The GBP/USD currency pair "flew" in all directions on Friday and displayed unusually significant volatility. Such "flights" were not provoked by macroeconomic facts or other occurrences, since neither the first nor the second just happened. Several studies have been issued in the States, in particular, changes in the volume of personal income and expenses of the American population, the consumer sentiment index from the University of Michigan. Personal expenses climbed more than projected, personal income - within the prediction, and the consumer sentiment index was 51.5 points, which is one of the poorest readings in the last 25-30 years. In other words, what is absolutely not in the American economy right now is good expectations. Despite the fact that Jerome Powell believes in the potential to prevent a recession, consumers and experts believe that it has already begun. And it began against the background of the largest inflation, which even now cannot be stopped in growth yet. However, for the pound/dollar pair and for the broader currency market as a whole, this information is not particularly relevant. The fact that the American economy will encounter troubles is not news to anyone. There are also enough problems in the UK, and the British economy is undergoing the same slump. The only difference is that the Fed raises the rate more swiftly, so the economy slows down too soon and abruptly. The Bank of England raises the rate regularly but does it more steadily, so the British economy has not yet "responded" with a cut. However, in Britain, they also recognize that inflation needs to be battled, which implies that the rate will also continue to grow and, consequently, will "chill" the economy. Thus, we believe that British GDP will not escape negative values either.

The Bank of England will hike the rate by 0.5 percent almost guarantee.

In fact, only secondary reports are anticipated for this week in the UK. Indices of corporate activity in the service and manufacturing sectors are, of course, intriguing, but nonetheless, they are unlikely to significantly influence the mood of market players. But this week, the Bank of England will host a meeting, because of which the pound sterling could demonstrate an increase in recent weeks. Recall that the market is currently worrying about how much the regulator will hike the rate? At the latest meeting, three of the nine members of the monetary committee voted for a hike of 0.5 percent, while six voted for 0.25 percent . However, as the last inflation report indicated, it was not even possible to slow it down. Therefore, the probability of a 0.5 percent rate hike at the August meeting is at least 70 percent. Such a tightening of monetary policy, it would seem, should drive a large expansion of the British currency, but we believe that the market reaction may be reversed. There are at least three considerations in favor of this.

First, the pound has been growing for several weeks. It cannot be argued that it has managed to grow by some unreasonable value over this time, but nonetheless, it is growth and it cannot be denied. Second, the expansion of the British pound was not justified fundamentally or macroeconomically. That is, we believe that the market merely played back the BA rate increase in advance. If the rate hike has already been worked out, then on Thursday we will witness a decrease in the British pound, unless the regulator makes a really wild choice to raise the rate by 0.75 percent or more. Third, this is exactly what we witnessed last week when the Fed raised the rate by 0.75 percent. After all, it was also a big rise, but the US dollar did not enjoy any burst of strength after the ruling. It continued to fall in pair with the pound, and in pair with the euro – continued to stand in one position. Since the decision to raise the Fed's rate was also known well before the official announcement of the results, the market may have won it back in advance even in that scenario. Thus, we predict that the euro and the pound are on the verge of a new decline with the renewal of their 20-year and 2-year lows. Of course, we must not forget about the "method". For example, today the pound/dollar is trading above the moving average line. Therefore, if it does not go below the moving average, then there will be no cause to sell the pair. However, if we try to look at the scenario in general, we would predict that the fall will resume.

