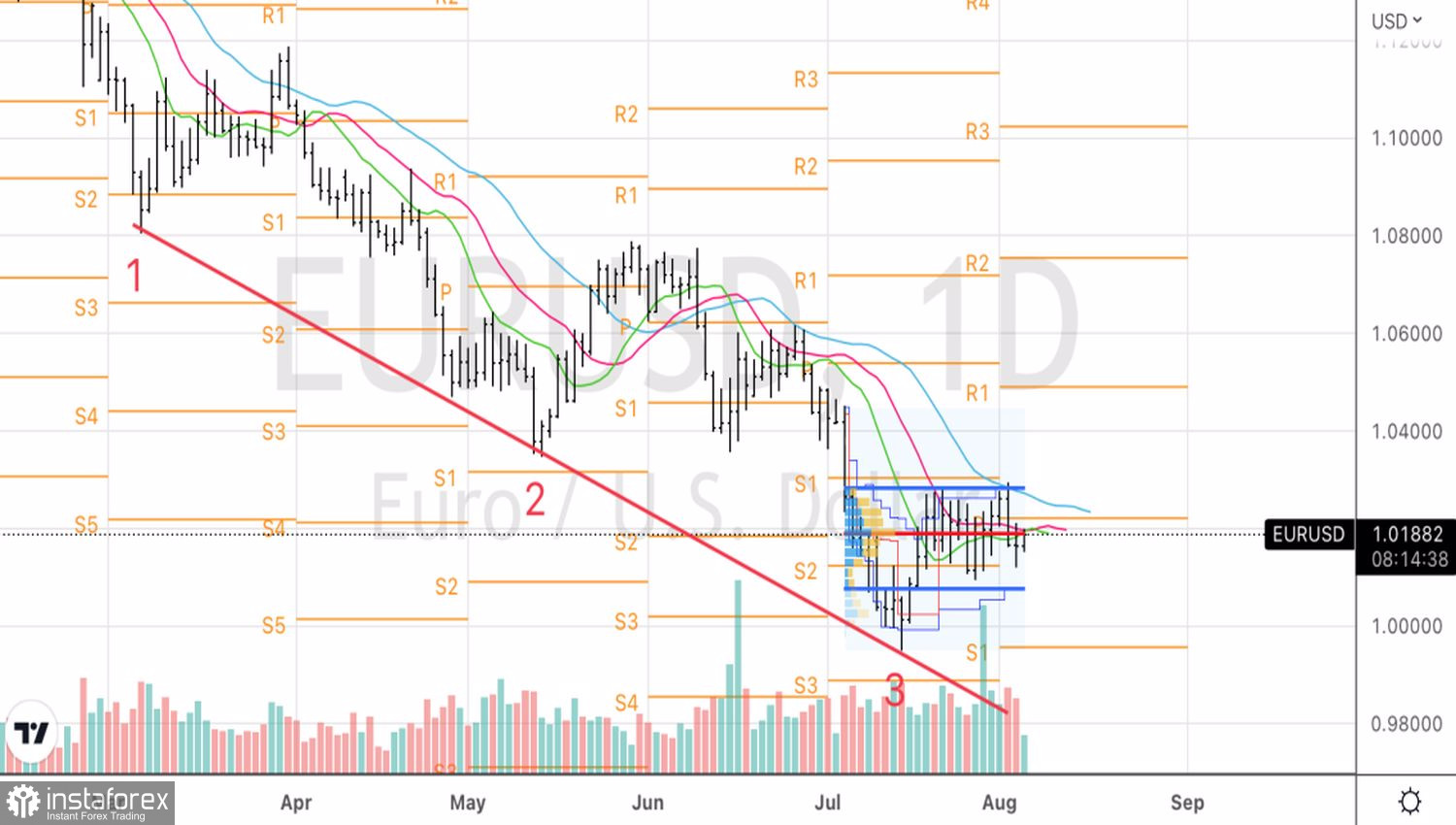

You can lead a horse to water, but you can't make it drink. No matter how much FOMC officials try to convince investors of the Federal Reserve's commitment to an aggressive tightening of monetary policy, so far the financial markets are not being led by the central bank. US stocks resumed their rally and climbed to a 2-month high on expectations that the Fed would put on the brakes. However, no one can guarantee that it will do it. Uncertainty swings the EURUSD pendulum from side to side, not allowing the pair to leave the boundaries of consolidation at 1.01-1.03.

Investors sincerely hope that the US labor market report for July will clear things up. Before its release, no one wants to climb ahead of the father into hell. Nerves are taut, and in the past, one or more big players, hedge funds, or big banks could trigger a false break to trap the smaller ones. To implement this idea, one or another statistics was used. Alas, but now no one wants to take risks. Eurozone data does not lead to serious fluctuations in EURUSD.

