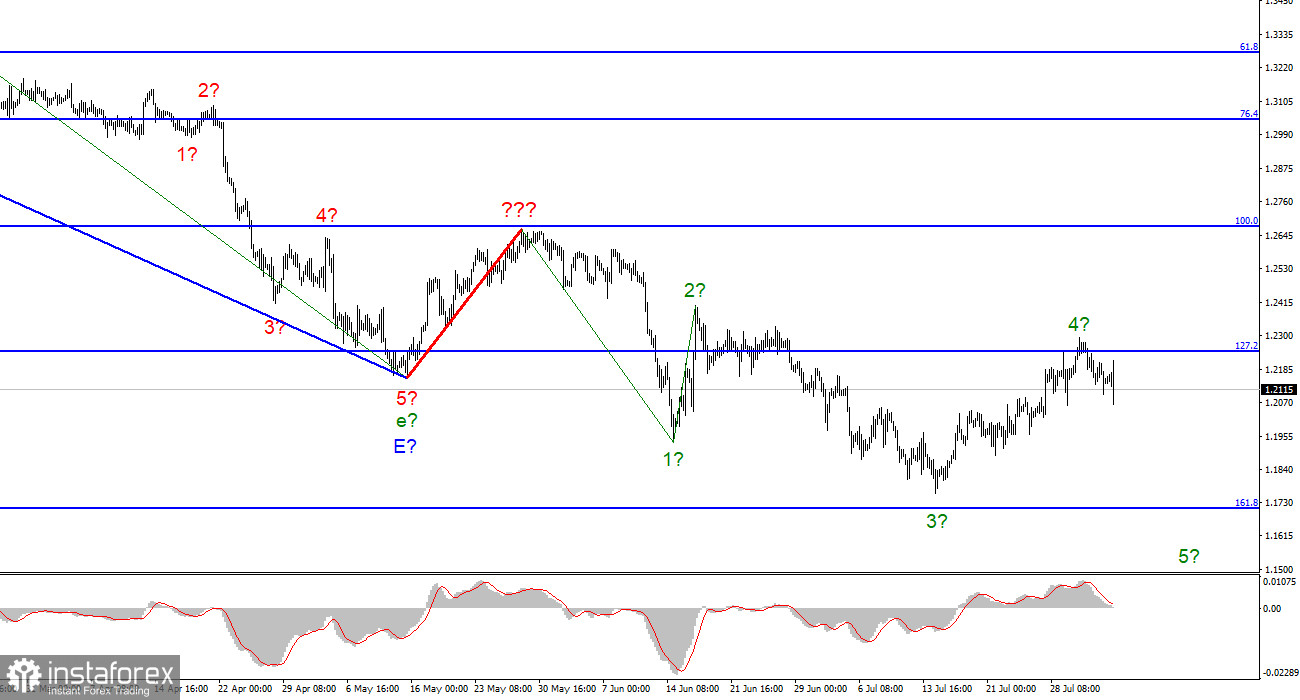

For the pound/dollar instrument, the wave marking at the moment looks quite difficult but does not require adjustments. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the construction of the upward correction section of the trend is canceled, and the downward section takes a more extended and complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area.

It would be much more practical to identify rare corrective waves, after which new impulse structures will be built. At the moment, we have completed waves 1, 2, and 3, so we can assume that the instrument is now in the process of building wave 4 (which may also be already completed or nearing completion). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost equally; at this time, both instruments can complete the construction of their fourth waves simultaneously. I still expect a new decline in the British dollar in the coming days.

The market reacted quite expectedly to the meeting of the Bank of England

The exchange rate of the pound/dollar instrument decreased by 50 basis points on August 4, but by the end of the day, the decline may be stronger. A few hours ago, the meeting of the Bank of England ended, and its results were announced. The market had no doubt that the interest rate would be raised by 50 basis points, and it turned out to be right. But there were still a few unresolved economic and monetary policy issues. So the regulator announced that from September, it would begin unloading its balance sheet for 10 billion pounds per month. Let me remind you that the Fed has begun to take similar actions, but for a much larger amount, about $ 100 billion a month. However, the US economy is much larger than the UK, so these figures should not be confusing. The MPC committee should approve the decision to start reducing the Bank of England's balance sheet in September.

