Looking back at the past four weeks, we can draw certain conclusions, projecting them onto the August prospects. Actually, the main conclusions revolve around the parity level. Firstly, the EUR/USD bears managed to overcome the 1.0000 mark for the first time in 20 years, and secondly, they failed to settle below this target. Having analyzed the reasons for the unsuccessful assault on the main price barrier, we can draw certain conclusions in the context of the future fate of the pair, at least in the medium term.

The dollar is getting more expensive on two whales: this is the hawkish attitude of the Federal Reserve and the growth of anti-risk sentiment. And if the hawkishness of the Fed does not work in all dollar pairs (for example, in the USD/CAD pair, the loonie clearly dominates due to a 100-point rate hike by the Bank of Canada), then the status of a protective asset allows the greenback to stay afloat even in the most stressful situations for it. For example, the disappointing results of the July Fed meeting did not help bulls of the EUR/USD pair break out of the price range, amid increased flight from risky assets. Actually, for this reason, the dollar paired with the euro spent the second half of July in the 1.0130-1.0280 range. The bears did not have the opportunity to test the parity zone again, while the bulls could not even approach the boundaries of the third figure. The energy crisis in Europe and the accompanying economic (and political) problems allowed bears to boldly open short positions when approaching the upper limit of the aforementioned range.

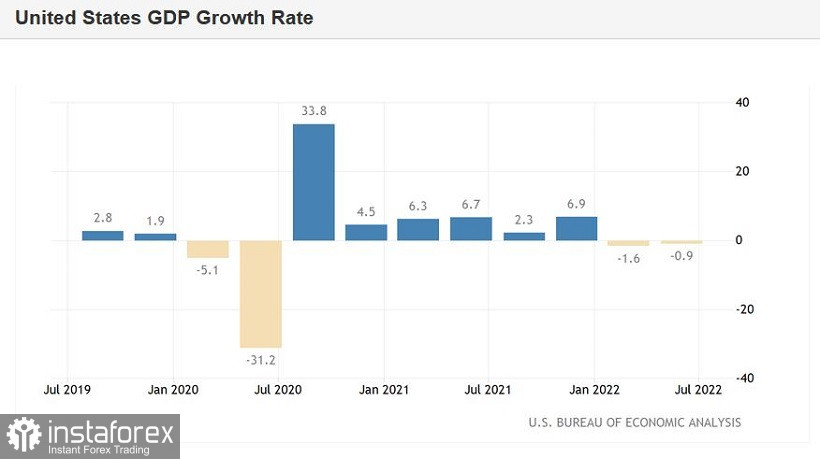

All the weaknesses of the US currency faded into the background – by and large, EUR/USD traders only reflexively reacted to the fundamental factors negative for the greenback. There were plenty of them in July. For example, the American economy has formally entered a recession: according to the results of the second quarter of 2022, the volume of US GDP decreased by 0.9%, while the first quarter was also closed in the red (-1.6%). And although the head of the US Treasury Janet Yellen suggests calling the current situation a "planned slowdown" (and not a recession), the fact remains that for two consecutive quarters the country's economy has shown a negative result. Many other macroeconomic reports published in July were also disappointing – for example, the data on industrial production in the United States (for the first time since December 2021, it is in negative territory), the US PMI index for the services sector (which collapsed to 47 points), reports in the housing market (a significant decline in sales of new and secondary real estate) and an indicator of American consumer confidence (a three-month decline in the indicator, in June - at least since February 2021).

Summing up the results of the US central bank's July meeting, Fed Chairman Jerome Powell noted that despite the rise in inflation and the strengthening of the labor market, "other economic indicators have noticeably softened." He uttered this phrase in response to a question about the further pace of monetary policy tightening. He made it clear that the central bank will aggressively raise the interest rate only as a last resort if inflation does not show signs of slowing down. Such a moderate attitude disappointed dollar bulls, after which the greenback was under pressure in many pairs of the major group.

The EUR/USD pair is an exception in this case. The worsening energy crisis on the eve of the autumn-winter period serves as a heavy anchor for the pair. Despite the minimal growth of the European economy in the second quarter (0.7%), many economists are sounding the alarm, looking back at the rising cost of blue fuel. The price of gas in Europe is kept above the $ 2,000 mark, and last week it rose to $2,500 per thousand cubic meters. Following gas, electricity is also increasing in price. In July, it became known that German electricity contracts for next year's supply (considered a market benchmark) reached the highest levels in history: 325 euros per MW-hour. The equivalent contract in France has doubled since the beginning of the year (to 366 euros per MWh).

