What is the best growth driver for gold? Inflation? Hardly. Despite the fastest rise in US consumer prices in four decades, the precious metal has failed to gain ground. On the contrary, expectations of an aggressive tightening of the Fed's monetary policy made it weaker. Recession? XAUUSD does not react as violently to data indicating a slowdown in the US economy as it does to geopolitics. Remember how gold took off at the beginning of the armed conflict in Ukraine? In August, House Speaker Nancy Pelosi's visit to Taiwan sparked a new wave of its purchases.

For the first time in 25 years, an American official of such a high rank has stepped into territory that China considers its own. In response, Beijing cut off trade relations with Taipei and began massive military exercises near Taiwan. Looking at the situation in Ukraine, investors cannot rule out repetition. Uncertainty leads to an increase in the volatility of financial markets and increases the demand for gold. Commerzbank notes that after a continuous 21-day outflow from specialized exchange-traded funds, ETF holdings rose for the third day in a row.

Uncertainty is created not only by geopolitics but also by the Fed. At its last meeting, the Central Bank made its future decisions on the rate dependent on incoming data, and Fed Chairman Jerome Powell announced his intention to act on a meeting-by-meeting basis. If earlier the Fed's monetary policy was more than transparent due to direct management, now an element of uncertainty has been added to it. In addition, expectations of a slowdown in the monetary restriction cycle put pressure on the US dollar, thus supporting the "bulls" in XAUUSD.

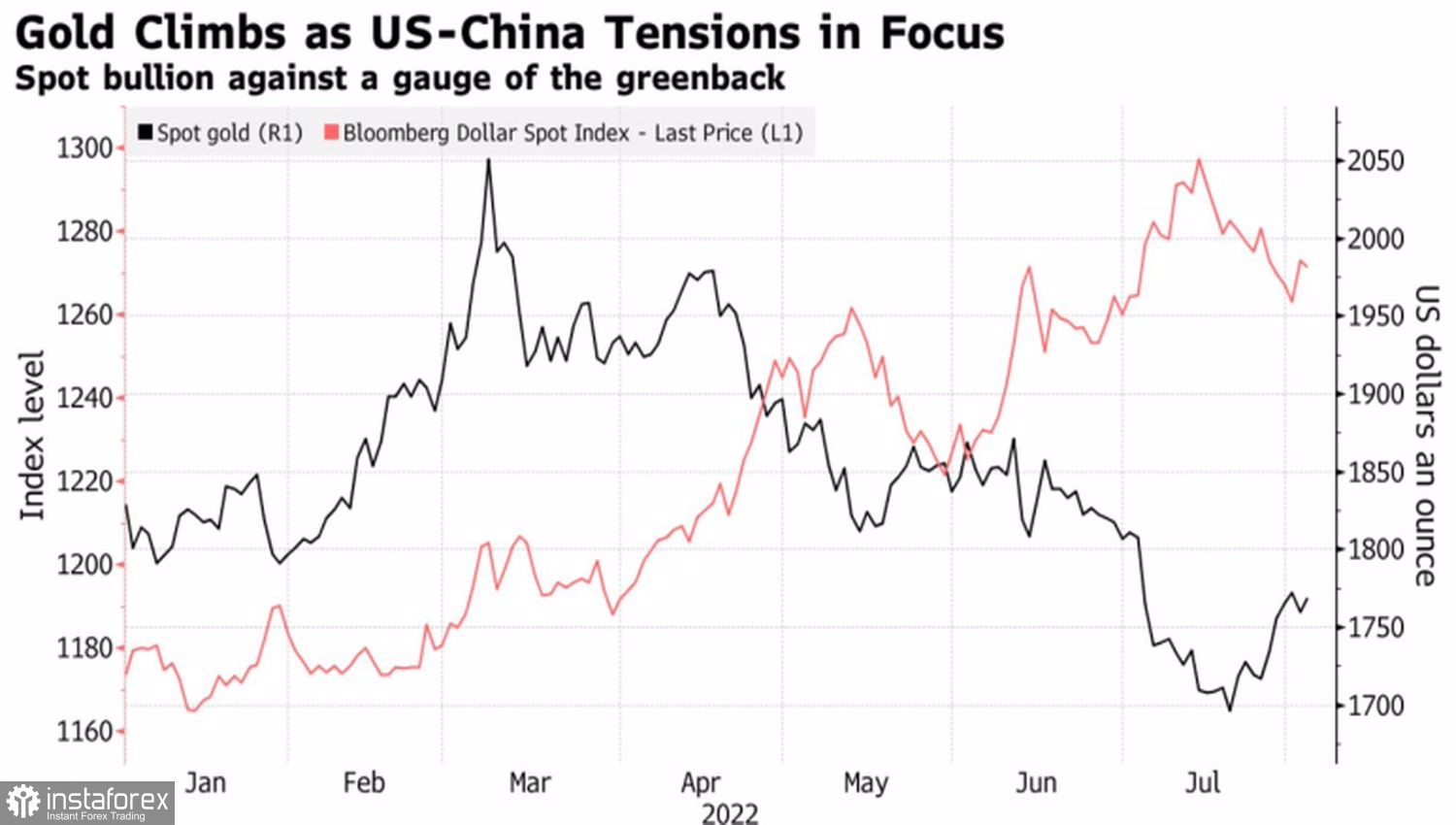

Dynamics of gold and US dollar

At the same time, Pelosi's visit to Taiwan is unlikely to lead to a direct confrontation between the United States and China, suggesting a reduction in geopolitical risks. Simultaneously, the hawkish chorus of Fed officials made it clear that financial markets are wishful thinking. There is no question of any pause in the process of raising rates, not to mention their decline.

