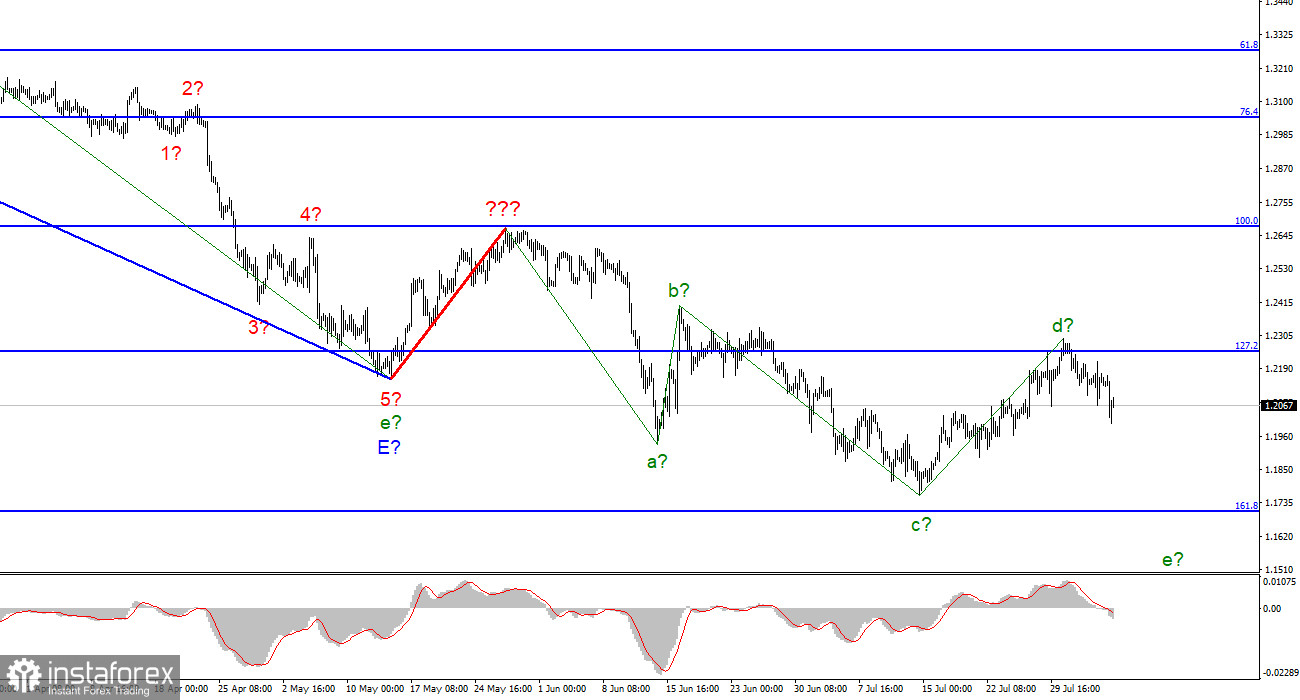

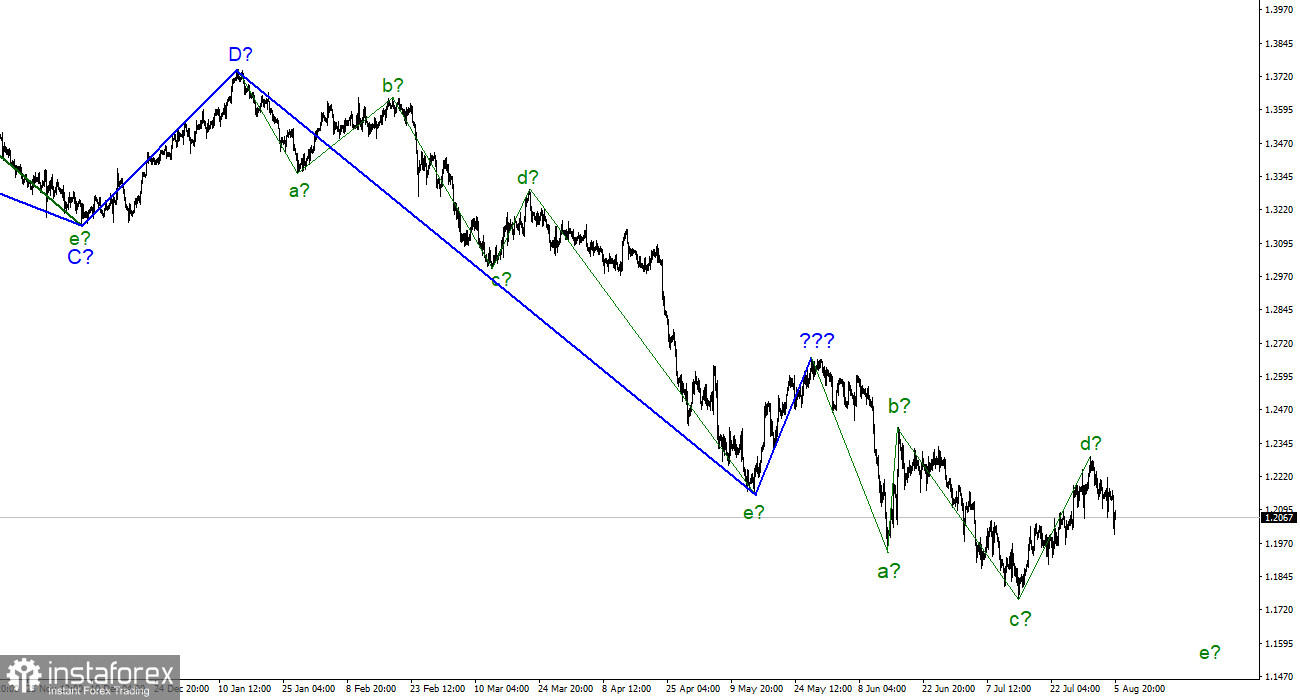

For the pound/dollar instrument, the wave marking at the moment looks quite complicated but does not require any clarification. The upward wave, which was built between May 13 and May 27, does not fit into the overall wave picture, but it can still be considered corrective as part of the downward trend section. Thus, it can now be concluded that the construction of the upward correction section of the trend is canceled, and the downward section takes a more extended and complex form. I am not a big supporter of constantly complicating the wave marking when dealing with a strongly lengthening trend area. It would be much more practical to identify rare corrective waves, after which new impulse structures would be built. We have completed waves a, b and c, so we can assume that the instrument is now constructing wave d (which may also be already completed). The wave markings of the euro and the pound differ slightly in that for the euro, the downward section of the trend has an impulse form (for now). But the ascending and descending waves alternate almost the same way, and at this time, both instruments can complete the construction of their fourth waves simultaneously. I still expect a new decline in the British pound in the coming days.

The market moved the British quite expectedly on Thursday and Friday.

The exchange rate of the pound/dollar instrument decreased by 90 basis points on August 5. It is very important to tell you that on August 4 (the day of the Bank of England meeting), the pound sterling declined by 150 points but closed the day 10 points above the opening level. Thus, the conclusions I made after the meeting with the British regulator need to be slightly adjusted. The market did not react positively to everything that was voiced by Andrew Bailey and published by the Bank of England unequivocally. At first, the Briton