US stock index futures increased early on Monday as yields of US bonds fell. Treasury bond yields went up on Friday following the release of strong US labor market data, but reversed downwards later. The yield of 10-year Treasury bonds decreased below 2.8%. S&P 500 and Nasdaq 100 futures increased by about 0.6%.

Friday's strong employment data release has increased expectations of further monetary policy tightening by the Federal Reserve. However, traders expect this week's US inflation data to clarify the regulator's policy course. Expectations of a Fed funds rate hike in September have pushed up the yield of US Treasury bonds and has given support to the US dollar.

As oil prices fall amid concerns about a global economic slowdown, the outlook of investors is becoming more optimistic – the inflationary pressure could be about to peak. The corporate earning season is drawing to a close, and investors are expecting many companies to withstand inflationary pressure. Optimism over the Fed's dovish rhetoric amid the release of weaker economic data has also increased the sentiment of market players.

This week's US inflation data could lead to higher volatility in the market, even though price pressure is unlikely to peak at this point. The latest remarks by Fed policymakers have put their plans to decrease the rate in 2023 into question.

Mary Daly, the president of the Fed Reserve Bank of San Francisco, stated that the Federal Reserve is "far from done yet" in bringing down inflation. She was joined by Fed Governor Michelle Bowman, who said that the Fed should continue increasing interest rates by 75 basis points.

Premarket movers

Shares of Palantir fell by 15.6% in premarket action after the company reported an unexpected quarterly loss, and lowered its full-year forecast due to the uncertain timing of some government contracts.Global Blood Therapeutics increased by 4.2% during the premarket. Earlier, the company's share price jumped by 88% following the news that Pfizer (PFE) would acquire Global Blood for $5.4 billion or $68.50 per share in cash.

Baidu added 1.2% during the premarket after the company won approval to operate driverless taxi services in two Chinese cities, the first such approvals in the country.

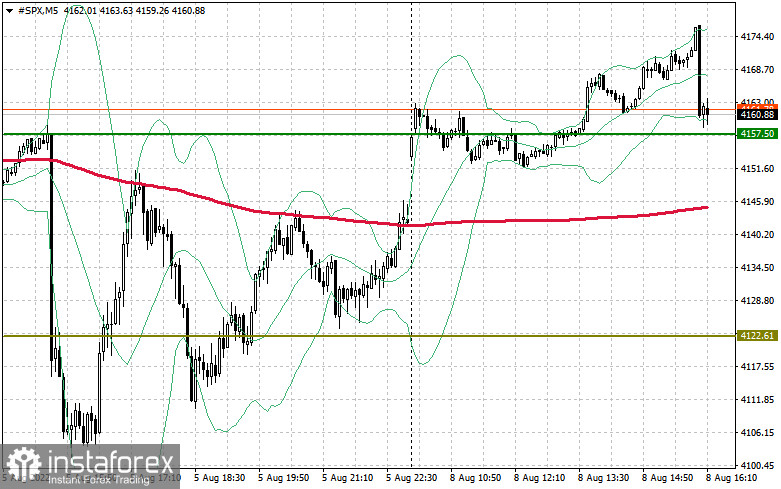

On the technical side, S&P 500 bulls are currently on solid ground. However, they would need to keep the index above the range at $4,157. This would allow them to maintain the initiative in the market. If the S&P 500 breaks through the nearest resistance at $4,197, it could then surge towards $4,234, where major buyers would return into the market once again. Some market players could also take profits from their long positions. From there, the index's next target would be $4,265. If the S&P 500 breaks below $4,157 amid weak corporate revenue reports, bulls would have to keep the index above $4,122 and $4,089. A breakout below this level would send the index towards $4,064 and $4,038, as well as $4,003 below. At this point, the index's next target would be the $3,968 area, where buyers would act more aggressively.