Details of the economic calendar for August 9

Tuesday was not much different from Monday in terms of the macroeconomic calendar. Important statistics in Europe, the United Kingdom, and the United States were not published. Investors and traders took a wait-and-see attitude ahead of the release of US inflation data on Wednesday.

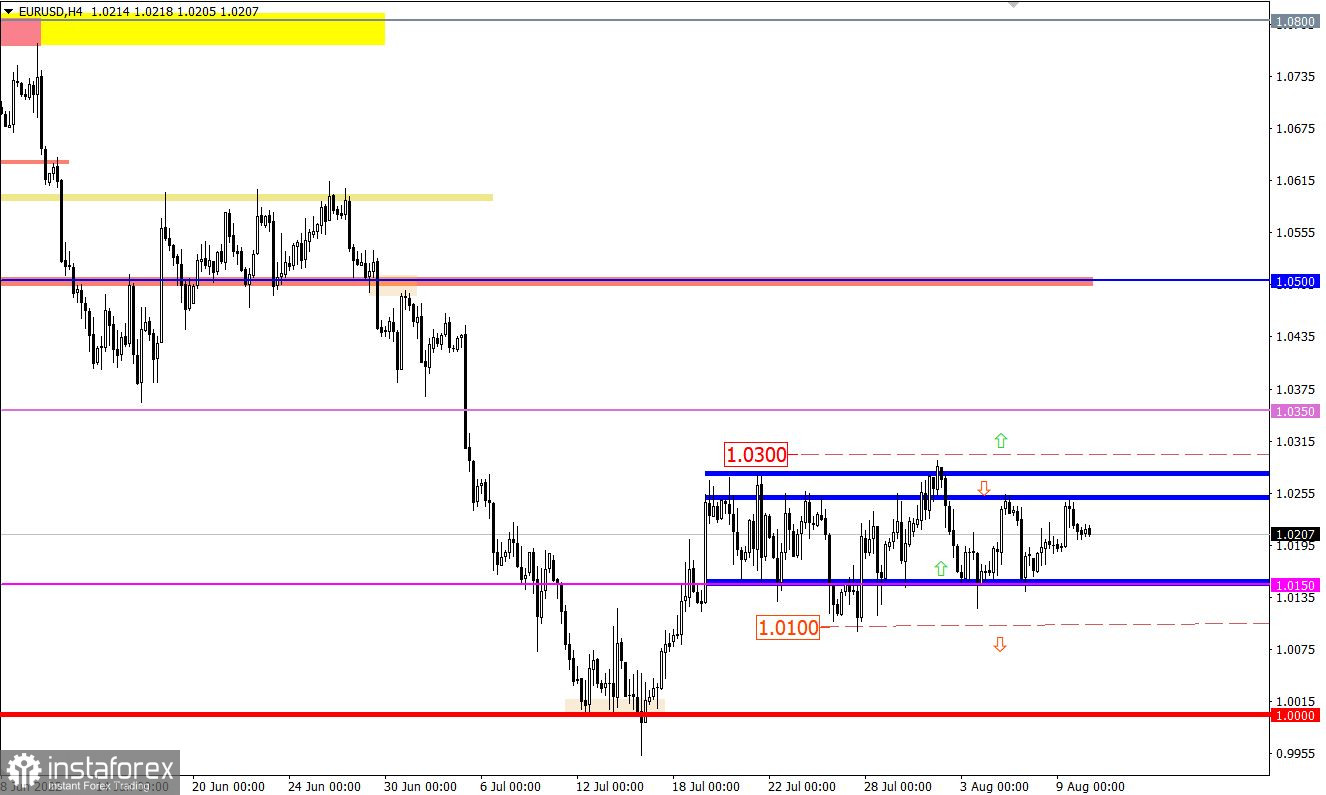

Analysis of trading charts from August 9

The EURUSD currency pair slowed down its upward course with surgical precision within the local high on August 4, where the upper border of the side channel is located. As a result, there was a reduction in the volume of long positions, which led to a pullback.

The GBPUSD currency pair during the past day was moving within the framework of 1.2060/1.2135 stagnation, having variable activity. This kind of stop indicates the process of accumulation of trading forces, which ultimately leads to an acceleration in the market.

Economic calendar for August 10

Today, the focus will be on inflation data in the United States, where there are two main forecasts.

The first considers maintaining inflation at the same level, 9.1%. In this case, we have a guaranteed increase in the refinancing rate in September by at least 75 basis points. In this scenario, the US dollar will move to strengthen its position in the market.

The second scenario considers a slight decrease in inflation to 8.7% due to a slight decline against the backdrop of falling gasoline prices. Nevertheless, inflation figures will still leave a mark in the form of a high growth rate over the past four decades.

How will lower inflation affect the US dollar?

Much here will depend on the speculative mood since, based on the Fed's comments, the decline in inflation is the very indicator that they will be guided by in their decision on the interest rate. That is, theoretically, with a decrease in the level of inflation, the Fed can slow down the pace of raising the rate in the future. This, in turn, will lead to a gradual weakening of the US dollar.

What if inflation rises?

This scenario is also worth considering. If inflation rises, investors' fears regarding the refinancing rate hike by 100 basis points in September will increase significantly. In this case, there will be a sharp speculative interest in dollar positions.

Time targeting:

US Inflation – 12:30 UTC

Trading plan for EUR/USD on August 10

In this situation, there is already a primary price rebound from the area of the upper border 1.0250/1.0270. Strengthening of short positions is possible after holding the price below the value of 1.0200, which will open the way in the direction of the lower border of the flat 1.0150.

An alternative scenario is possible if the price returns to 1.0250. In this case, euro buyers will have a second chance to move towards the values of 1.0270/1.0280.

Cardinal changes on the trading chart are possible only after the price stays outside one of the control levels: 1.0300—when considering the upward development of the market; 1.0100—if market participants are focused on going towards the parity level.

It is worth noting that the signal must be confirmed in a four-hour period.

Trading plan for GBP/USD on August 10

It can be assumed that the current stagnation will soon complete the formation. As a result, speculative interest will arise in the market, which will lead to local price jumps.

The values 1.2050/1.2155 serve as signal levels. Holding the price outside of one or another value in a four-hour period may indicate a subsequent path.

What is shown in the trading charts?

A candlestick chart view is graphical rectangles of white and black light, with sticks on top and bottom. When analyzing each candle in detail, you will see its characteristics of a relative period: the opening price, closing price, and maximum and minimum prices.

Horizontal levels are price coordinates, relative to which a stop or a price reversal may occur. These levels are called support and resistance in the market.

Circles and rectangles are highlighted examples where the price of the story unfolded. This color selection indicates horizontal lines that may put pressure on the quote in the future.

The up/down arrows are the reference points of the possible price direction in the future.