When to go long on EUR/USD:

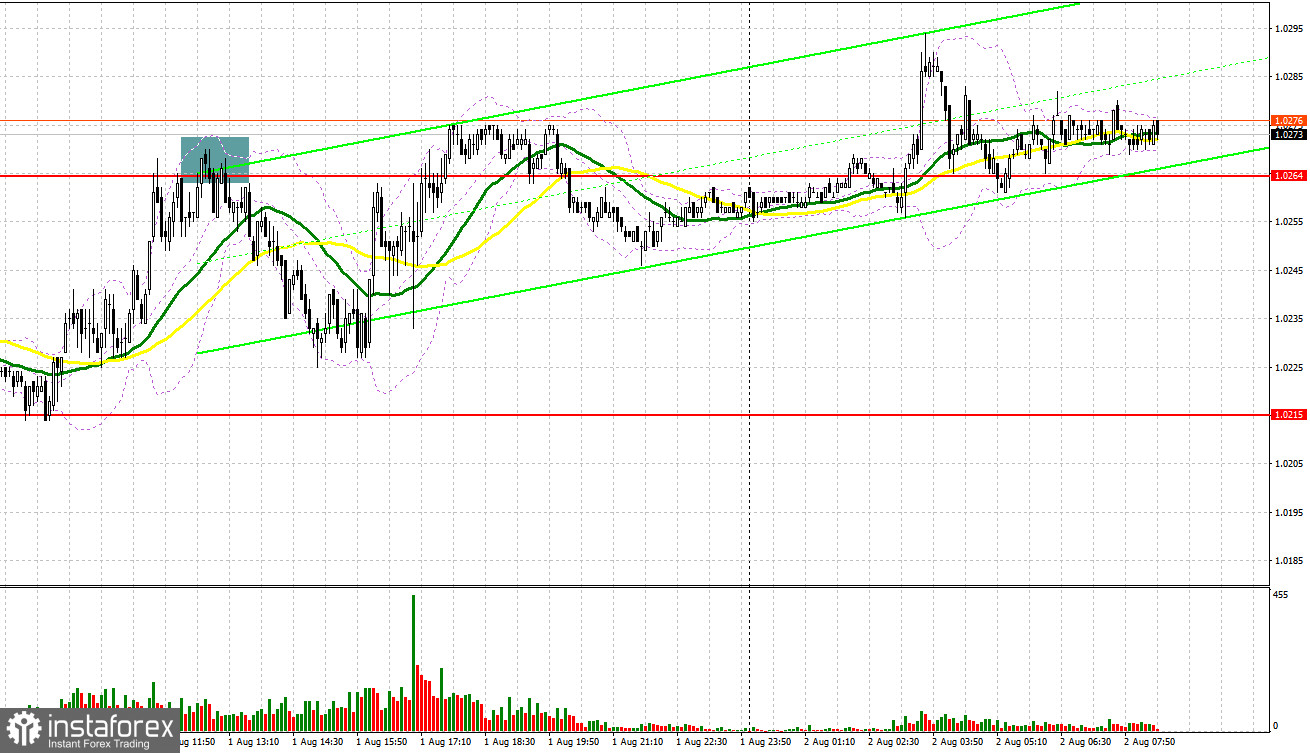

Several excellent market entry signals were formed yesterday. I suggest you take a look at the 5-minute chart and figure out what happened. I paid attention to the 1.0264 level in my morning forecast and advised you to make decisions on entering the market. Growth to the area of 1.0264 in the morning and an unsuccessful attempt to consolidate led to a false breakout and a signal to sell the euro. As a result, the downward movement amounted to about 40 points, but we did not reach the nearest support. After a second test of 1.0264, this range was surpassed, but I did not see a reverse update from top to bottom.

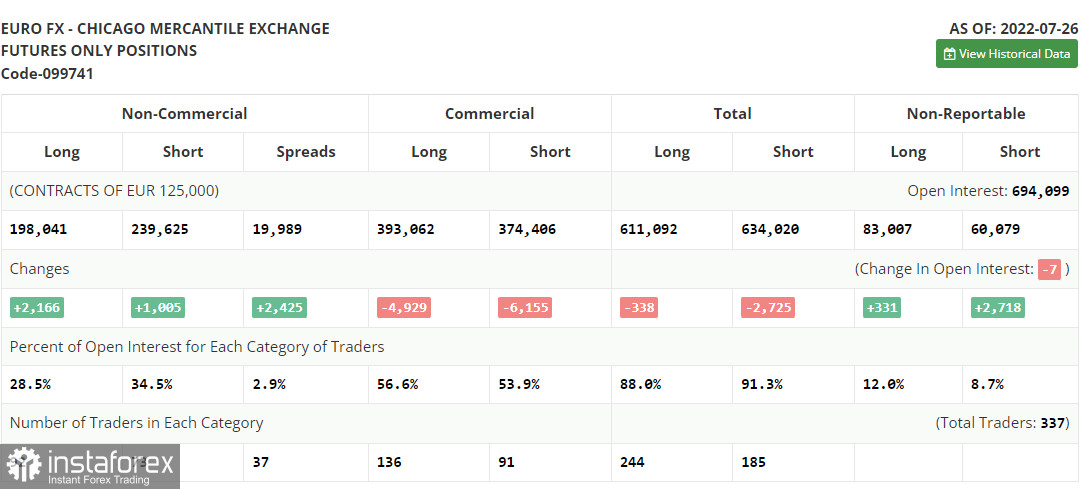

COT report:

