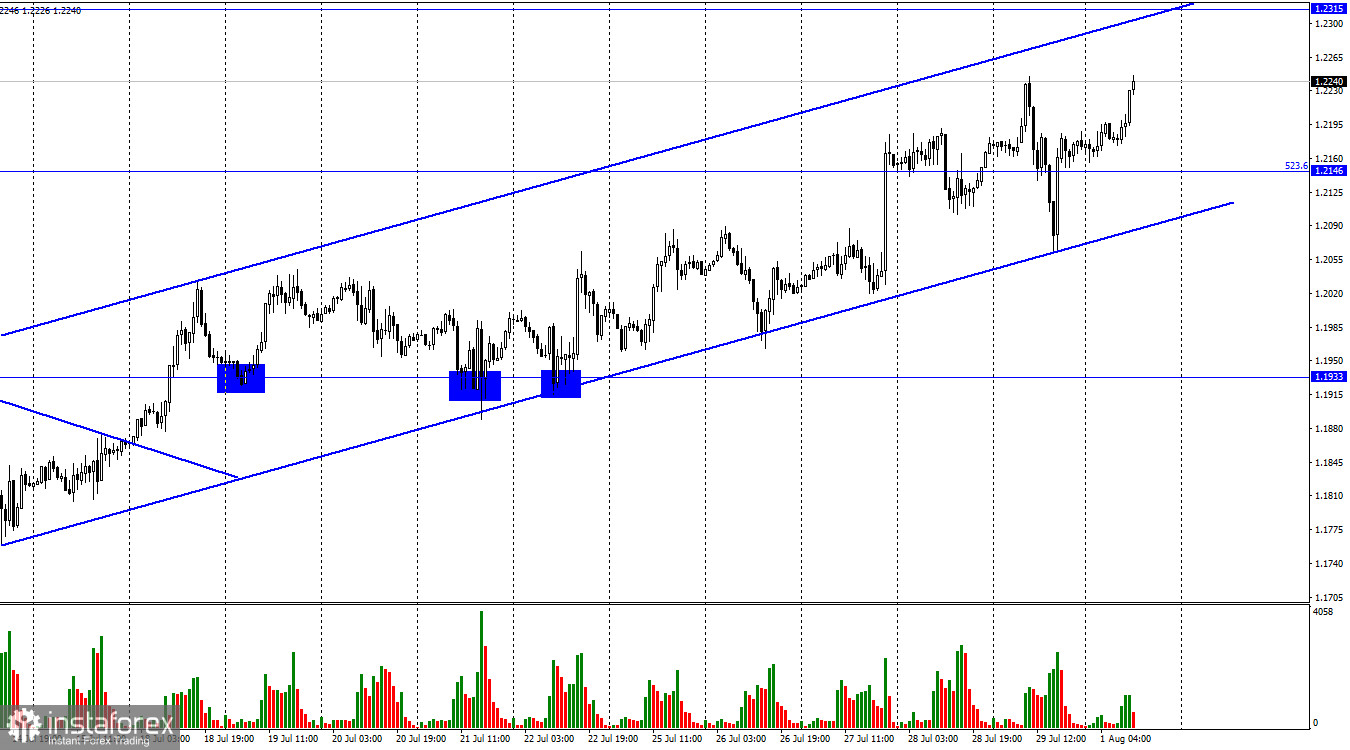

Hello, dear traders! On Monday, the pound/dollar pair resumed rising towards 1.2315 on the one-hour chart. For the last few weeks, the British pound has been surprisingly stable. It managed to test the lower limit of the upward channel four times. Each test was followed by a rebound, which led to new highs.

The trend channel is reflecting bullish sentiment among traders. Thus, the pair will hardly decline deep until it closes below the channel. In my article devoted to the euro/dollar pair, I have already emphasized that traders are paying zero attention to the news flow. On Friday, the UK did not provide any important report. Nevertheless, the pound/dollar pair showed a significant drop. Today, it resumed gaining in value regardless of weak data from the UK. Notably, the pair showed some signs of a rise already on Friday.

In July, the UK manufacturing PMI totaled 52.1 points, whereas in the previous month it was at 52.8 points. It is not a significant decline, but still it happened. I suppose that traders are waiting for the key interest rate hike of 0.50% instead of 0.25% by the BoE. These expectations are supporting demand for the pound sterling. However, traders should take a close look at the meeting results that will be unveiled on Thursday.

