Ethereum, like the entire cryptocurrency market, is storming ahead of the publication of US inflation reports. Part of the altcoin's excitement is due to the correlation with Bitcoin. However, for the most part, it is due to the huge reservoir of institutional investors who have preferred ETH over Bitcoin in the current market cycle. It is precisely because of the high attention of institutional investors that Ethereum becomes dependent on the trend of the consumer price index.

Recently, the main altcoin was approaching a significant mark of $1800 and tried to gain a foothold above, but failed. Subsequently, the entire market and Ethereum began to decline against the background of the meeting on inflation today at 12:30 UTC. The altcoin has managed to keep the local support zone around $1650, but the bearish pressure is intensifying. Technical indicators confirm the presence of large volumes for sale, which put pressure on the ETH/USD quotes.

The stochastic oscillator was in the overbought zone above 80. Subsequently, the metric formed a bearish cross, which reflected the sudden appearance of large bearish volumes. As a result, the stochastic fell to the level of 40, where it stopped the downward movement. At the same time, the relative strength index indicates a drop in buying activity, as a result of which the metric has acquired a downward direction. The MACD indicator continues to move in a flat above the zero mark, indicating the impulsiveness of the current fall.

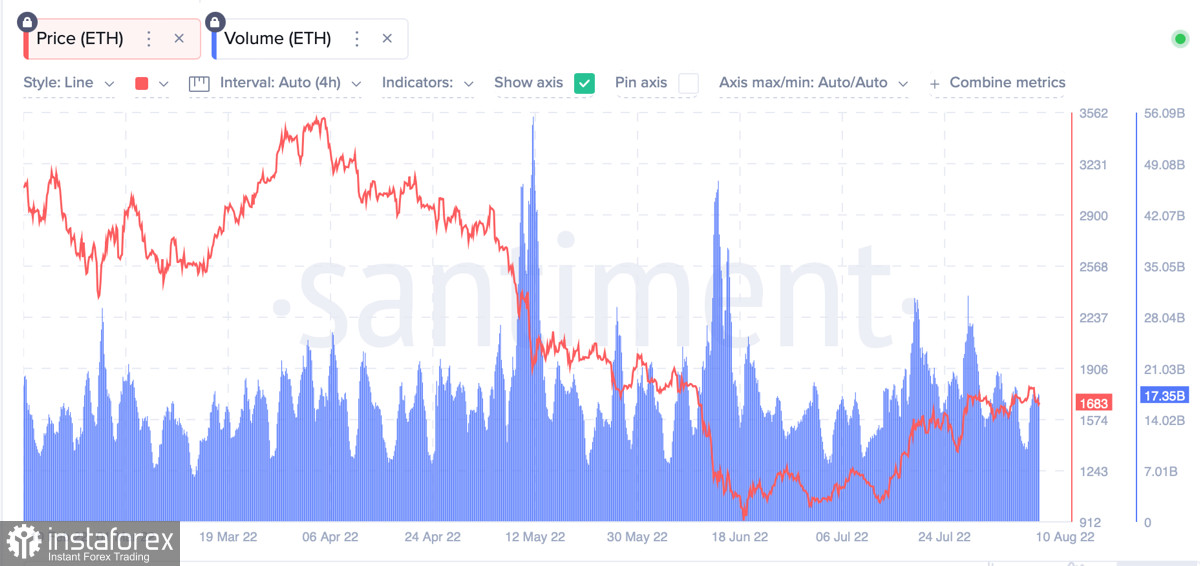

The increase in the level of volatility is confirmed by the on-chain metrics of Ethereum. The number of unique active addresses on the ETH network began to fall while daily trading volumes jumped. This again confirms the fact that the current price drop was provoked by a sharp infusion of bearish volumes and a local drop in buying activity. As a result, we see a growing level of volatility, which will peak shortly before the announcement of inflation data.

The inflation data for July will be decisive for Ethereum, not Bitcoin. This is due to the transition to the PoS algorithm and the corresponding attention of the institutional audience. If the inflation rate continues to fall, the big players should expect the Fed to ease its monetary policy. This, in turn, will ease the liquidity problems, allowing the main altcoin to continue its upward movement to new highs. As of August 10, Ethereum has two options for the development of events after the publication of inflation reports.

If the CPI is below the predicted level of 8.7%, we should expect the cryptocurrency to continue its upward movement. The nearest targets of the altcoin will be the difficult area of $1800–$2100, where a large number of orders and local resistance zones are concentrated. With favorable reporting in the second half of August, the air will make its way through this resistance zone.

The second scenario assumes that the inflation rate will remain above the forecasted 8.7%. With this development of events, we expect an increase in volatility and the preservation of local bearish dynamics on the ETH/USD charts. The nearest targets for the bears in this scenario will be the level of $1550, $1400, and the final area of $1200. It is unlikely that the asset will go lower given the positive news background and the presence of a foundation for an upward movement, which is supported by institutional investors.