It's hard to find a black cat in a dark room. Especially if it's not there. An attempt by investors to find a dovish reversal in the speech of Federal Reserve Chairman Jerome Powell turned first into the rise of EURUSD, and then the collapse of the currency pair, after traders realized that there was no reversal. Then the market began to look for a positive from the US GDP, which also did not turn out. The US dollar slipped again, but the strong statistics for the eurozone were not enough for the main currency pair to be able to leave the boundaries of the consolidation range of 1.01-1.027.

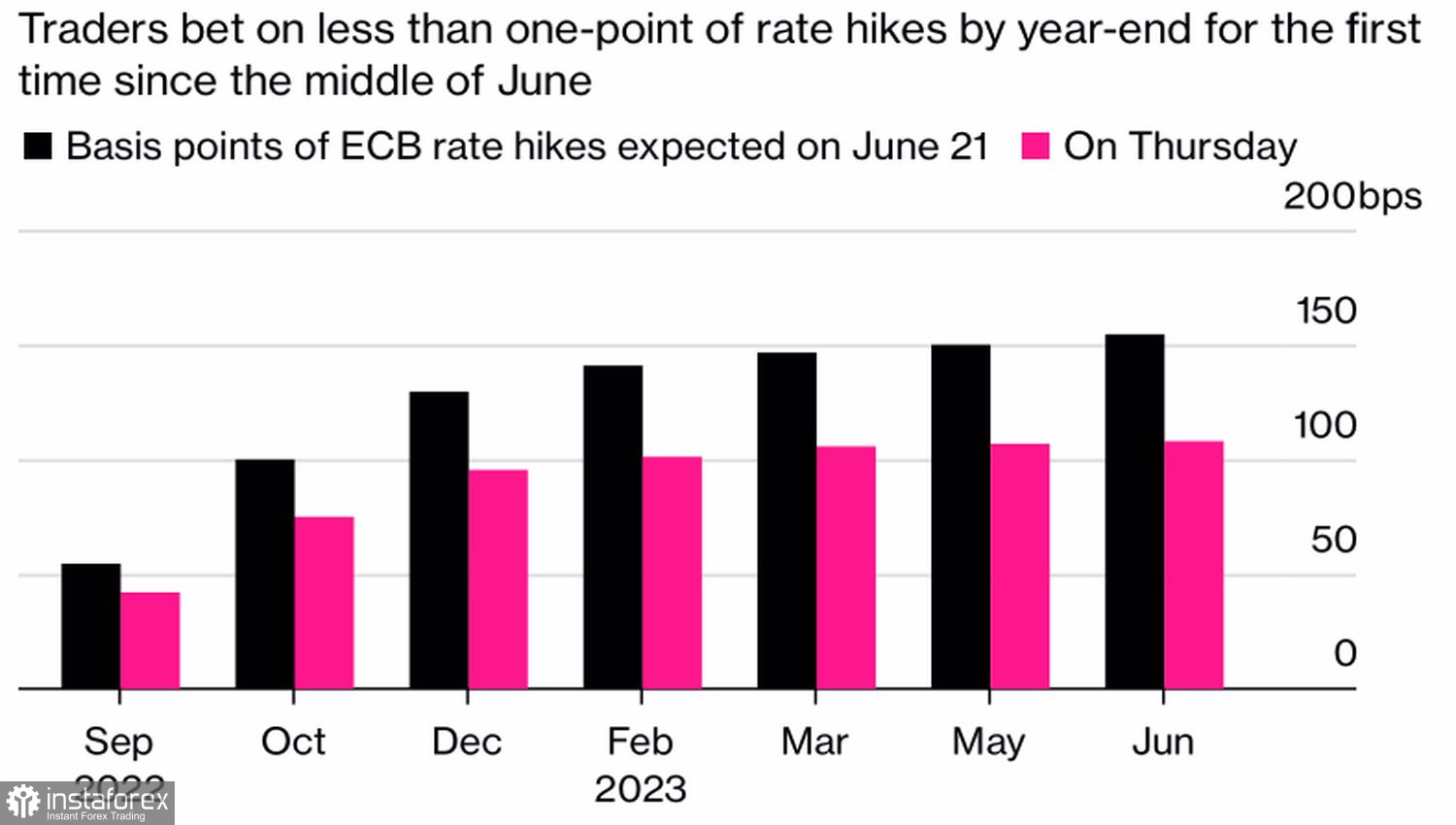

The question is, if inflation reaches a record level of 8.9%, and the economy remains resistant to the tightening of the European Central Bank's monetary policy, why do the money markets reduce the expected increase in the deposit rate by the end of the year from +140 bps after the meeting of the Governing Council to +100 bps? It was investors' distrust of the central bank, or rather, of its determination, that prevented the EURUSD bulls from continuing the attack.