The fact is that now, traders are buying the pound sterling on the expectations of the most hawkish scenario. What if the regulator decides to raise the benchmark rate by 0.25%? What if Andrew Bailey will be less radical in his comments or the regulator postpones the BoE's balance sheet reduction program? In fact, there are numerous variants, but traders have priced in the most hawkish ones. Thus, it is quite possible that on Wednesday or Thursday, bears will have a chance to regain control over the market.

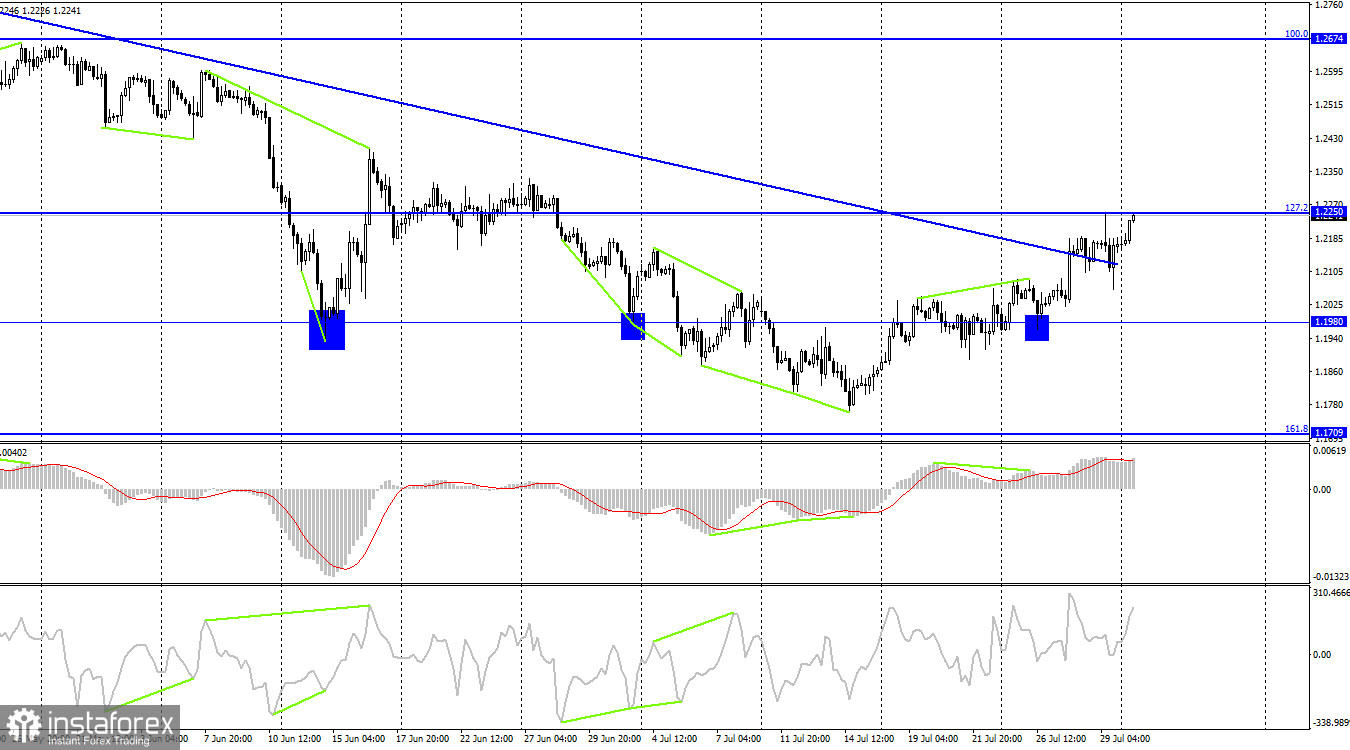

On the four-hour chart, the pair climbed to the 127.2% correctional level located at 1.2250 and consolidated above the downward trend line. Although it is a very strong signal, I recommend that traders wait until the price settles above 1.2250. This will give more chances for a further rise. Traders should also wait for the BoE's results since just after their publication, traders' sentiment may change. Thus, it is too early to make any conclusions.

