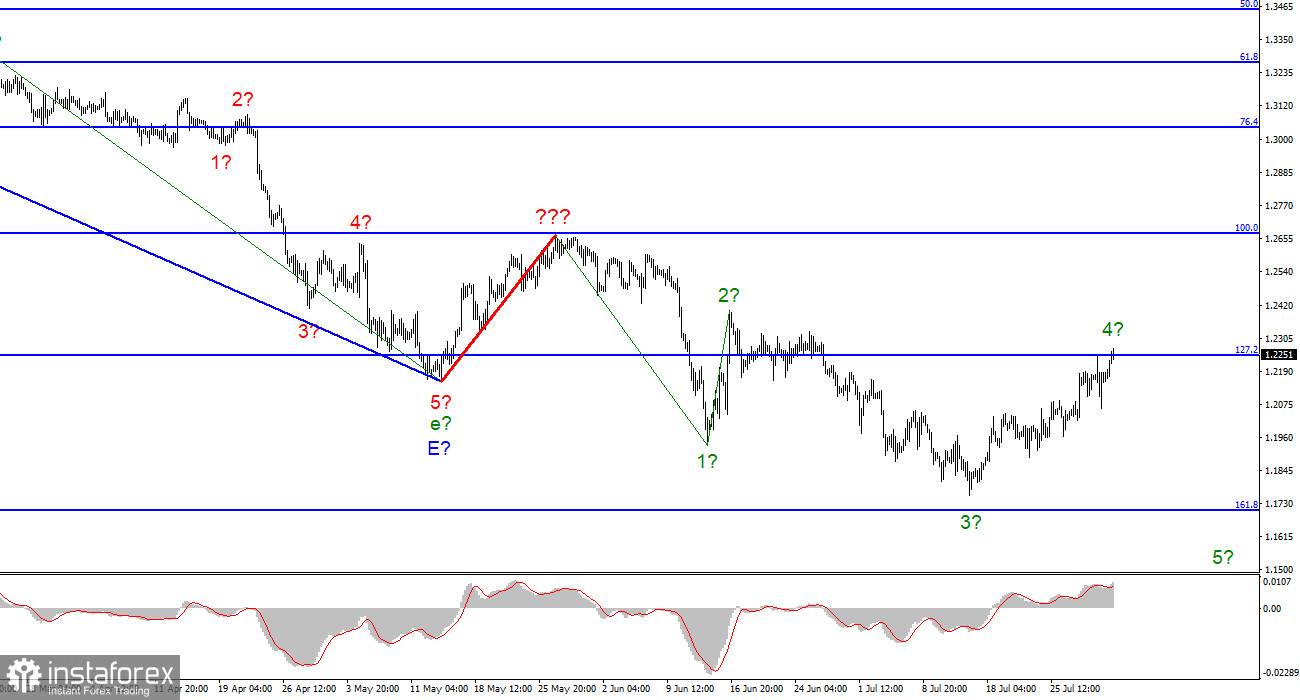

For the pound/dollar instrument, the wave marking at the moment looks quite difficult, but does not require adjustments. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, now we can say for sure that the construction of the upward correction section of the trend is canceled, and the downward section of the trend will take a longer and more complex form. I am not a big supporter of constantly complicating the wave marking when we are dealing with a strongly lengthening trend area. I think it would be much more expedient to identify rare corrective waves, after which new impulse structures would be built. At the moment, we have completed waves 1, 2 and 3, so we can assume that the instrument is now in the process of building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate in almost the same way. I expect a new decline in the British pound in the coming days.

Liz Truss will not allow a new referendum in Scotland

The exchange rate of the pound/dollar instrument increased by 80 basis points during August 1. The Briton is in demand now, which greatly interferes with the current wave marking. As long as the peak of wave 4 has not gone beyond the peak of wave 2, we can assume that the wave marking is preserved. But the longer the Briton rises (and it grows almost every day), the greater the chances that the current wave pattern will require new additions. Meanwhile, the topic of the referendum on Scottish independence is gaining momentum in the UK. Let me remind you that this country was against leaving the European Union and has been trying for several years to organize a new referendum on independence from Britain (the last one was in 2014). However, in order to hold a referendum, you must obtain official permission from London. Boris Johnson flatly refused to give it, but now Boris Johnson is resigning, and Liz Truss and Rishi Sunak are claiming his place, who will clash in the last round of voting. Will changing the leader of the Conservative Party help Scotland?

