US inflation disappointed: all components of today's release came out in the red zone, significantly falling short of the forecast estimates. The core consumer price index showed a particularly weak result: experts expected it to slow down, but the real figures were below the forecast level. Traders of dollar pairs clearly did not expect such an unambiguously negative outcome, so the greenback plunged sharply throughout the market. And the EUR/USD pair is no exception here. The price has updated the monthly high and tested the 3rd figure for the first time since the beginning of July. And although bulls of the pair hardly hold the price boundaries they have won, the fact remains that the dollar has significantly weakened its position today. EUR/USD bears can forget about returning to the parity level for now, while the bulls of the pair have received a reason to develop corrective growth.

The importance of today's release cannot be overestimated. Such a violent reaction of traders is quite justified, since at the moment the scales have tilted towards a 50-point hike in the Federal Reserve's interest rate in September, whereas last Friday the market was talking about a 75-point increase in the rate. The probability of implementing a more hawkish scenario increased to 68% after the release of the July Nonfarm. The US labor market really pleased dollar bulls: all components of the report came out in the green zone and in some positions the final result was twice the forecast level. For example, the number of people employed in the non-agricultural sector increased by 528,000, although most experts expected an increase of 250,000. Salary indicators increased (+5.2% Y/Y), and unemployment decreased to 3.5%. Such rosy results reinforced hawkish expectations, especially after comments by Fed Board member Michelle Bowman, who stated that she "strongly supports raising rates on an ultra-large scale." But at the same time, she clarified that aggressive rates of monetary policy tightening are acceptable if inflation continues to show active growth.

A similar position was recently voiced by the head of the San Francisco Federal Reserve, Mary Daly, who also has the right to vote in the Committee this year. She spoke in favor of a 75-point rate hike, "if the central bank sees a further increase in inflation." Otherwise, a 50 basis point increase would be a reasonable step. In turn, the head of the Federal Reserve Bank of Chicago, Charles Evans, after the release of Nonfarm, said that a rate hike of 50 basis points "is a reasonable estimate for the September meeting of the Fed."

After the release of key data on the growth of the US labor market, Goldman Sachs currency strategists reported that the published data "will not encourage members of the Federal Reserve to increase the rate by 75 points" – only if Nonfarm "strengthens" inflation. Goldman Sachs' forecast for the September meeting is moderate – an increase in the rate by 50 basis points.

As we can see, the July inflation report was of a key, decisive nature – the scales could well lean towards further aggressive steps by the Fed, especially amid strong Non-Farms. But this house of cards collapsed in an instant: we saw the first signs of a slowdown in inflationary growth, and this fact speaks for itself.

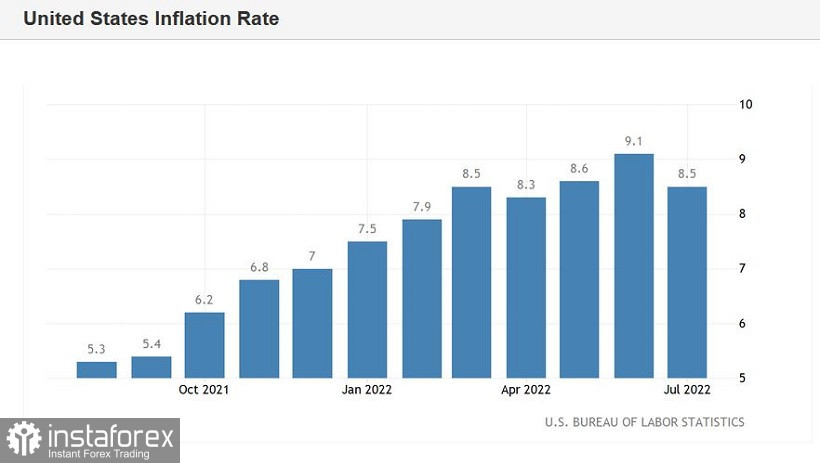

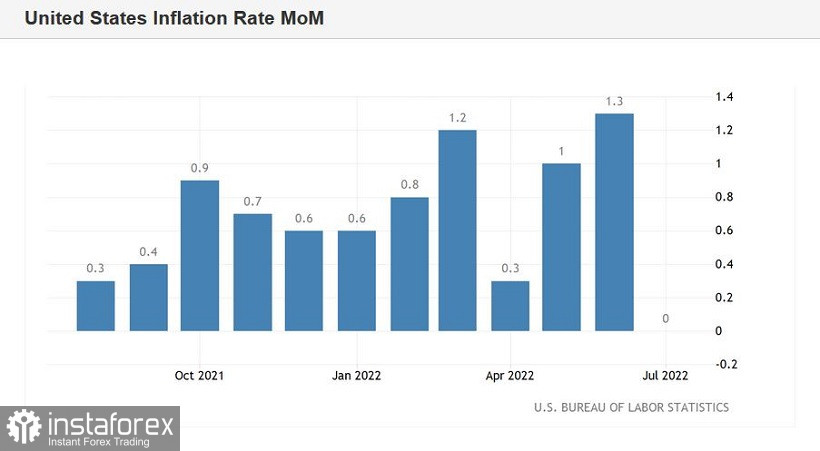

Thus, the overall consumer price index on a monthly basis came out at zero: this is the weakest result since June 2020 (when the indicator was in the negative area). In annual terms, the overall CPI slowed to 8.5% (with a slowdown forecast to 8.7%). Let me remind you that in June this component reached a 40-year high (9.1%). As for the dynamics of the core consumer price index, here the picture also looms very sadly for dollar bulls. In annual terms, the core CPI came out at around 5.9% (with growth forecast to 6.1%), and on a monthly basis it slowed down to 0.3%.

The structure of the report suggests that the growth rate of energy prices in July slowed to 32% after the highest June growth (a 42-year high of 41.6% was recorded). In particular, gasoline has risen in price by 44% (in June, the increase was at the level of 60%, this is the highest since March 1980). Natural gas prices rose by 30% after rising by almost 40% in June (this is the highest value since the fall of 2005). The cost of air tickets in July increased by 27% (whereas the month before last this segment rose by 34%).

All this suggests that the growth of consumer prices in America in June could reach its peak. And judging by the dynamics of EUR/USD, many traders have come to similar conclusions. These are the fundamental conclusions that allow us to talk about the pace of further tightening of monetary policy. Moreover, there is no doubt that the market will again return to talk about the fact that next year the Fed will resort to lowering the interest rate to stimulate economic growth. Such assumptions were already made at the end of July, however, many representatives of the Fed stopped such conversations "in the bud", saying that the Fed has not yet coped with "number one task", that is, it has not yet curbed the spasmodic growth of inflation. Now that the first signs of a slowdown in the CPI have appeared, dovish rumors will again flood the information space.

Considering the release, short positions on the pair began to look risky. EUR/USD bulls are trying to settle above the resistance level of 1.0320 (the upper line of the Bollinger Bands indicator on the daily chart). If they manage to settle above this target within the next day, it will be possible to talk about the continuation of corrective growth – at least to the level of 1.0420 – this is the lower limit of the Kumo cloud on the same timeframe.