The GBP/USD currency pair pulled back slightly from its local highs on Tuesday but maintained an upward trend. In total, the British currency has risen in price by 500 points in recent weeks. It's not too much, but it's not too little. And most importantly – now it is very difficult to say what the fundamental reasons for the pound's growth are. We remember repeatedly stating the need to adjust from time to time. But then it turns out that the entire current movement is a banal correction, after which the downward trend will resume. Because for an upward trend, we need some clear reasons, and they still don't exist. Why can the pound grow now, even if there are no macroeconomic statistics? From our point of view, there are two reasons. Technical and fundamental. We have already discussed the technical one, but the "foundation" is that the Bank of England is almost guaranteed to raise the key rate by 0.5% this Thursday. However, if the pound is now growing at this event, what will happen when BA announces a rate hike? The answer is simple: the market will have no good reason to buy the pound since it has already made this decision. Therefore, just as after the Fed meeting, we saw the dollar fall, so after the BA rate hike, we could see the British pound fall.

Of course, you should always remember that the market is capable of surprising. Technical analysis so far indicates the continuation of a short-term upward trend. If the pair continues to remain above the moving average after Thursday, it will not be necessary to sell the pair. The pound has repeatedly shown its resistance against the dollar in recent months. Suddenly now, major traders have decided that it's time to end the massive sales. Unfortunately, it is impossible to predict their actions, but COT reports in the last few months indicated only a weakening of the "bearish" mood. We are inclined to believe that the pound will also resume falling.

The "Northern Ireland Protocol" is still a problem.

In principle, so much has already been said about the meeting of the Bank of England that it remains only to wait for the meeting itself and see the market's reaction. However, nothing interesting is happening in the UK right now. There are practically no macroeconomic statistics. Boris Johnson has stopped making resonant statements. The election of a new leader of the Conservative Party has stalled as Parliament has gone on summer vacation. There is no news on Brexit. Therefore, it is now possible to note only the new measures of the European Union against the UK, which has not changed its position on the protocol on the border of Northern Ireland. Recall that Brussels has repeatedly insisted on compliance with all agreements signed by London concerning Brexit. And London, in turn, demanded to revise some of them since their implementation is impossible without significant problems for the UK itself. The parties failed to agree on this issue, and in mid-June, the EU began "procedures" concerning London. Now, these measures have been supplemented with four more.

Brussels says that the "procedures" are aimed at complying with all the points of the protocol and are necessary to ensure Northern Ireland's access to the Single Market without threatening the security of EU citizens. The UK does not comply with customs conditions or requirements for supervision and control of the movement of goods from Northern Ireland to the UK, so the EU can no longer "indifferently observe systematic violations of the agreement." It is also reported that London has been given another two months to contact Brussels and try to resolve the issue peacefully, without sanctions and court proceedings. However, Westminster's position is likely to remain the same.For the British currency, this new "micro-conflict" hardly means anything bad. The pound is already so used to disagreements between the EU and the Kingdom, so used to political crises in its homeland, that it has no desire to pay attention to them either. Nevertheless, we could not ignore another "point of tension" on the geopolitical map of the world, especially since there have been too many such points recently.