grew, then declined greatly, and then grew strongly. The market's reaction to the American statistics on Friday was much more understandable. Thus, I think that the market did not fully understand the meeting results and did not quite understand what needed to be paid more attention to. Is it a rate hike and a willingness to start unloading the balance sheet or pessimistic forecasts for the British economy? Not having figured out the answer to this question, the market went both ways, just in case, but in general, the British declined by 182 basis points over the last 4 days. I believe this is enough to consider wave d completed and wave e started. If this is true, then the demand for the British should decrease in the coming weeks. We get a wave picture in which demand should continue to fall for both the euro and the pound. From my point of view, this is quite real. We saw this week that the ISM index in the service sector held above the 50.0 mark, and the data on unemployment, Payrolls, and wages turned out to be much better than market expectations. All this suggests that Jerome Powell was right when he spoke about the impossibility of a recession in the American economy in a strong labor market. The dollar may continue to strengthen.

General conclusions.

The wave pattern of the pound/dollar instrument suggests a further decline. I advise now to sell the instrument with targets near the estimated mark of 1.1708, which equates to 161.8% by Fibonacci, for each MACD signal "down." An unsuccessful attempt to break through the 1.2250 mark indicates that the market is not ready to continue buying the British pound.

The picture is very similar to the Euro/Dollar instrument at the higher wave scale. The same ascending wave does not fit the current wave pattern, the same three waves down after it. Thus, one thing is unambiguous – the downward section of the trend continues its construction and can turn out to be almost any length.