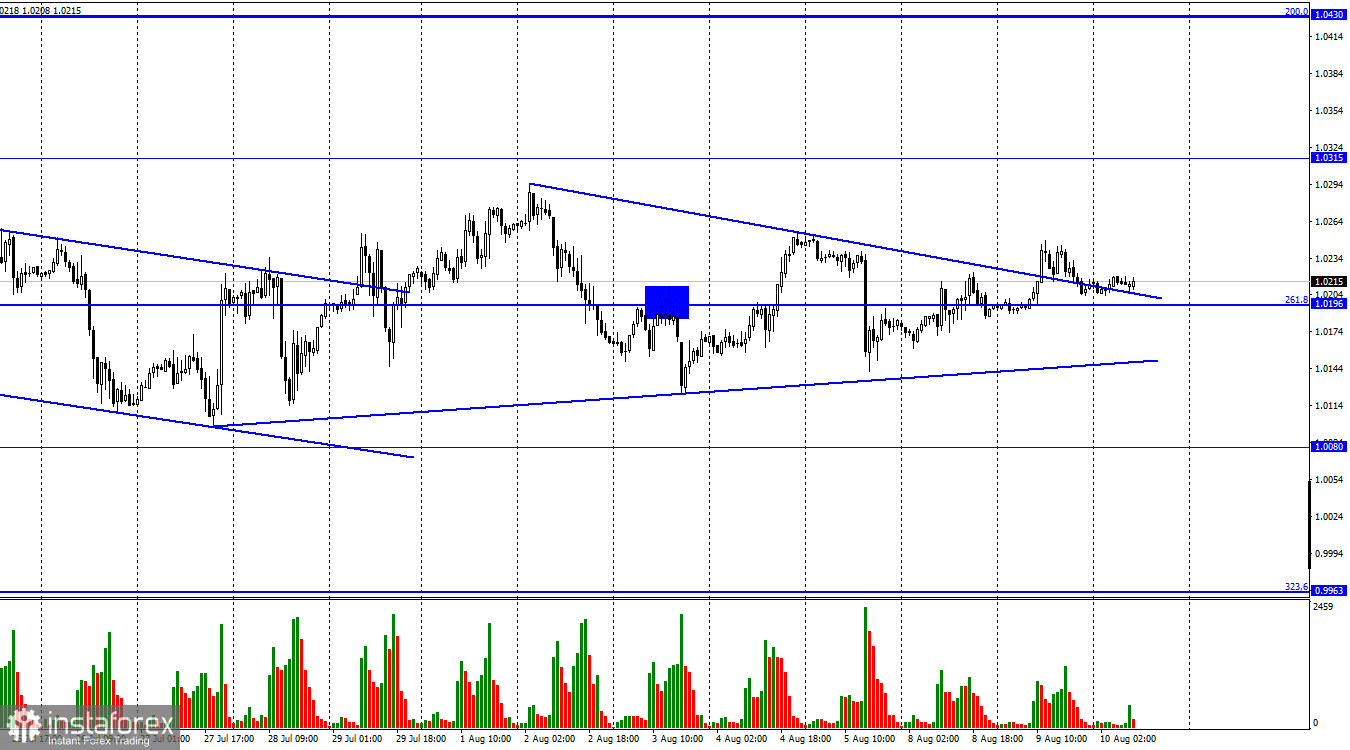

The EUR/USD pair secured above the triangle on Tuesday, but instead of continuing to grow towards the 1.0315 level, it returned to the corrective level of 261.8% (1.0196). Thus, the triangle can be considered untenable without paying attention. More important is the side corridor on the 4-hour chart, from which I propose to dance. The first two days of this week passed without major price changes. The European currency has grown quite a bit, and this change should not even be considered. Everything now rests on the fact that there is a side corridor on the 4-hour chart from which the pair cannot exit for a long period. The information background could help traders choose the direction of trading, but there was just no information background on Monday and Tuesday. But today, traders can take their souls away.