Before talking about the further prospects for the EUR/USD movement, let's look at what happened in the futures market and how the Commitment of Traders positions have changed. The Commitment of Traders (COT) report for July 26 logged an increase in both short and long positions, but the former turned out to be more, which indicates a gradual end of the bear market and an attempt to find a market bottom after reaching euro parity against the US dollar. Obviously, the data on the European economy that was released last week helped the euro to some extent. A slight acceleration in the growth of the consumer price index was offset by a sharp upsurge in the European economy in the second quarter of this year. GDP growth of 4.0% per annum surprised many economists, which supported the bullish mood of traders after the Federal Reserve hinted at a possible milder further cycle of interest rate hikes. All this will make it possible for us to count on further upward movement of the EUR/USD pair. The COT report shows that long non-commercial positions rose by 2,166 to 198,041, while short non-commercial positions jumped by 1,005 to 239,625. At the end of the week, the overall non-commercial net position, although it remained negative, rose slightly from -42,745 to -41,584. The weekly closing price decreased and amounted to 1.0161 against 1.0278.

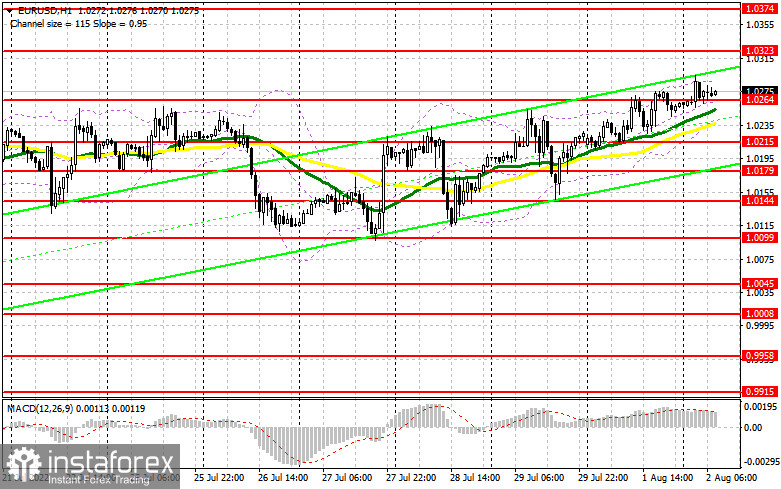

It is obvious that euro bulls have a good chance to further build an upward trend, but in order to do so they need to settle above the nearest support of 1.0265, which has been a major resistance for several consecutive weeks, preventing the bulls from breaking through to new highs. Today there are no statistics on the euro area that can harm the pair's upward potential, so the bulls have everything in order to continue rising. Most likely in the first half of the day, the struggle will unfold for the support of 1.0264, just below which there are moving averages, playing on the bulls' side. After forming a false breakout at this level, you can count on a further upward correction. The nearest target will be resistance at 1.0323 – a new local high, rising above which will be quite problematic. A breakthrough and test of this range would hit bears' stops, signaling long positions with a big upside opportunity towards 1.0374. A more distant target will be the area of 1.0437, where I recommend taking profits.

In case EUR/USD falls and the bulls are not active at 1.0264, which is more likely, the pressure on the euro will seriously increase again. This will bring the pair back into the wide horizontal channel at 1.0099-1.0265, where it could spend the entire week or even the first half of August. In this case, I advise you not to rush to enter the market: the best option for opening long positions would be a false breakout in the intermediate support area of 1.0215. I advise you to buy EUR/USD immediately on a rebound only from the level of 1.0179, or even lower - in the area of 1.0144 with the goal of an upward correction of 30-35 points within the day.

When to go short on EUR/USD:

Euro bears have every chance to return the market balance, but for this it is necessary to take control of the level of 1.0264 as quickly as possible - a major resistance, which until recently limited the pair's upward potential. Only a breakthrough and reverse test from the bottom up of this range will provide a signal to sell the euro, which will pull the bulls' stop orders, which intensified last Friday amid strong fundamental statistics. All this will increase the pressure on the pair, and a breakthrough and test from the bottom up of 1.0215 can pull the euro to the lows of 1.0179 and 1.0144, where I recommend taking profits. A more distant target will be the area of 1.0099 - the lower boundary of the wide horizontal channel, which I mentioned above.

In case EUR/USD moves up in continuation of the bullish trend, and this option cannot be ruled out, at least because the bears are not active above 1.0265, I advise you to postpone short positions until an attractive resistance like 1.0323 is within reach. Forming a false breakout there may be a new starting point in hopes of a return of the bear market. I advise you to sell EUR/USD immediately on a rebound only from the high of 1.0374, or even higher - in the region of 1.0437, counting on a downward correction of 30-35 points.

Indicator signals:

Moving averages

Trading is above 30 and 50 moving averages, which indicates a continuation of the upward correction.

Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differs from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

A breakthrough of the lower border of the indicator in the area of 1.0235 can push the euro to fall. Surpassing the upper border of the indicator in the area of 1.0275 can cause the euro to rise.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked in yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence — convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between short and long positions of non-commercial traders.