Expectations for the ECB deposit rate

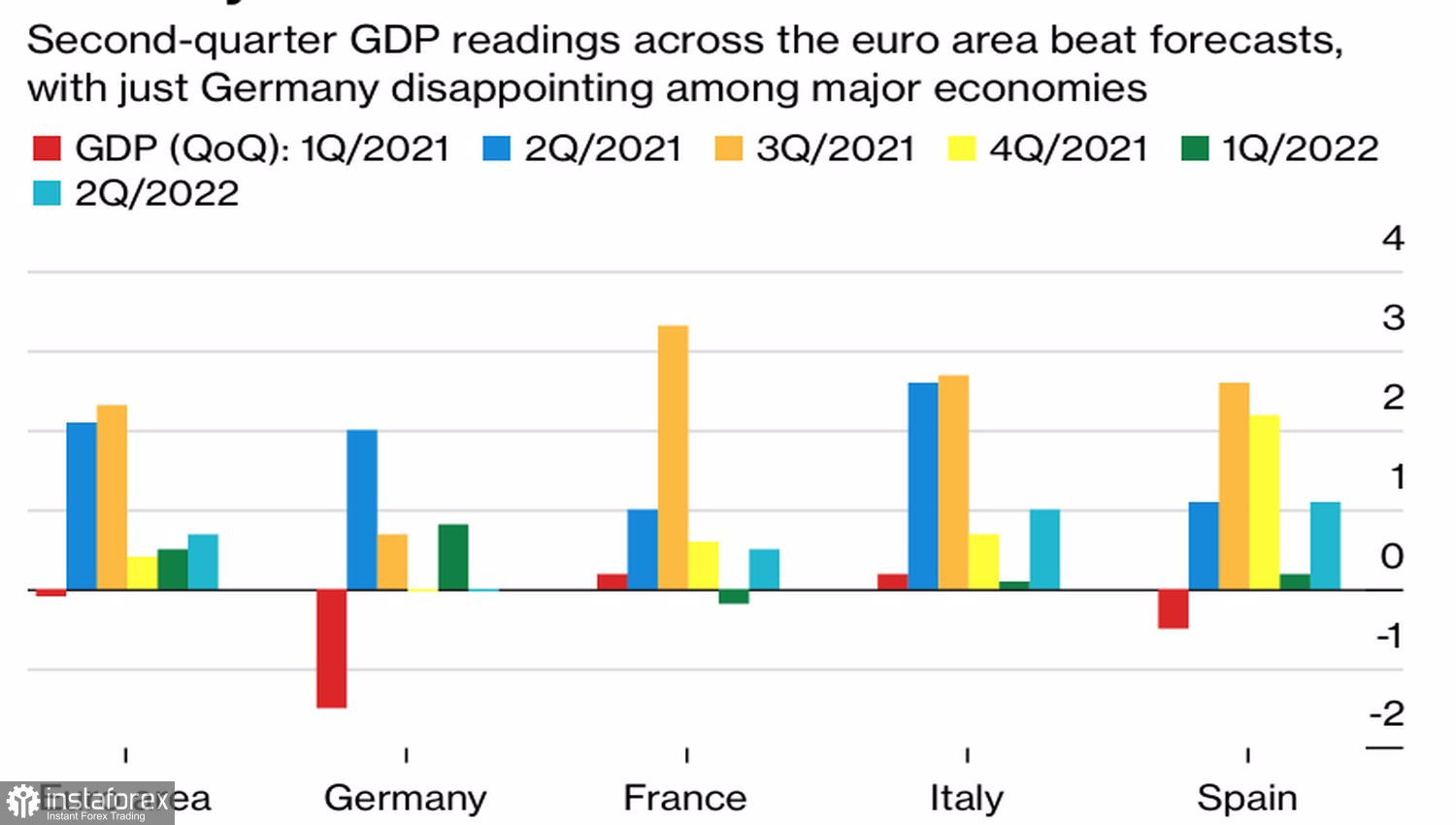

Theoretically, everything should be different. The rise of core inflation and consumer prices in the euro area to new all-time highs of 4% and 8.9%, respectively, should provoke a hawk attack within the ECB. Most likely, supporters of aggressive monetary tightening will insist on repeating the June trick with a 50 bp rate hike in September. The only thing that could hold them back is weak statistics on the economy of the currency bloc. But the release of GDP data was surprisingly good. Instead of a modest expansion of 0.2%, the figure increased by 0.7%. At the same time, Italy and Spain marked growth by 1% and 1.1%, France - by 0.5%. Only Germany turned out to be disappointing. Complete anemia, and if you look at the second decimal place, then a technical recession.

Eurozone GDP dynamics

It seems that investors are afraid that the largest economy in the eurozone will pull the entire currency bloc to the bottom, and the problems of US GDP will affect global economic growth. Has the US stock market rally gone too far? And isn't it time to return to such a safe-haven asset as the dollar?

