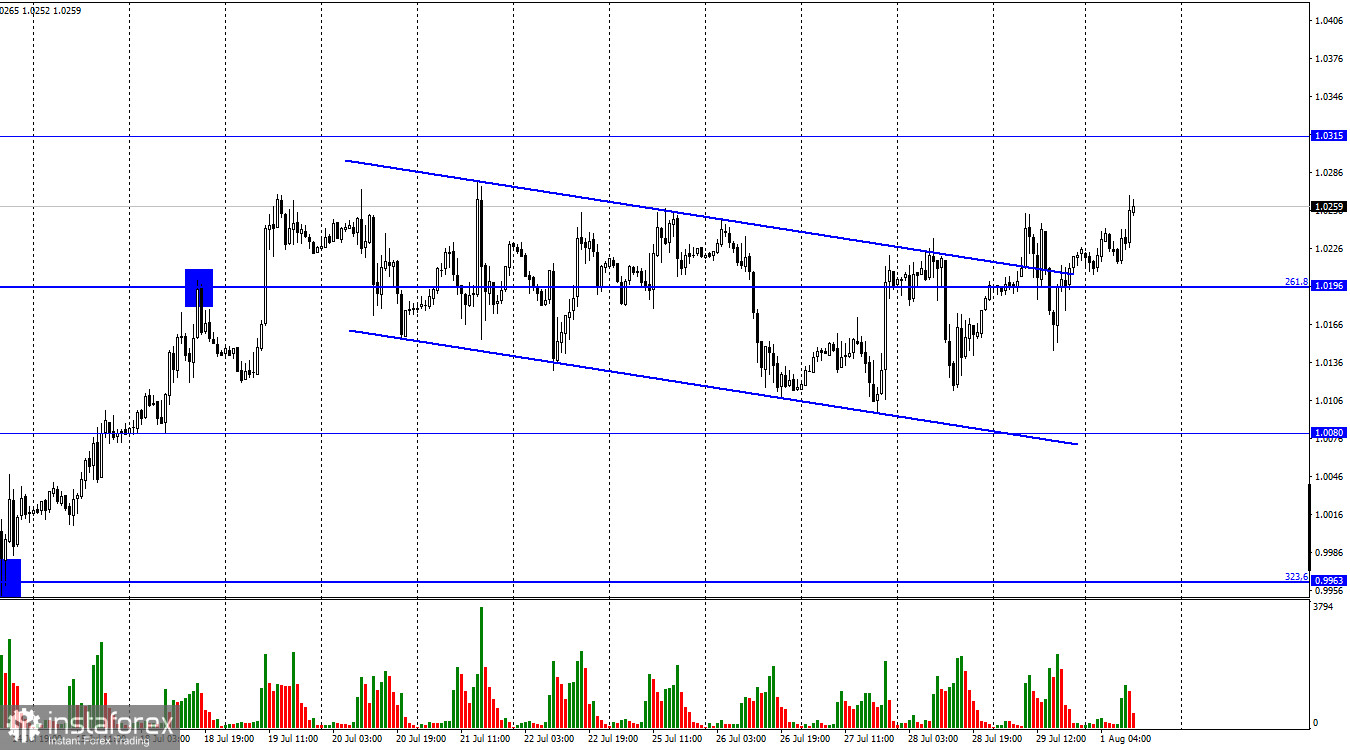

The EUR/USD pair resumed the growth process on Monday after consolidating above the corrective level of 261.8% (1.0196) and a downward trend corridor. Thus, the growth of quotations may continue in the coming days in the direction of the 1.0315 level. The rebound of the pair's rate from this level may work in favor of the US currency and the beginning of a new fall in the direction of the level of 261.8% (1.0196). However, the currency is already rolling back against the main movement almost every day. On Monday, of the interesting events, I can note only the S&P business activity index in the manufacturing sector. As it was already known earlier, this index fell below 50.0 and amounted to 49.8. However, bull traders did not pay attention to this report. Neither did they pay attention to the reports on inflation and GDP on Friday. Let me remind you that GDP grew stronger in the second quarter than traders expected, so bull traders had very real reasons to buy euros. Inflation also increased by the end of July, which makes it possible for the ECB to raise the rate again at the next meeting.

And this was also a reason to buy the euro currency. But just on Friday, the European currency did not rise, although it had several growth segments during the day. But today the euro is showing growth, although a fall would be more logical. Thus, I can say that the information background now and in the last few weeks does not matter much for traders. Let me remind you that earlier the European currency did not show particularly strong growth at the first ECB interest rate hike, and the dollar did not rise after the second consecutive Fed rate hike by 0.75%. It seems to me that now, in the literal sense of the word, there is a struggle between bulls and bears, who are pulling the rope each to their side. The euro does not show strong growth, as if a new uptrend had begun, but it is still moving up. The US dollar has plenty of reasons for new growth, but it is still falling. Constant kickbacks also indicate that neither the first nor the second will give up without a fight.

