The British pound is gradually adjusting from the highs set on August 1, but so far, there is no special reason to say that the bull market is under threat. Today is one of the most important days of this summer: the Bank of England is expected to decide on the biggest interest rate hike in the last 27 years, despite the growing risks of economic recession. But whether buyers of the British pound will be able to take advantage of this and return to monthly highs, or the pound will fall even lower, and the pressure on the pair will increase – let's figure it out.

In addition to raising interest rates, it is much more important that the UK Central Bank plans to tell in detail how it will adjust to the $1 trillion economic stimulus program, which has been in operation for more than a decade. Immediately after the meeting, Governor Andrew Bailey will hold a press conference, during which the most active movements will occur.

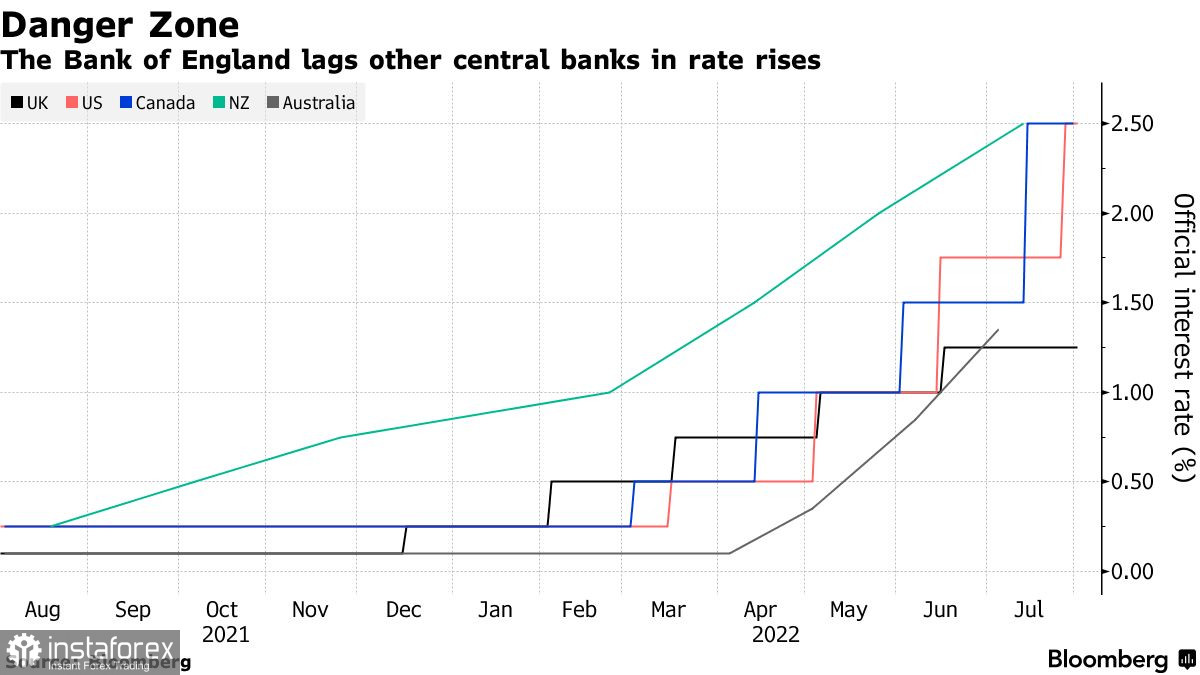

About 70 central banks worldwide have raised interest rates by at least half a percent in one meeting – it seems that the Bank of England will be next. There is a historic rejection of easy money used to reduce the cost of borrowing during the pandemic and the global financial crisis that began in 2008. Now more than ever, the Bank of England needs to respond to the strongest inflation in 40 years, as many prices have already gotten out of control after the COVID lock.

But even if the regulator decides to raise rates by 50 points, this is already almost fully taken into account in the price of GBPUSD. Given the imported inflation, a weak British currency is an additional risk factor that may tip the scales in favor of more decisive actions by the regulator. In other words, the low exchange rate of the pound provokes even greater inflationary pressure, so the Bank of England has no choice but to continue aggressively raising interest rates against the backdrop of a rapidly weakening economy. Since all this is considered in the quotes of the pound, it is unlikely that one increase of 50 points will be enough to continue growth – more aggressive plans are needed to combat inflation further. If they are not announced, the pound has every chance of falling.

Investors are betting on an 80 percent chance of raising the key interest rate by half a percent, to 1.75%. 30 out of 43 banks expect this kind of decision. These include: Barclays, Deutsche Bank, Goldman Sachs, and HSBC. However, Citigroup, Lloyds, Natwest, Morgan Stanley, and UBS are among those that forecast a 0.25% increase.

Importantly, the Bank of England will also present its quarterly forecast. From it, we will find out whether the economy is heading for a recession and, possibly, a complete recession against the background of the expected inflation of 11% or not. As for the forecasts for the economy, in the last May assessment, the Bank of England did not predict a technical recession, defined by a contraction for two consecutive quarters, as has now happened in the United States. But many economists are sure that this cannot be avoided in the future. Economists now expect a 50-50 contraction of the UK economy.

Inflationary pressure has not decreased after five consecutive rate hikes of 25 basis points, so the MPC will likely agree to a higher rate hike at today's meeting. Most economists expect the nine-member monetary policy committee to vote 7 to 2 in favor of a 50 basis point increase, with Bailey and chief economist Hugh Pill joining those who will vote for a more active increase.

As for the reduction of incentive programs, perhaps Governor Andrew Bailey will announce an increase in the reduction of the balance sheet by 50 billion pounds, to 100 billion. More detailed information on the pace and timing will be published after the meeting.

It is worth noting that the UK economy is likely already in recession, as the cost-of-living crisis has devastating consequences for household incomes. According to a rough estimate by the National Institute of Economic and Social Research, average real household disposable income will fall by an unprecedented 2.5% this year and remain 7% below its pre-pandemic level until 2026. "The UK economy is heading towards a period of stagflation with high inflation and recession hitting the economy simultaneously," NIESR macroeconomics said. It is estimated that the number of households living from paycheck to paycheck will almost double by 2024 and reach 7 million.

The pound has obvious problems with continuing growth, and everything needs to be done to stay above 1.2140. If this can be done, we can expect a larger movement of the trading instrument and talk about updating 1.2200 with a further exit to 1.2235 and a return to 1.2290. A break of this range will easily return the pound to 1.2330 and 1.2390. With the breakdown of 1.2140 and the absence of buyers, the situation will change dramatically since the upward trend of July 14 will be broken, and many local lows will open up to sellers. If there is no one at 1.2140, we will strongly adjust to the area of 1.2100 with the prospect of testing a larger level of 1.2060.

As for the prospects of the euro, only consolidation at the level of 1.0190 will give buyers of risky assets a great chance. Therefore, the whole emphasis is shifted to this immediate resistance. Going beyond it will give confidence to buyers of risky assets, which will open a direct road to the level of 1.0235, which determines the further uptrend of July 14. A breakdown of 1.0235 will open the possibility of updating 1.0280 and 1.0330. In case of a decline in the euro, buyers need to show something around 1.0150. Otherwise, the pressure on the trading instrument will only increase. Having missed 1.0150, you can say goodbye to hopes for recovery, which will open a direct road to 1.0110 and 1.0080. A breakthrough in this support level will certainly increase the pressure on the trading instrument, opening the possibility of a return to 1.0040.