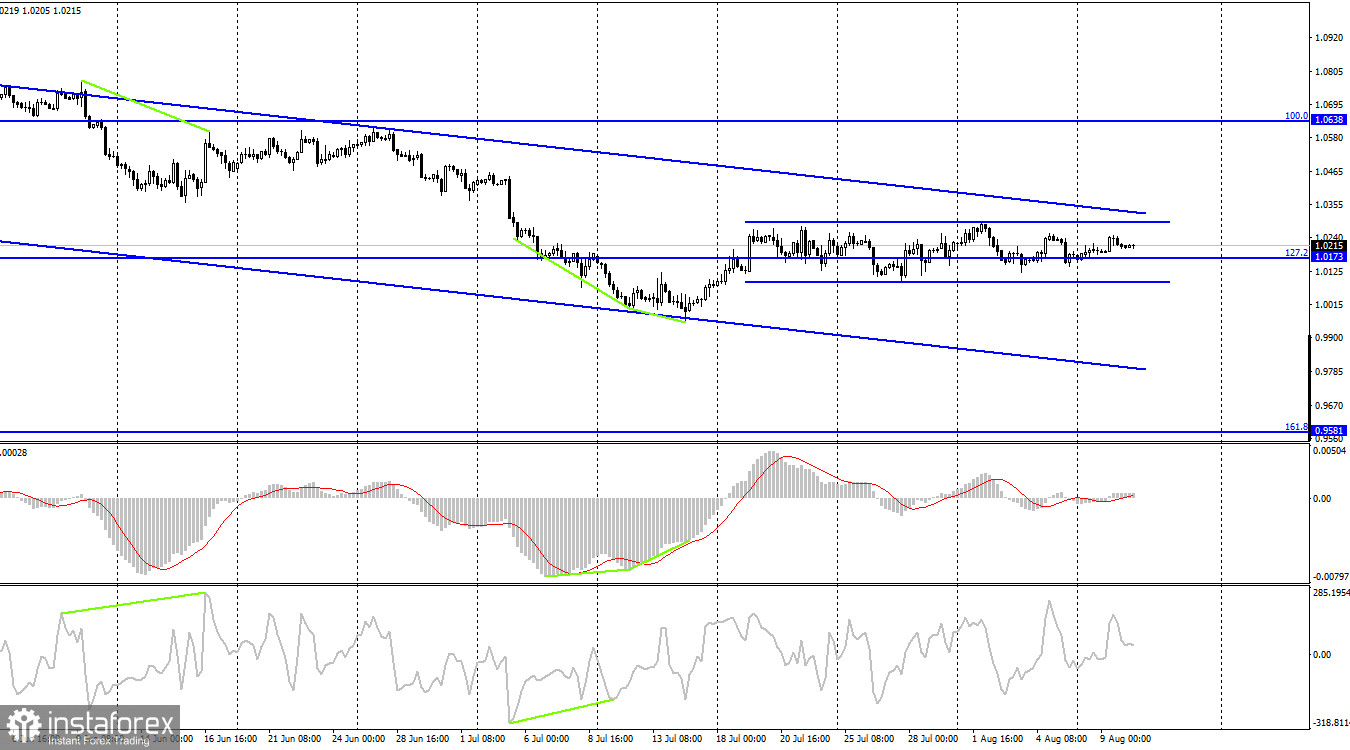

In the US, the long-awaited inflation indicator for July will be released, which is crucial now for traders, the Fed, the economy, and monetary policy. However, this report is now on the calendar in proud solitude. It is certainly important, and traders are unlikely to ignore it, but it is only one. Remember that three important reports were released in the US last Friday (unemployment, nonfarm payrolls, and wages). And these three reports failed to push the couple out of the side corridor. What are the chances that one report can do this today? After all, we are not interested in how much the dollar will rise or fall within one or two hours after the report. We wonder where the pair will move over the next week or two. And so far, the answer can only be given as follows: horizontally, along the corrective level of 127.2% (1.0173) on the 4-hour chart. On the hourly chart, you can not follow the level of 261.8% (1.0196).

On the 4-hour chart, the pair continues to remain above the level of 127.2% (1.0173). However, the pair also remained inside the side corridor, which they got into on July 19. Thus, fixing above or below this corridor will allow traders to count on movement in a certain direction. The downward trend corridor continues to characterize the general mood of traders as "bearish." Hence, I expect quotes to consolidate under the side corridor with the resumption of the fall in the direction of the Fibo level of 161.8% (0.9581).