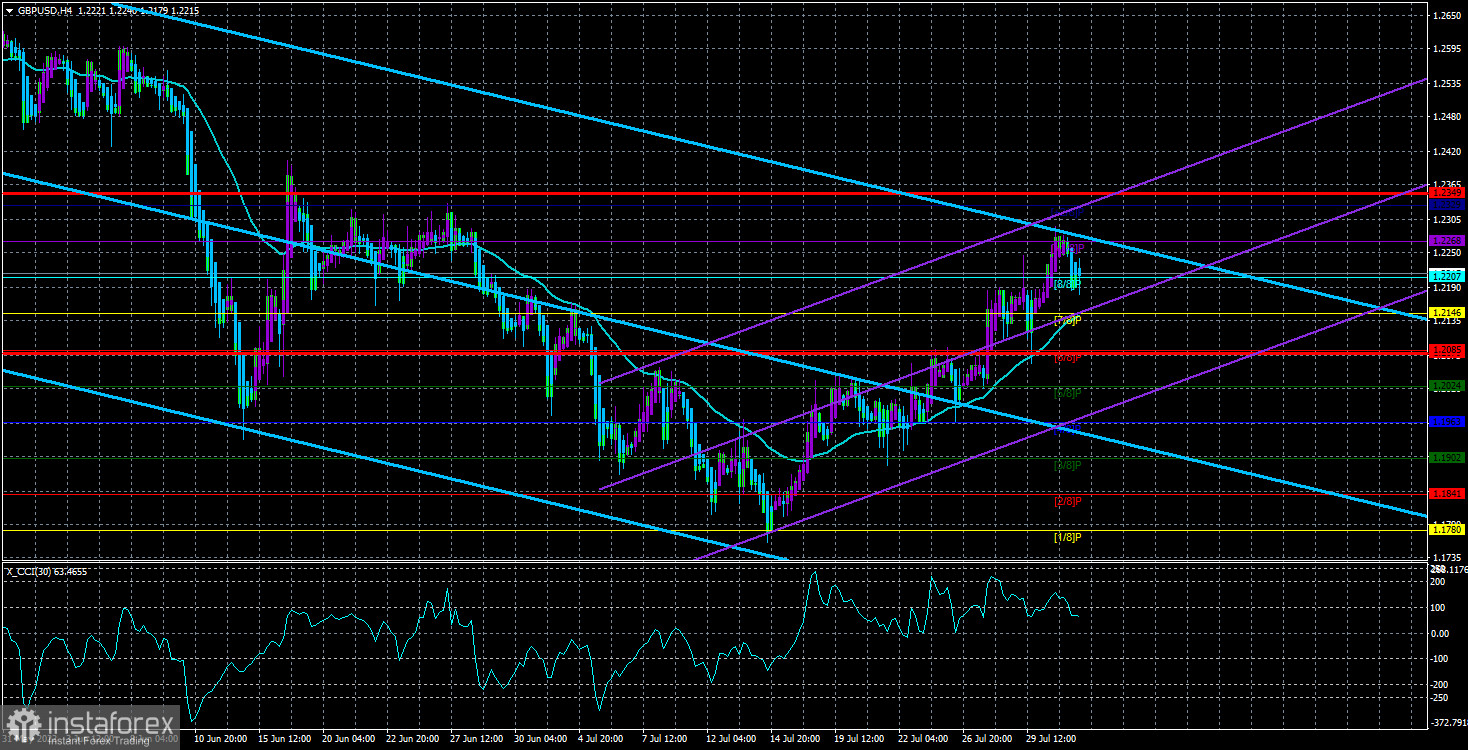

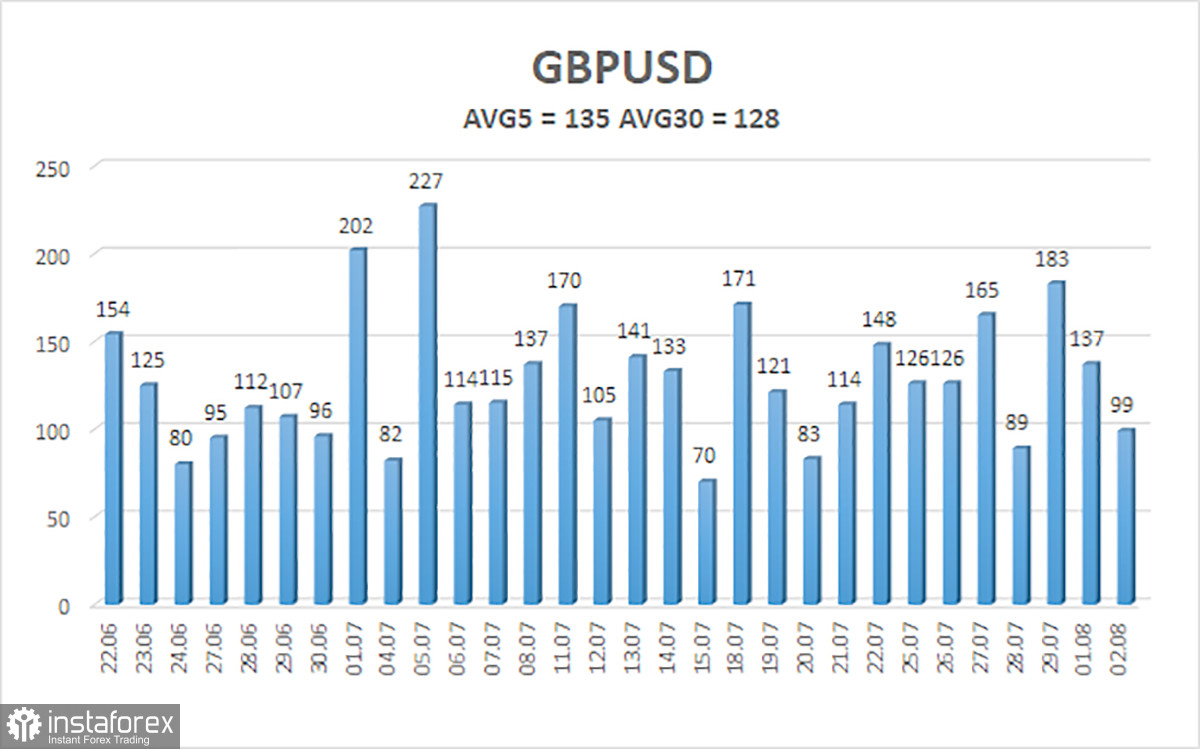

The average volatility of the GBP/USD pair over the last 5 trading days is 135 points. This value is "high" for the pound/dollar pair. On Wednesday, August 3, therefore, we expect movement inside the channel, limited by the levels of 1.2079 and 1.2349. The upward reversal of the Heiken Ashi indicator signals the resumption of the upward movement.

Nearest support levels:

S1 – 1.2207

S2 – 1.2146

S3 – 1.2085

Nearest resistance levels:

R1 – 1.2268

R2 – 1.2329

Trading Recommendations:

The GBP/USD pair continues to be located above the moving average on the 4-hour timeframe. Therefore, at the moment, new buy orders with targets of 1.2268 and 1.2349 should be considered after the Heiken Ashi indicator turns up. Sell orders should be opened when anchoring below the moving average line with targets of 1.2085 and 1.2024.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.