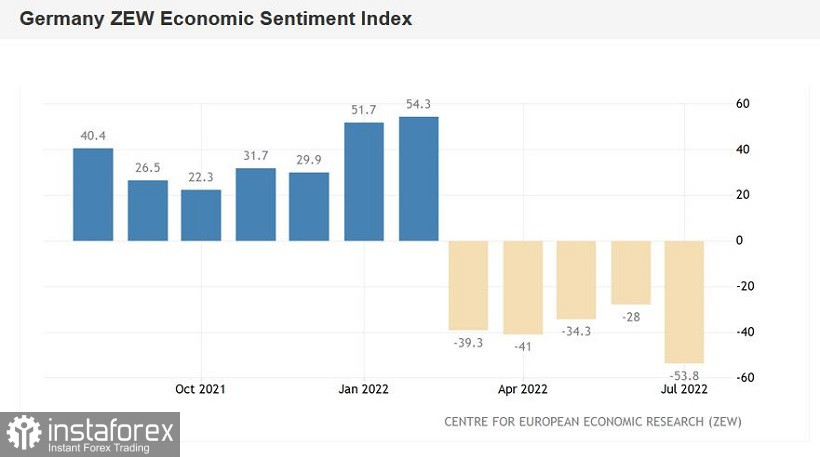

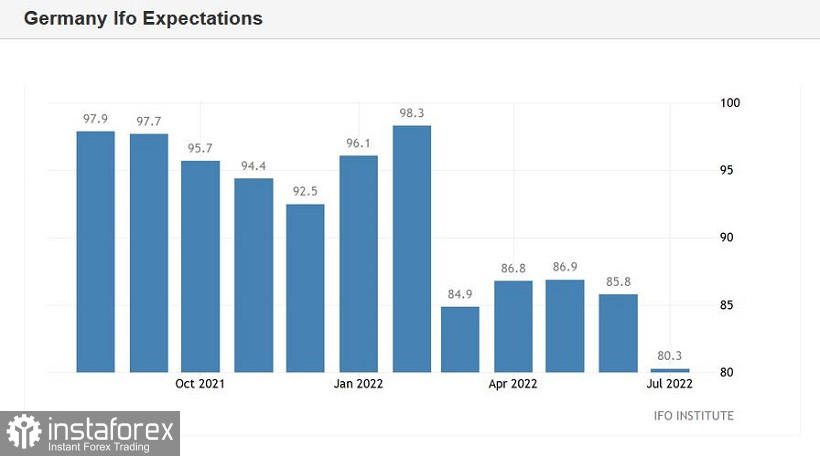

As you know, electricity prices largely depend on the cost of gas, so a further increase in the cost of blue fuel will put pressure on the euro. After all, not only economists and politicians have already sounded the alarm about this, but industrialists (in particular, German ones), who have outlined a gloomy picture of the near-term prospects. By the way, the latest reports from many institutions (IFO, ZEW, GfK, PMI indices) reflected the growing pessimism of representatives of the European business environment - both about the current situation and about the future prospects. In turn, the European Commission in July lowered estimates of growth rates and sharply raised the inflation forecast. According to EC economists, inflation will reach 7.6% by the end of the year, and in 2023 it will remain at a level twice the ECB target.

In such circumstances, it will be difficult for the European Central Bank to intensify aggressive rhetoric regarding the future prospects. The ECB may decide on another 50-point rate hike in September or October, although according to Goldman Sachs analysts, the central bank will limit itself to a 25-point hike. Amid such indecisiveness of the ECB, the dollar again "wins" against the euro, even if we take into account the Fed's baseline scenario, which assumes a 50-point rate hike at each meeting until the end of the year (with a possible option of a 75-point increase in September).

Also, the dollar is kept afloat due to the strengthening of anti-risk sentiment. And here the focus is not only on the "Ukrainian case". Tensions between the United States and China increased significantly in July. The reason for the escalation was the planned visit of the speaker of the lower house of the US Congress Nancy Pelosi to Taiwan. Her plane, which flew to Asia (and hypothetically could have tried to land in Taiwan) landed in Hawaii. Since then, it has disappeared from the available (to the general public) radars – the pilots obviously turned off the transponder. A possible visit to the island, which is considered the territory of China, has already caused the military preparations of China. In other words, the situation is tense to the limit, so its development will undoubtedly affect the further behavior of the EUR/USD pair. If geopolitical tensions (not to mention any military actions) between the US and China increase, the dollar will again be in high demand as a protective asset.

Thus, summarizing the above, we can conclude that July was not on the US dollar's side. But the greenback does not look like a loser either. After a sharp takeoff in the middle of the month, it retreated from the height taken and lay down to drift. EUR/USD bears were able to "dive" under the parity level, but could not stay below 1.0000. The pair was trading in the range of 1.0130-1.0280 in the second half of July. In my opinion, in the medium term, bears will try to go below the lower limit of this price range in order to settle below the 1.0100 mark. In this case, the bears will again have a chance to retest the parity level. The likelihood of this scenario will increase significantly if the cost of gas in Europe continues to grow, and relations between the United States and China continue to deteriorate. Taking into account the prevailing fundamental background for the EUR/USD pair, it is advisable to consider short positions on the upward corrective pullbacks, with targets of 1.0150, 1.0100 and 1.0050. The main goal of the downward trend remains the same – the level of parity.