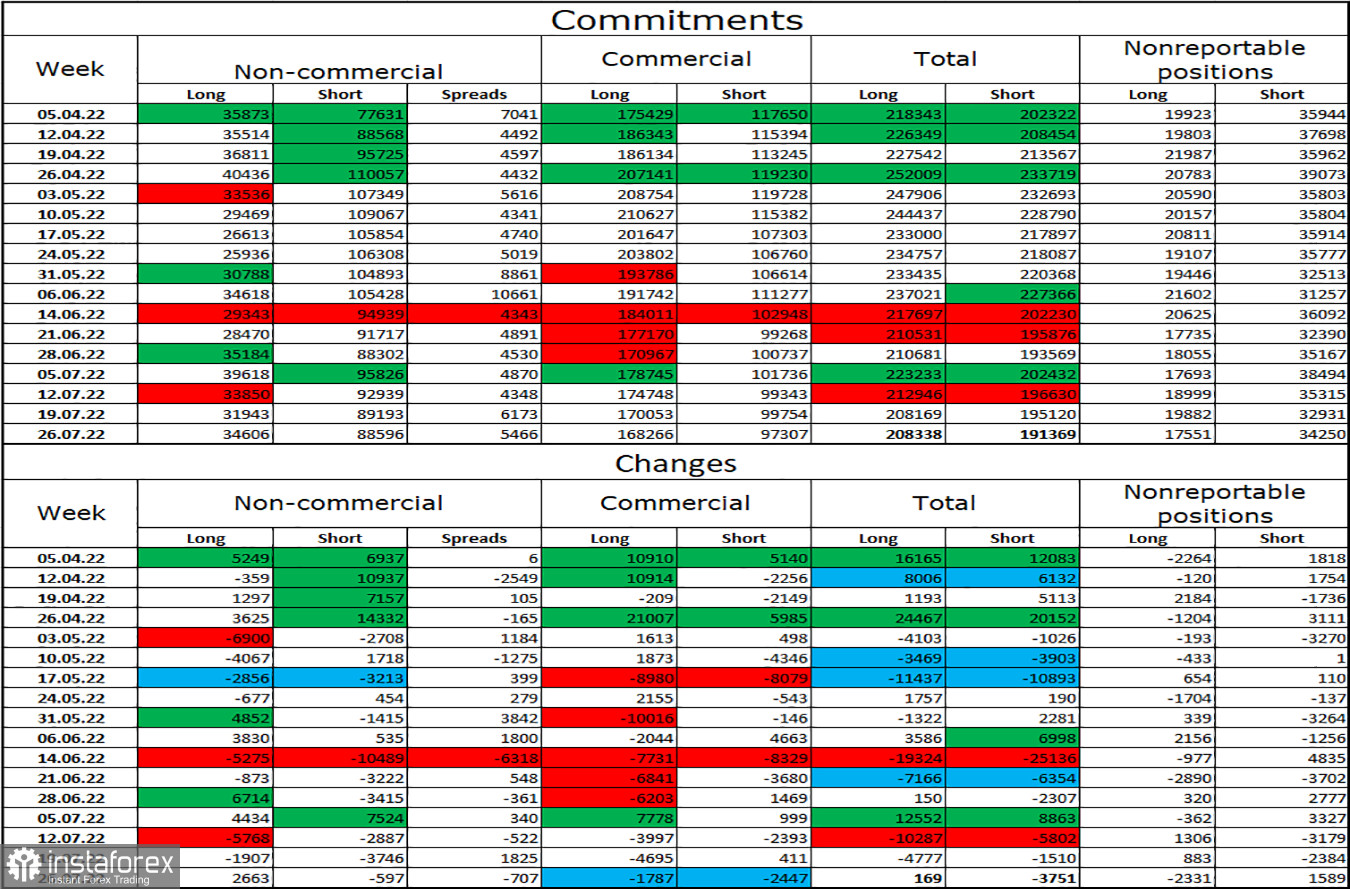

COT report

Last week, sentiment among non-commercial traders became less bearish. The number of long contracts increased by 2,663, whereas the number of short contracts declined by 597. Thus, the overall sentiment of big traders remained bearish. The number of short contracts is still exceeding the number of the long ones by several times. Big players are selling off the pound sterling, remaining bearish. Although during the last two weeks, the pound sterling has been gaining in value, the COT report unveiled that the currency may resume falling in the next few weeks. The fact is that bulls' positions are unlikely to increase so much to push the price higher.

Trader's calendar for the US and the UK:

UK – Manufacturing PMIUS - Manufacturing PMIUS – ISM Manufacturing PMI

On Monday, the UK will disclose only one important report. The US will provide traders with two reports that may affect the market situation. However, the news flow is expected to have a moderate influence on traders' sentiment.

Outlook for GBP/USD and trading recommendations:

Traders may sell the pound sterling if it settles below the upward channel on the one-hour chart. The target is located at 1.1933. Buy orders could be initiated after a rise from 1.1933 on the one-hour chart with the target at 1.2146. If the price hits this level, new buy positions could be opened after a rebound from 1.2146 or a lower limit of the upward channel with the target at 1.2315.