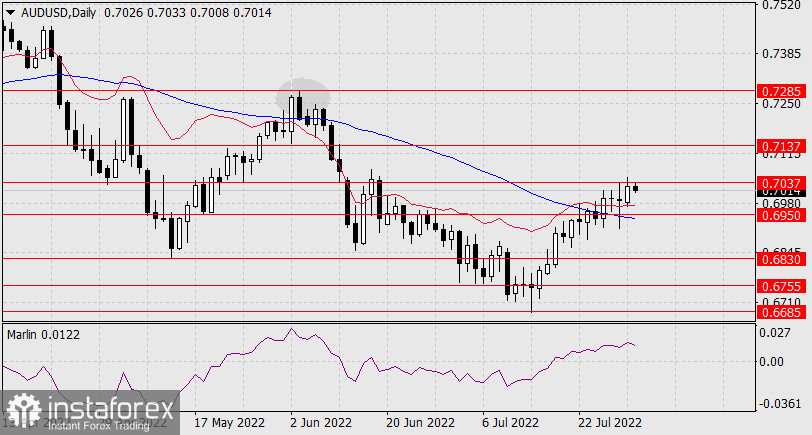

Yesterday, the Australian dollar reached the first growth target (0.7037). In today's Asian session, the price rolls back down from it. The Marlin Oscillator is beginning to turn down and this is a sign of the completion of the upward correction that began on July 14-15.

Visually, this may be a repetition of the pattern of the first ten days of June, marked on the chart with a gray oval – then the price went above the MACD indicator line with the target resistance at 0.7285, now the role of the target resistance was played by the level of 0.7037. Consolidating above it, however, will allow further growth to the level of 0.7137.

The price is developing above both indicator lines on the four-hour timescale, the Marlin Oscillator is staying in the positive area, although it shows the intention to decrease. For a reversal, the price needs to go deep down, under the level of 0.6950. The level is preceded by the support of the MACD line (0.6973), but in the current situation, the price level (lows of May 18 and 19) is the priority.