

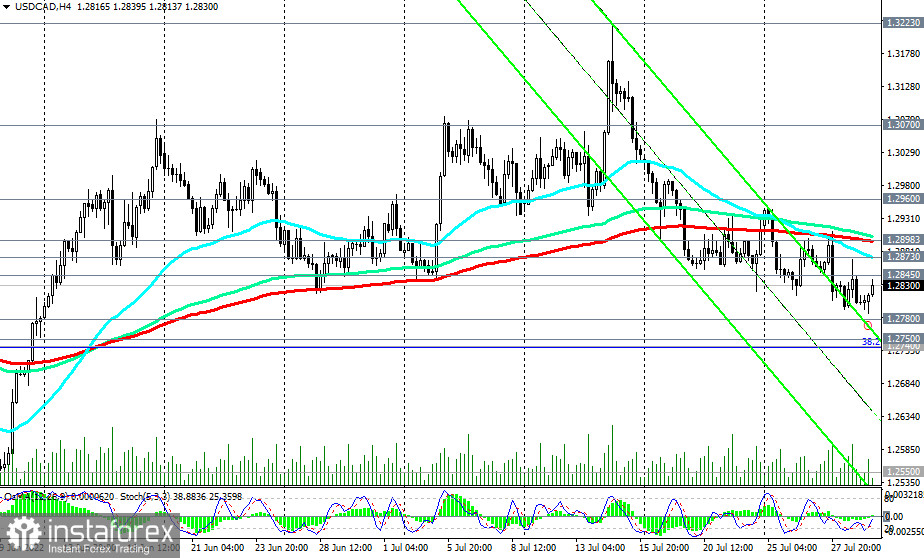

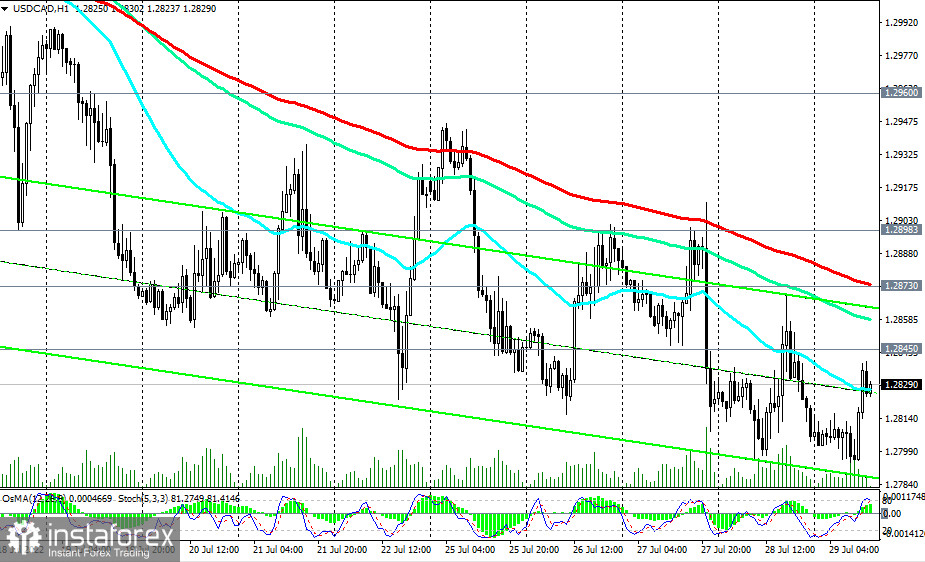

From a technical point of view, USD/CAD is in the stage of a downward correction within the overall upward trend, above the key support levels 1.2780 (144 EMA on the daily chart), 1.2750 (200 EMA on the daily chart).

A return to the zone above the long-term support level of 1.2845 (EMA200 on the weekly chart) will resume the bullish trend of USD/CAD. The driver of growth may be today's publication at 12:30 (GMT), if the data for the US turns out to be positive and for Canada (GDP for May)—negative.

The breakdown of short-term resistance levels 1.2873 and 1.2898 will confirm the resumption of long positions in USD/CAD.

Support levels: 1.2845, 1.2800, 1.2780, 1.2750, 1.2700, 1.2550, 1.2520

Resistance levels: 1.2873, 1.2898, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100, 1.3223

Trading Tips

Sell Stop 1.2770. Stop-Loss 1.2860. Take-Profit 1.2750, 1.2700, 1.2550, 1.2520

Buy Stop 1.2860. Stop-Loss 1.2770. Take-Profit 1.2873, 1.2898, 1.2900, 1.2960, 1.3000, 1.3070, 1.3100, 1.3223