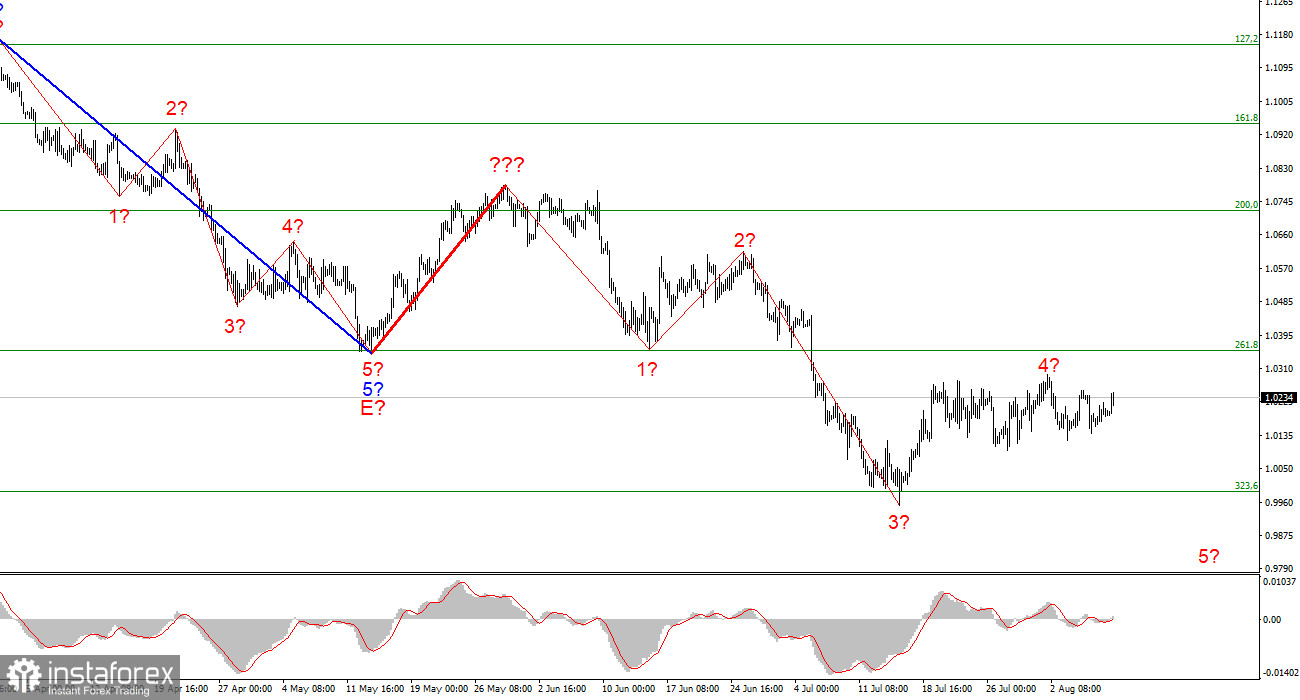

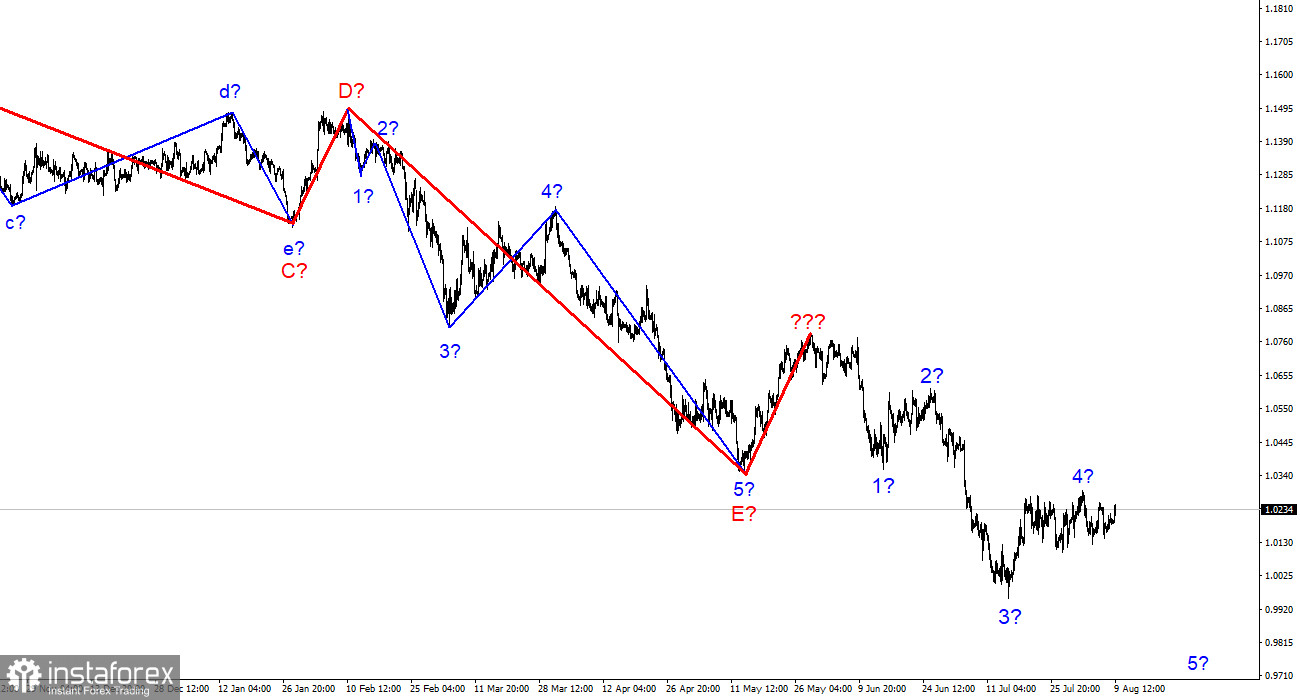

The wave marking of the 4-hour chart for the euro/dollar instrument does not require adjustments at the moment. The new wave marking does not yet consider the rising wave marked with a bold red line. The whole wave structure can become more complicated again, which is the disadvantage of wave analysis since any structure can always take a more complex and extended form. Therefore, now I propose to work on wave structures of a lower scale. As you can see, the construction of a descending wave has presumably begun, which may be wave 5 of a new downward trend section. If this assumption is correct, the instrument will continue to decline with targets below 1.0000. The supposed wave 4 took a three-wave form and surprisingly coincided with the peak of the supposed wave 4, according to the British. Thus, it is possible that the market was waiting for this moment to start selling both currencies from Europe at the same time. At the same time, the Briton is slowly declining, but the European is not. Wave 4, due to such a leisurely movement, can transform and take on an even more extended appearance. In the coming days, we urgently need an increase in demand for the dollar.

The market urgently needs to decide on its mood

The euro/dollar instrument rose by 45 basis points on Tuesday. Thus, the US currency was again unable to continue building the proposed wave 5, and the more it pulls with this, the more difficult it will eventually be to build this wave. Over the past few weeks, the market has had enough opportunities to resume dollar purchases. Even if we take the reports of just last week, Nonfarm Payrolls and the unemployment rate allowed us not only to buy the US dollar a little on Friday but also to continue doing it on Monday and