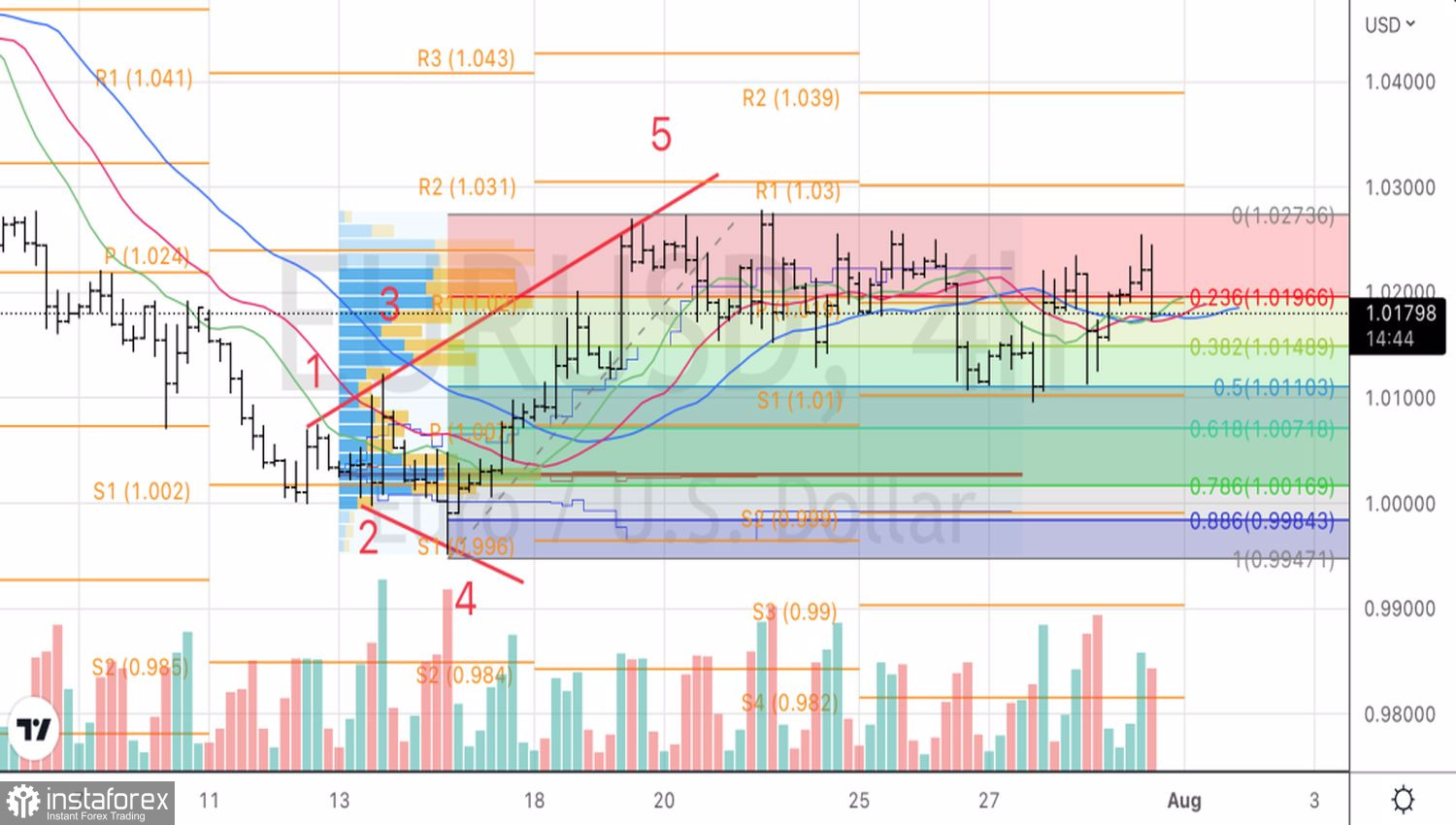

In my opinion, the markets are currently in tug-of-war mode. Some of the investors hope that the approaching recession in the United States will force the Fed to slow down the process of monetary restriction, and sell the American currency. Someone believes that the recession will be a global event, and on the contrary, they buy it as a safe haven. As a result, the EURUSD pair is thrown into the heat, then into the cold, and it cannot get out of the vicious circle of consolidation. Before the euro leaves the range of $1.01-1.027, it will be difficult for it to decide on the direction of further movement.

Technically, on the 4-hour EURUSD chart, consolidation continues within the "Splash and Shelf" pattern. A breakthrough of resistances at 1.0255 and 1.027 is a reason to open long positions. On the contrary, falling below 1.01 will be the basis for short positions in the direction of 1 and 0.985.