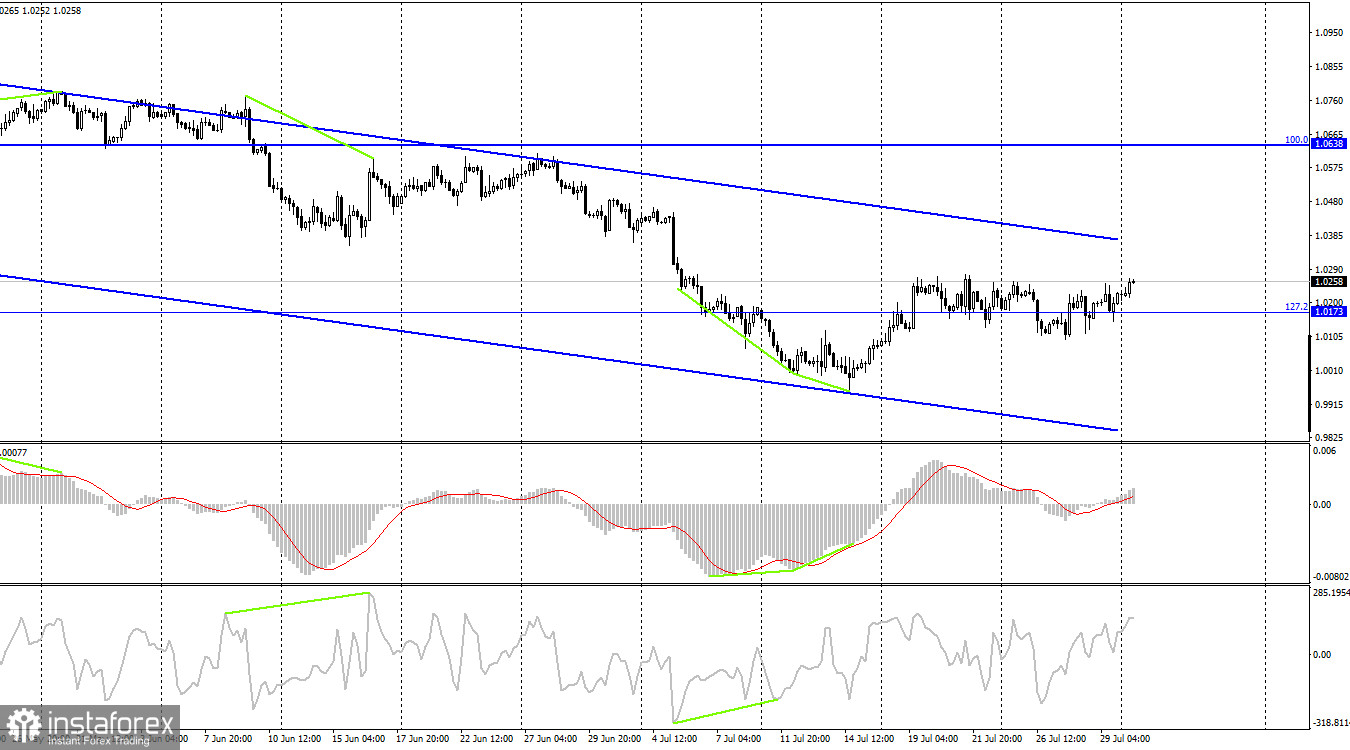

On the 4-hour chart, the pair performed a new reversal in favor of the euro and anchored above the level of 127.2% (1.0173), not the first in a row. Thus, the growth process can be continued in the direction of the upper line of the descending trend corridor. The rebound of quotes from this line will work in favor of the US currency and the beginning of a new fall in the euro. Consolidation above the corridor will increase the probability of continued growth towards the next corrective level of 100.0% (1.0638).