Tuesday. Since the growth of the US currency has not happened, the market is not currently set up for active trading and an increase in demand for the dollar. If this is true, then tomorrow's US inflation report will be perceived in the same way as Friday's data on the labor market and unemployment with wages.

The market is likely to react, but this reaction will not be enough to resume the construction of wave 5. Or maybe "start building wave 5", because the longer the instrument cannot show movement either up or down, the more I have confidence that wave 5 has not even started yet. It is strange, but with such "no" movements of the euro currency, the Briton almost every declines, that is, it implements the construction of its fifth wave, which is the wave e of the corrective structure. Wave markings on the British may also look less attractive, but while there is a working option, why invent a bicycle? Thus, the market can wait for the report on American inflation, but, in my opinion, it will not change its mood. Here, the causal relationship should be reversed. First, the market must change its mood and attitude to the Euro/Dollar instrument, and then, following this mood, work out all subsequent reports and news.

General conclusions

Based on the analysis, I conclude that the construction of the downward trend section continues. If so, it is now possible to sell the instrument with targets near the estimated mark of 0.9397, which equals 423.6% Fibonacci, for each MACD signal "down," counting on the construction of wave 5. Wave 4 can be completed.

At the higher wave scale, the wave marking of the descending trend segment becomes noticeably more complicated and lengthens. It can take on almost any length, so I think it's best to isolate three and five-wave standard structures from the overall picture and work on them.