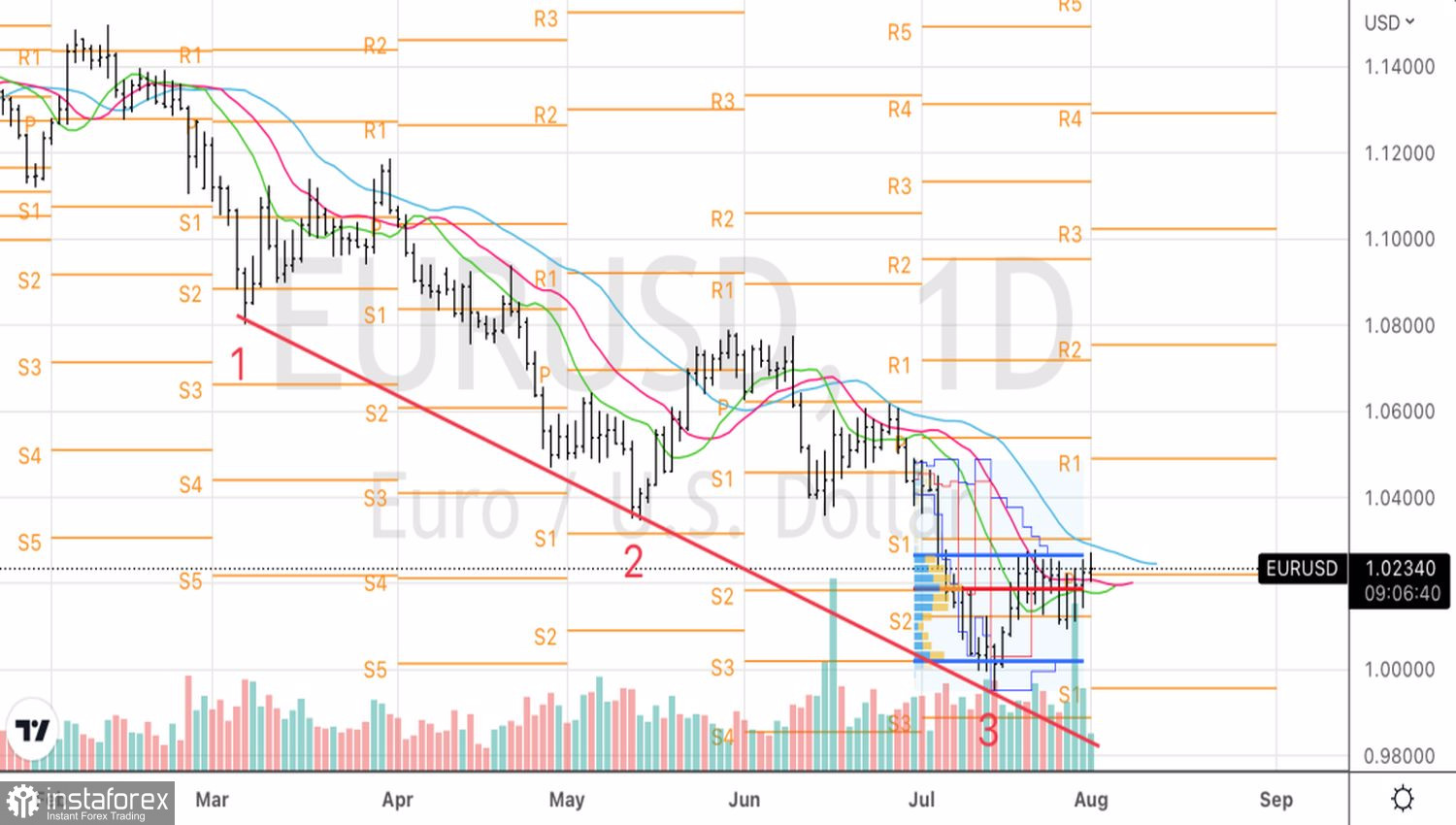

The inability of the "bulls" on EURUSD to bring the pair's quotes beyond the upper limit of the trading range of 1.01–1.027 will be evidence that the market has overestimated its strength. It sincerely hopes that the recession in the US forced the Fed to raise the rate modestly in 2022 and then move to lower it in 2023. At the same time, strong statistics on eurozone GDP for the second quarter suggested that the economy remains resilient in the face of all the troubles that have befallen it. However, it is not a fact that it will continue to do this in the second half of the year.

According to the ECB research, high energy prices will pinch off eurozone GDP by 0.8 percentage points over the next four years. Taking into account the cumulative effect of +5.2%, this is an insignificant amount. The Central Bank believes that the current increase in oil prices is less than the shocks of 1973 and 1979, as well as in the period from 2003 to 2008. At the same time, the calculation for the recovery of the currency bloc after the pandemic may be wrong. Only 20% of European households accumulated savings during COVID-19-related lockdowns, while 16%, on the contrary, reduced. As a result, 0.7% QoQ GDP growth in the second quarter, equivalent to 2.8% YoY, may be the last good news for EURUSD.