Chicago Fed President Charles Evans believes that if the inflation situation does not improve, the Fed may increase borrowing costs by another 75 bps in September. He counts on the positive and expects the rate to increase by 50 bps with a subsequent transition to +25 bps at each of the remaining two FOMC meetings in 2022. As a result, it will reach 3.5% and continue to grow in 2023. Cleveland Fed President Loretta Mester said evidence that inflation has peaked and begun to decline steadily is needed. This will take months. The Fed has a lot of work to do and is not going to stop.

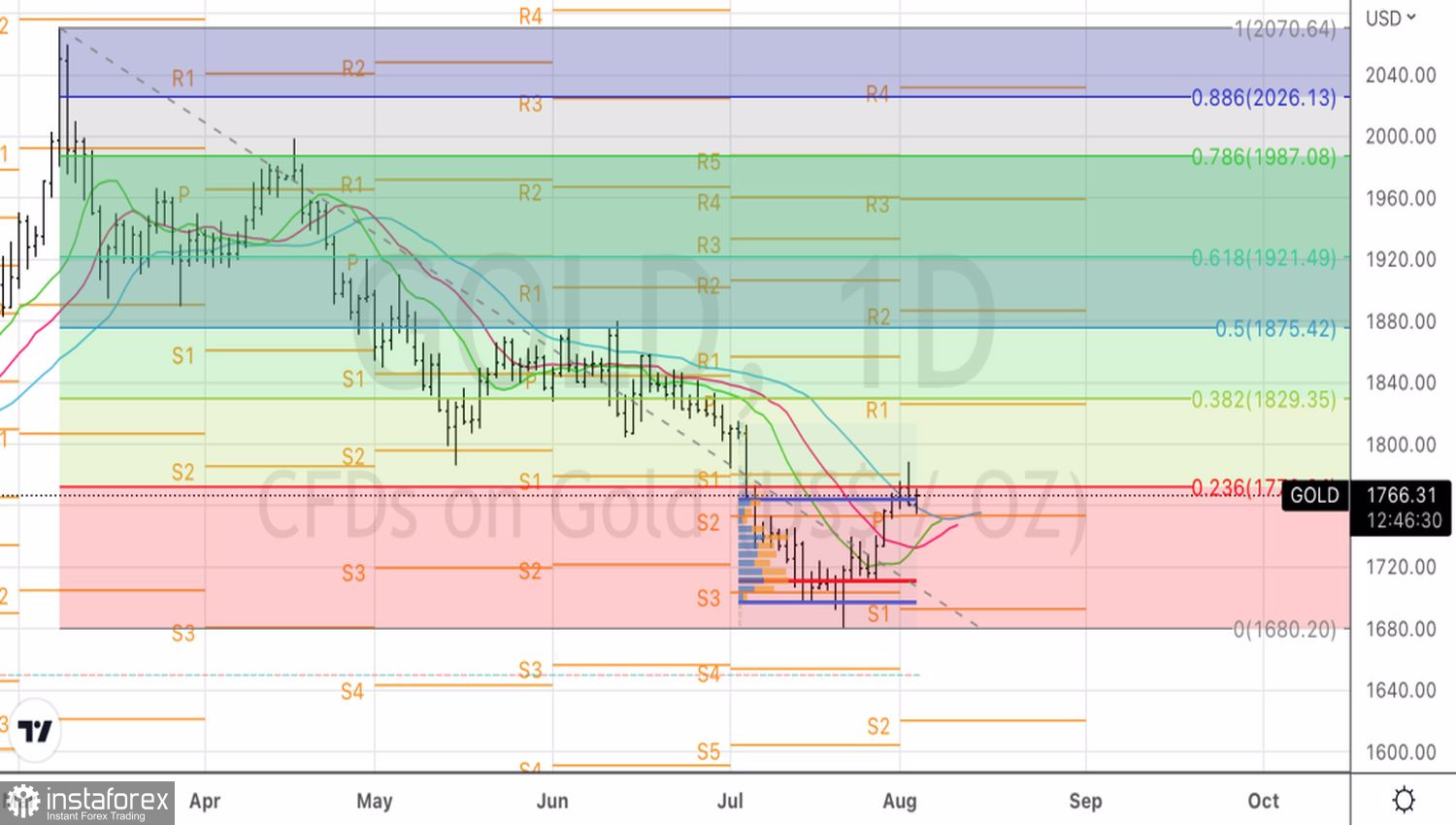

Technically, on the daily chart, gold's failure to storm the 23.6% Fibonacci level of the latest downward wave and the pivot at $1,780 an ounce is bullish weakness. The fall of the precious metal below $1,750 may be the basis for sales.