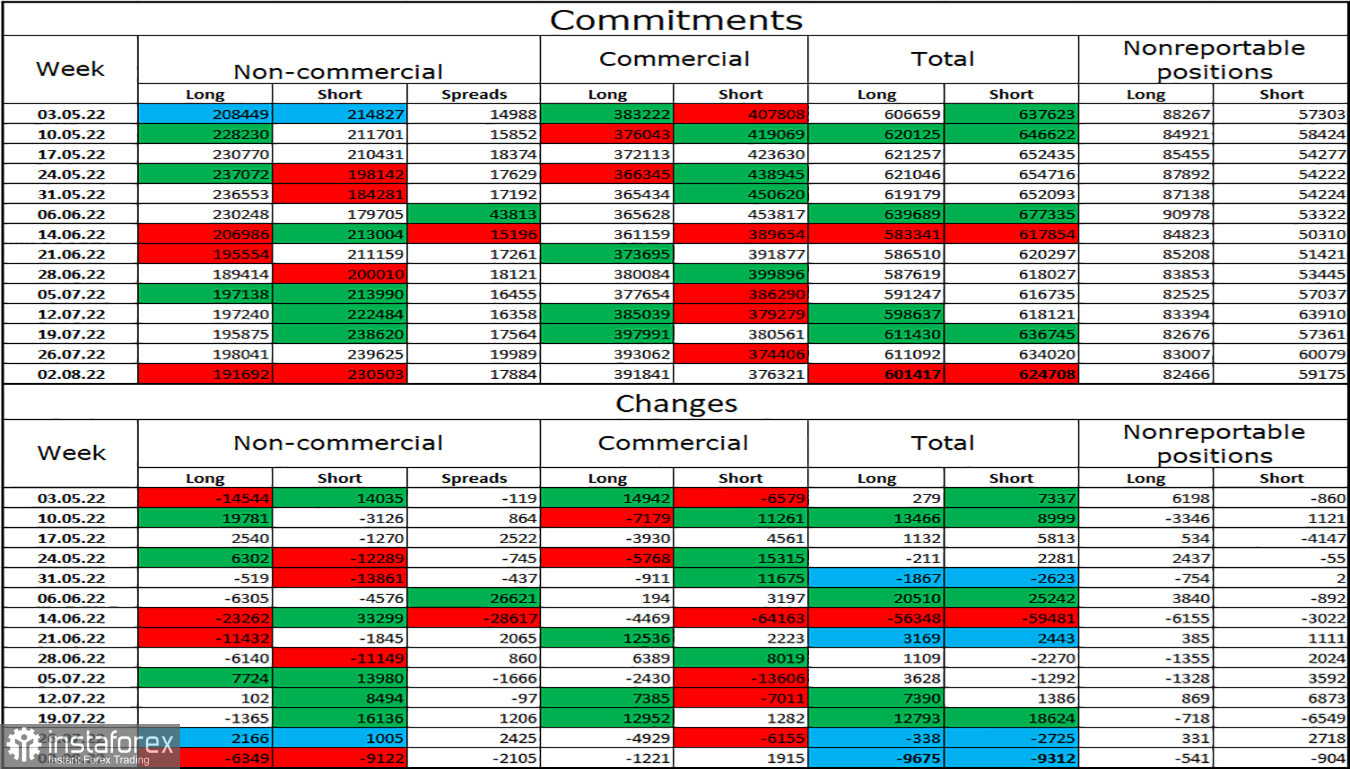

Commitments of Traders (COT) Report:

Last reporting week, speculators closed 6,349 long contracts and 9,122 short contracts. This means that the "bearish" mood of the major players has become a little weaker, but it has remained. The total number of long contracts concentrated in the hands of speculators now amounts to 191 thousand, and short contracts – 230 thousand. The difference between these figures is still not too big, but it remains not in favor of euro bulls. In the last few weeks, the chances of the euro currency's growth have been gradually increasing, but recent COT reports have shown no strong strengthening of the bulls' positions. The euro has failed to show convincing growth in the last four weeks. Thus, it is still difficult for me to count on strong growth of the euro currency. So far, I am inclined to continue the fall of the euro/dollar pair.

News calendar for the USA and the European Union:

US - consumer price index (12:30 UTC).

On August 10, the calendars of economic events of the European Union and the United States contained one entry for two. The influence of the information background on the mood of traders today may be average in strength and only in the afternoon.

EUR/USD forecast and recommendations to traders:

I recommend new sales of the pair when closing under a side corridor on a 4-hour chart with a target of 0.9581. I recommend buying the euro currency when fixing quotes above the descending corridor on the 4-hour chart with a target of 1.0638.