Yesterday's data on US inflation showed its slight weakening. The core consumer price index stayed at the previous 5.9% y/y against expectations of growth to 6.1% y/y, the overall CPI fell from 9.1% y/y to 8.5% y/y. Markets lowered their expectation of the September Federal Reserve rate hike from 0.75% to 0.50%, the euro jumped by one and a half figures and closed the day with an increase of 86 points. Now, the comments of the Fed FOMC members are gaining increased interest among market participants, but in general, yesterday's market reaction looks excessive.

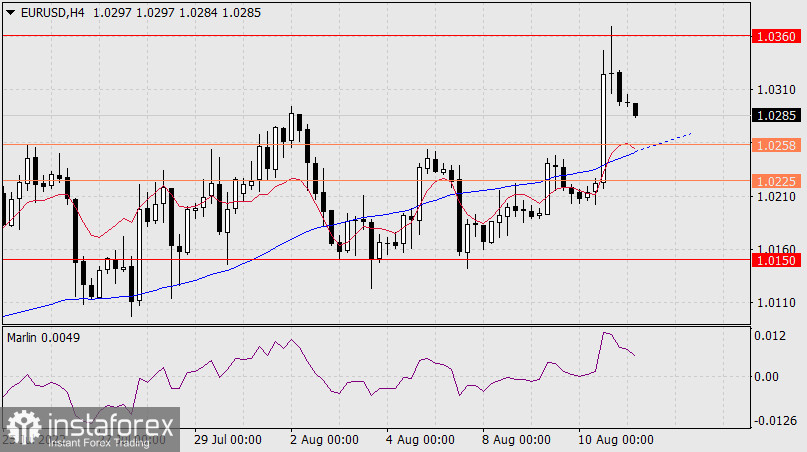

The price reached the target level of 1.0360, the June 15 low, on the daily time frame. From this level, according to one of the scenarios, earlier we expected a price reversal in the medium term, now such a moment has come. To confirm the reversal, the price should return under the MACD line (1.0225). In this case, the support at 1.0150 will most likely be overcome and the 1.0020 target will become available.

On the H4 chart, there is a standard reversal of the price and the oscillator after a sharp increase in the asset, confirmation, and the earliest, will be the price moving under the MACD line, under the level of 1.0258. Further, the price will have to struggle with the MACD line of the daily scale (1.0225).