The economic calendar for today reminds us about JOLTs job opening for June. Analysts project their contraction from 11.2 million to 11.00 million. It is not the best signal for the US dollar.

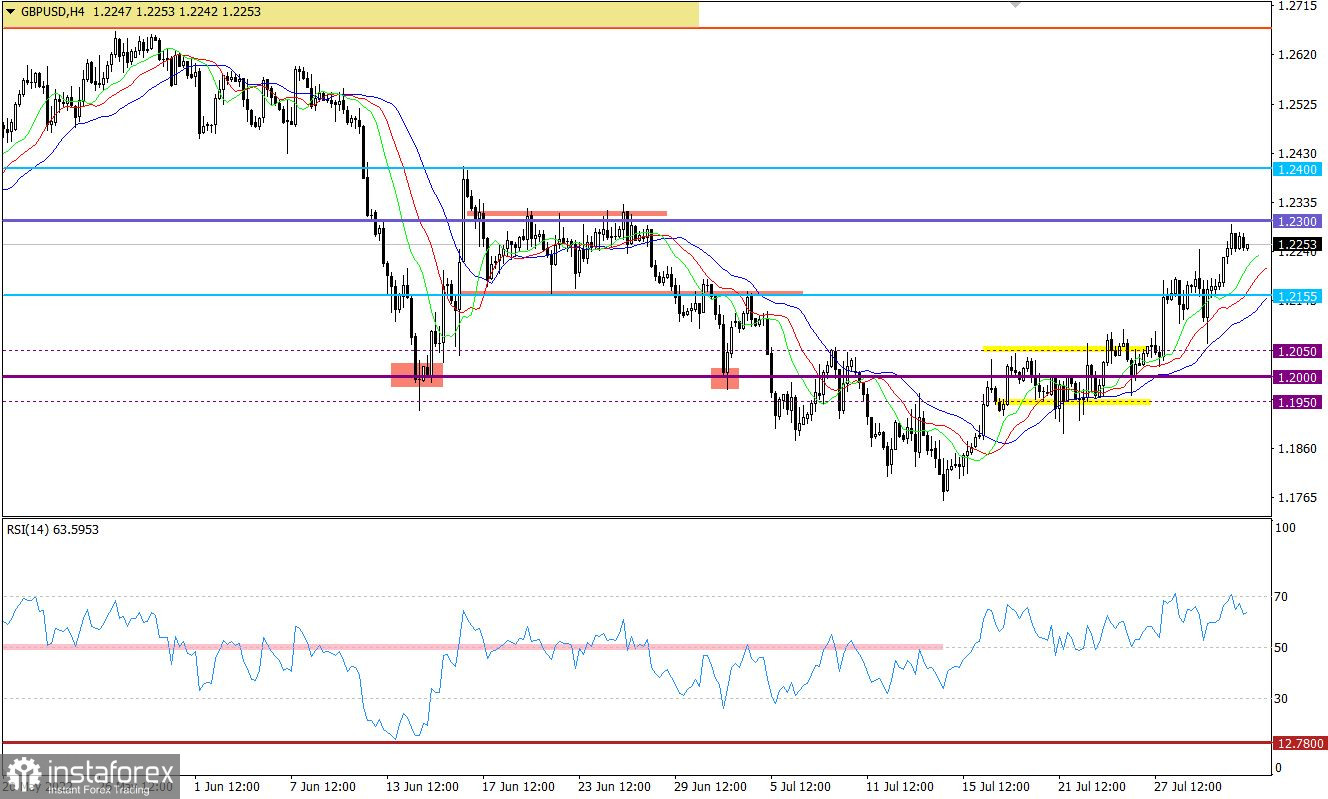

After a brief halt, GBP/USD managed to extend the ongoing upward correction. In the course of the upward move, the price reached the first expected target at 1.2300 where traders cut their long positions. The currency pair has corrected almost 500 pips upwards from the pivot point at1.1750. This move fits into the correction inside the medium-term downtrend.

The H4 RSI approached the overbought level of 70 as the price came closely to 1.2300. It is confirmed by the fact that traders cut on their long positions. The D1 RSI is still growing which increases the risk of a change in market sentiment.

Outlook and trading tips

We can suggest that the level of 1.2300 will matter a lot to the sellers and will encourage them to increase short positions. In this case, the ongoing correction could either enter the final stage or slow down. Traders will consider the scenario of a prolonged correction provided that the price settles above 1.2340. In this case, the sterling might climb towards 1.2400.

Importantly, the clear signal of a change in trading sentiment will pop up only after the price settles above 1.2400 in the daily chart.

Complex indicator analysis suggests buying in the short term for intraday trading on the back of the ongoing upward correction. Besides, technical indicators also generate a weak buy signal for the medium term, but it is still fragile.