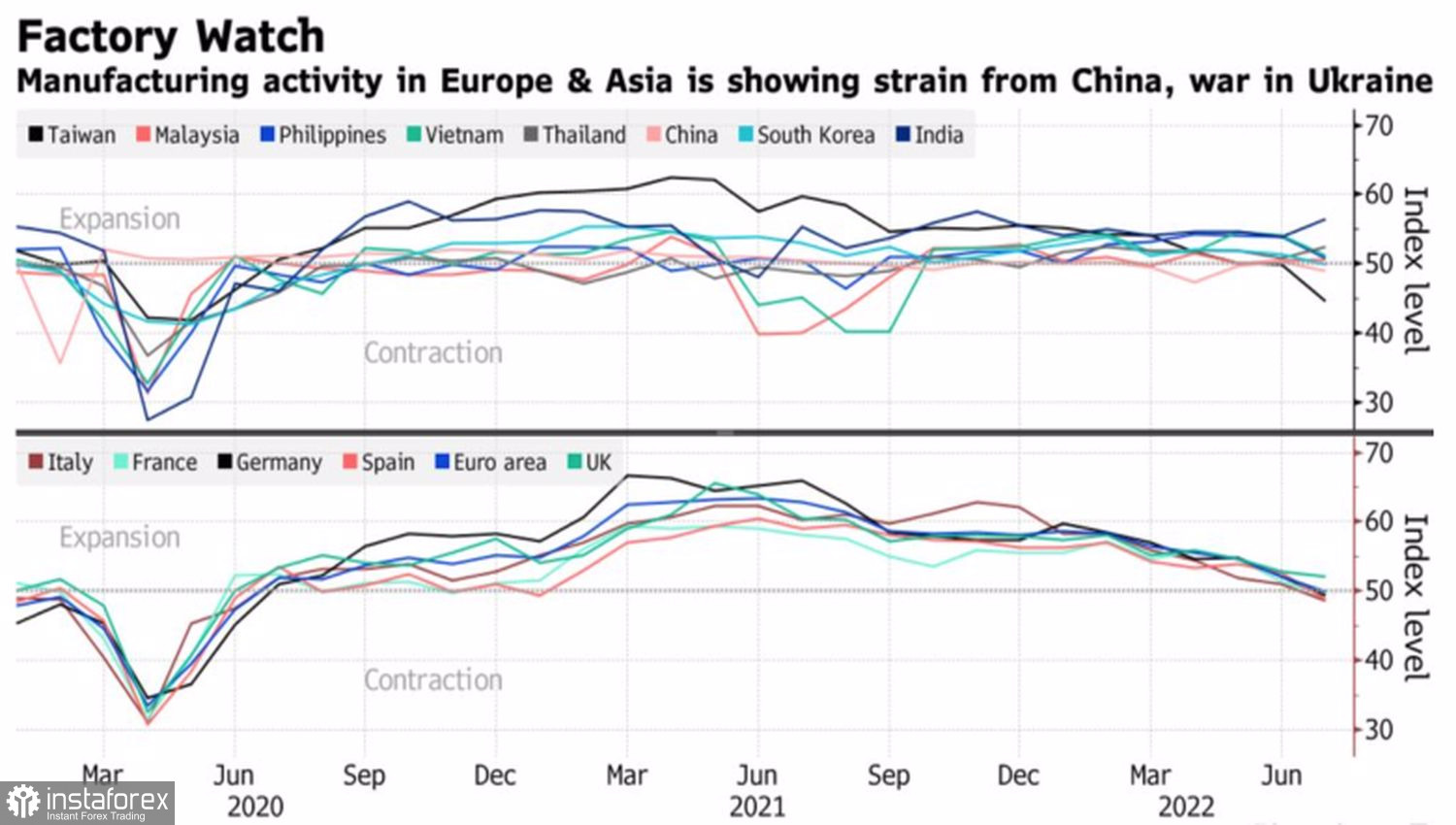

The slowdown in business activity around the world suggests that the second half of the year will not be as optimistic as the first. The global economy is poised to plunge into recession, and in such conditions, the demand for safe-haven assets, including the Japanese yen, Swiss franc, and US dollar, usually rises.

Business dynamics in Europe and Asia

Not everything is clear with the further monetary policy of the Fed. The rally of US stock indices by 14–17% from June lows indicates that investors believed that the US Central Bank would not raise the rate above 3.25%. Moreover, due to the recession in the economy, it will begin to decline in 2023. In fact, wishful thinking makes life difficult for the Fed. Rising S&P 500, falling Treasury yields, and weakening US dollar in response to Jerome Powell's statement that rates have reached a neutral level, lead to improved financial conditions. The Fed needs to tighten them in order to suppress inflation. No matter how the FOMC starts to act more aggressively than the financial markets currently expect, which will return investors' interest in selling EURUSD.

Thus, not everything is as clear in the main currency pair as one might assume. Markets that go against the Fed may well be wrong. If so, then the main currency pair will easily return to parity. On the contrary, the correctness of investors will result in the development of a correction in the direction of 1.05.

Technically, on the EURUSD daily chart, consolidation continues in the range of 1.01–1.027 within the Splash and shelf pattern. At the same time, the inability of the bulls to storm its upper limit indicates their weakness and creates prerequisites for sales in the event of a successful assault on the fair value of 1.018.