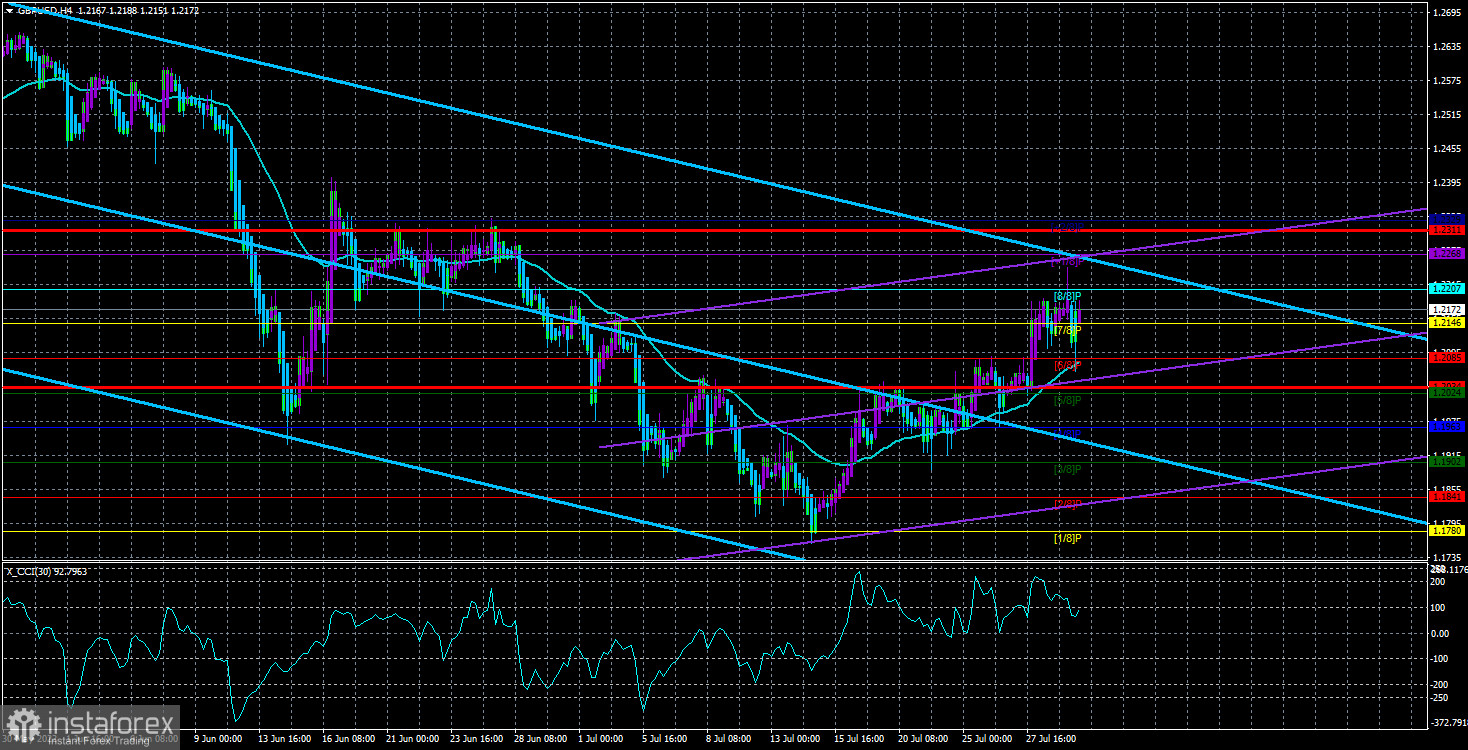

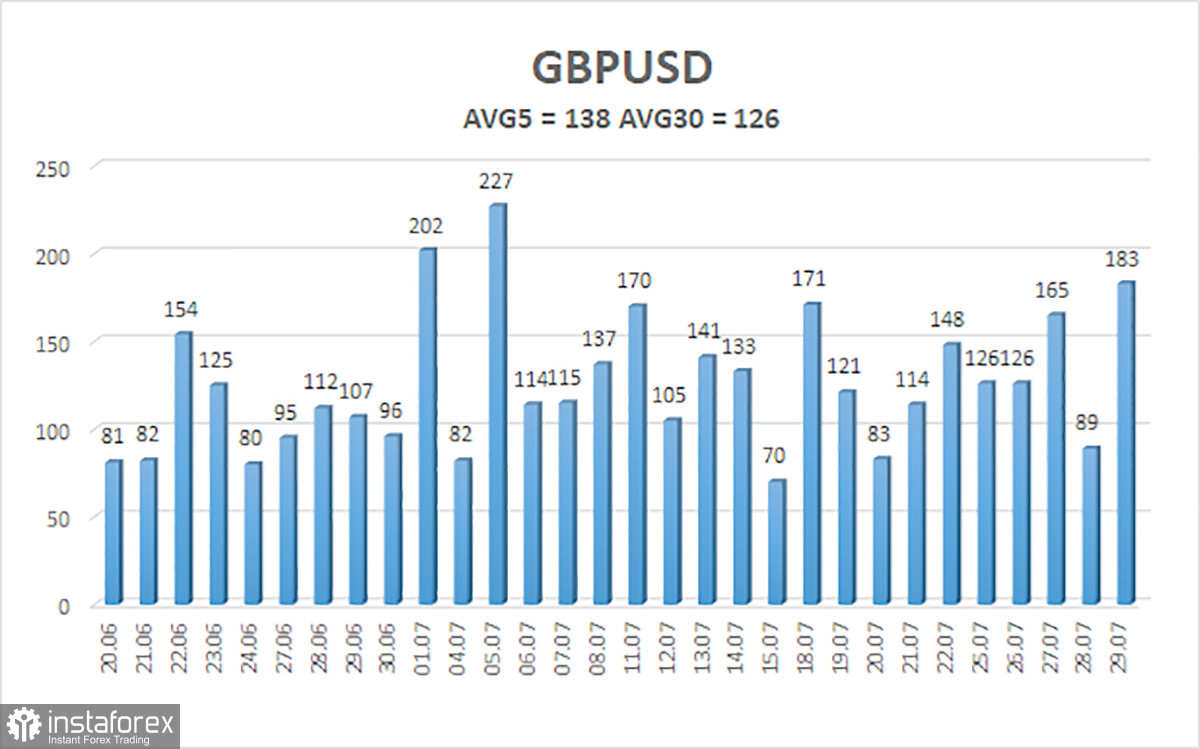

The average volatility of the GBP/USD pair over the last 5 trading days is 138 points. For the pound/dollar pair, this value is "high". On Monday, August 1, thus, we predict movement inside the channel, limited by the levels of 1.2034 and 1.2311. The reversal of the Heiken Ashi indicator to the top will signify the return of the upward movement.

Nearest support levels:

S1 – 1.2146

S2 – 1.2085

S3 – 1.2024

Nearest resistance levels:

R1 – 1.2207

R2 – 1.2268

R3 – 1.2329

Trading Recommendations:

The GBP/USD pair continues to be situated above the moving average on the 4-hour timeframe. Therefore, at the moment, we should continue to consider buy orders with targets of 1.2268 and 1.2311, as the pair bounced off the moving average. Sell orders should be opened when anchoring below the moving average line with targets of 1.1963 and 1.1902.

Explanations for the figures:

Channels of linear regression – aid in determining the present trend. If both are moving in the same direction, the trend is currently strong.

Moving average line (settings 20.0, smoothed) – determines the current short-term trend and trading direction.

Murray levels serve as movement and correction targets.

Volatility levels (red lines) represent the expected price channel that the pair will trade within over the next trading day, based on the current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal is imminent.