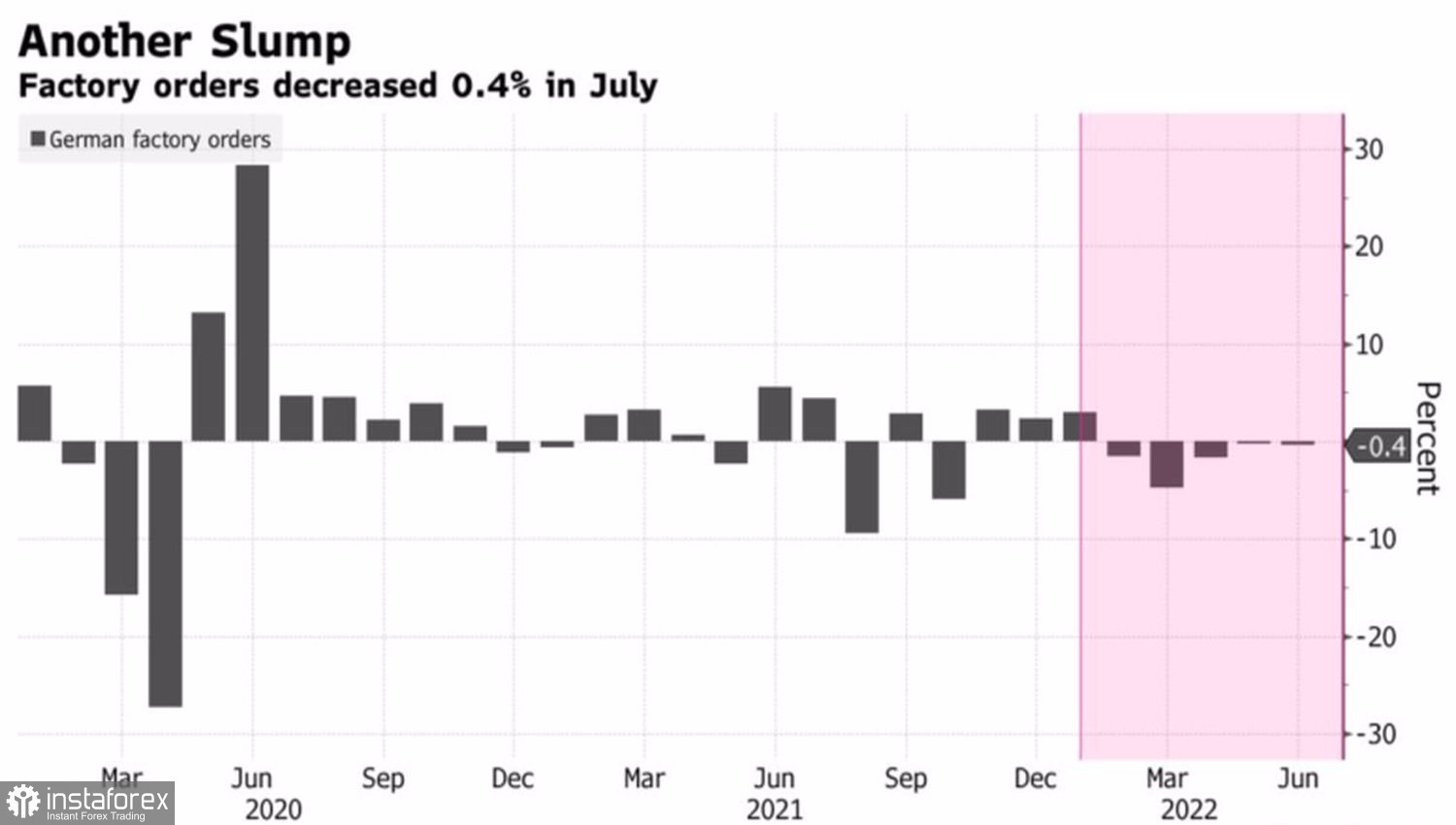

In particular, the fact that German factory orders have been falling for the fifth consecutive month could have hit the euro. However, the bulls on the main currency pair found a positive in it: in fact, the indicator fell by 0.4% m/m, while the forecast was -0.9%.

Dynamics of production orders in Germany

Meanwhile, consumer expectations of future inflation remain at elevated levels in the eurozone: on the horizon for a year – at around 5%, for three years – at 2.8%, which is 0.3 percentage points higher than in the previous European Central Bank survey and more than its target of 2%. Respondents from Germany, France, Italy, Spain, the Netherlands and Belgium, whose economies account for about 85% of the currency bloc's GDP, expect gross domestic product to shrink by 1.3% during the year, and unemployment to jump to 11.5%. This is in sharp contrast to the forecasts of the central bank. It does not expect a recession and sees the unemployment rate at around 7% until 2024.

The pessimism of the population probably affects consumption and GDP, forcing the ECB to be cautious. The Fed does not want to do this. According to FOMC officials, if a recession occurs in the process of tightening monetary policy, so be it. No one has canceled the business cycle. The paradox is that if the Fed talks about a soft landing, it will not reduce domestic demand and will not slow down inflation. If we talk about a recession, everything may eventually end with a soft landing.

Technically, the EURUSD pair has been wandering in the consolidation range of 1.01-1.03 for many weeks, periodically rewriting its boundaries. The euro is trading around fair value and the pivot level at $1.019, and it takes a strong argument to kick it out of there. The formation of a doji bar on the daily chart can be the basis for placing pending long positions from 1.021 and short positions from 1.012. At the same time, moderate targets should be preferred.