No, it won't help. Both candidates for the post of Prime Minister in the last two weeks have been doing nothing but talking about how they will lead the country and what decisions they will make if they win the elections. Both Sunak and Truss flatly refused to give Scotland the opportunity to hold a second referendum in the last 10 years. In particular, Sunak said that the Scottish government is trying to divide the country in difficult times instead of working to unite the nation. Liz Truss, in turn, recalled that in 2014, the condition for holding a referendum was the promise of the SNP that this referendum would be the only one in the current generation. Therefore, we can say for sure that Westminster will not provide official permission. And the Scottish Parliament may try to prove its right to hold a referendum through the courts, or to hold it illegally, and only then prove through the courts that this is the decision of the Scottish people.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. Thus, I advise now selling the instrument with targets located near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down". An unsuccessful attempt to break through the 1.2250 mark may indicate that the market is not ready to continue buying the British pound.

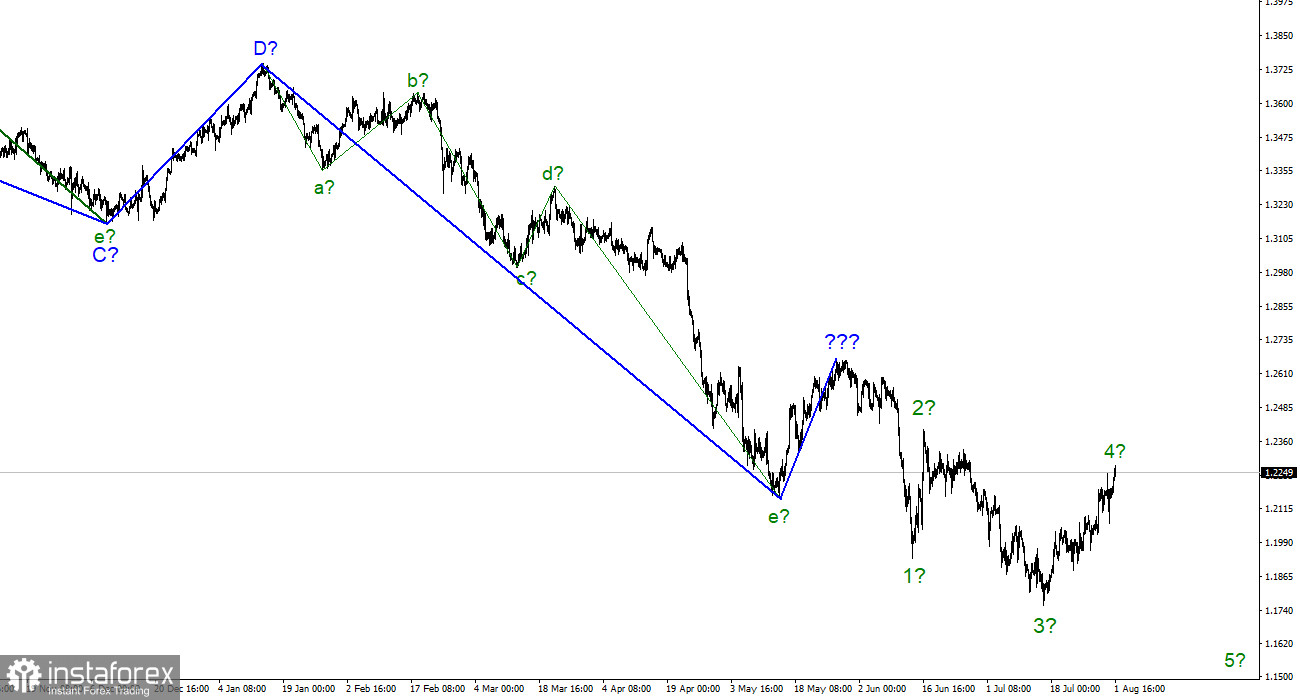

At the higher wave scale, the picture is very similar to the euro/dollar instrument. The ascending wave is also not suitable for the current wave pattern, which is the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.