I think there will be no problems with approving this decision since, in the final statement, the Central Bank of Great Britain announced its main goal for the next two years to fight inflation. The British regulator is ready to sacrifice economic growth to return inflation to 2%. According to the expectations of the Central Bank itself, inflation will continue to accelerate in the coming months and may peak at around 13%. The Bank of England also forecasts that by the end of 2022, a recession will begin in the British economy, which may last 15 months. From this, it is easy to conclude that the interest rate will continue to increase since the Central Bank expects further inflation growth, although it has already raised the rate six times in a row. We are waiting for more than one tightening of monetary policy, which can support the demand for the pound if we talk about the prospect for several months. But today, the pound sterling has been declining, and we need this decrease in demand for the proposed wave 5 to complete its construction.

General conclusions

The wave pattern of the pound/dollar instrument suggests a further decline. I now advise selling the instrument with targets near the estimated mark of 1.1708, which is equivalent to 161.8% Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready to continue buying the British pound.

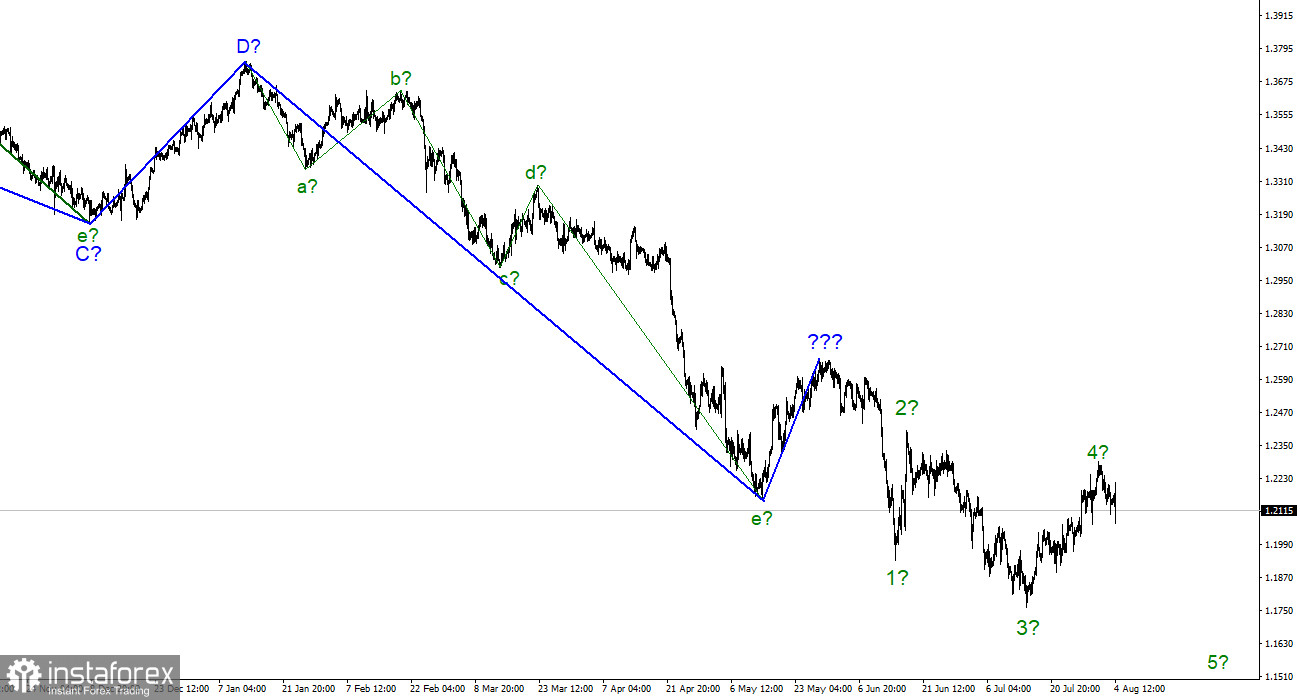

The picture is similar to the euro/dollar instrument at the larger wave scale. The same ascending wave that does not fit the current wave pattern, and the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.