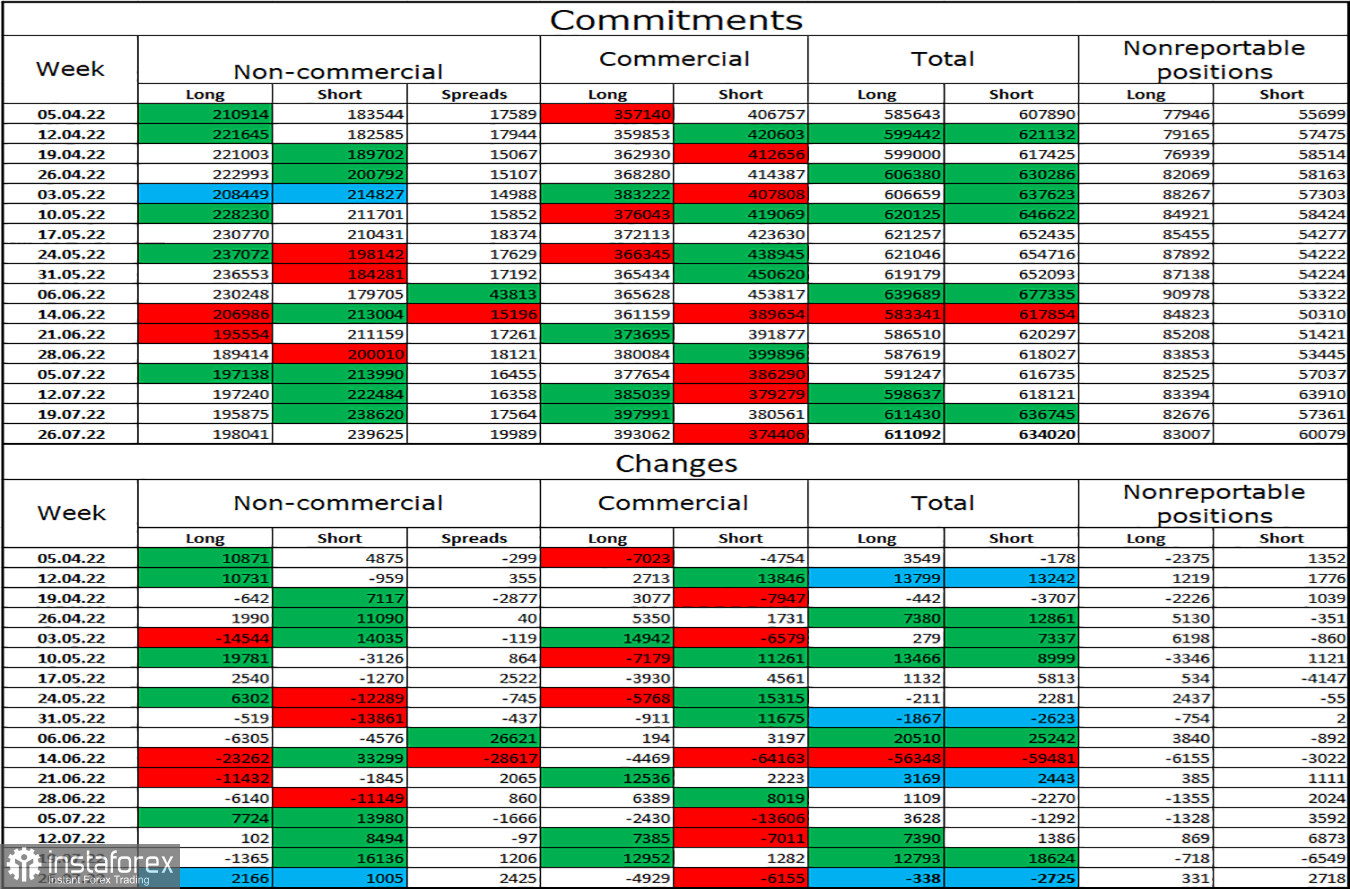

Commitments of Traders (COT) Report:

Last reporting week, speculators opened 2,166 long contracts and 1,005 short contracts. It means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators is now 198 thousand, and short contracts – 240 thousand. The difference between these figures is still not too big, but it remains not in favor of the bulls. In the last few weeks, the chances of the euro currency's growth have been gradually growing, but recent COT reports have shown that there is no strong strengthening of the bulls' positions. Thus, it is still difficult for me to count on a strong growth of the euro currency.

News calendar for the USA and the European Union:

EU – index of business activity in the manufacturing sector (PMI) (08:00 UTC).

EU – unemployment rate (09:00 UTC).

US - index of business activity in the manufacturing sector (PMI) (13:45 UTC).

US - index of business activity in the manufacturing sector (PMI) from ISM (14:00 UTC).

On August 1, the calendars of economic events of the European Union and the United States contain two entries each. European reports have already been released, but they did not make a big impression on traders. The impact of the US data on the mood of traders may be stronger.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when rebounding from the upper line of the corridor on the 4-hour chart with a target of 1.0173. I recommended buying the euro currency when anchoring above the corridor on the hourly chart with a target of 1.0315. Now this deal can be kept.