The euro-dollar pair continues to climb up, taking advantage of the general weakening of the US currency throughout the market. EUR/USD bulls did not hold the occupied height on Wednesday (the day's high was fixed at 1.0370), but on Thursday they resumed their attack on the upside. Moreover, the prevailing fundamental background is quite conducive to the development of the upward trend within the framework of a large-scale corrective pullback.

It is still too early to talk about a trend reversal, but the prospects for resuming the downward movement look rather vague at the moment. The dollar lost an important trump card this week, which allowed it to dominate not only against the euro, but also in almost all dollar pairs. We are talking about the hawkish attitude of the Federal Reserve: until recently, members of the US central bank took the most aggressive position regarding the pace of monetary policy tightening. Perhaps only the Bank of Canada could compete with the Federal Reserve, which at the last meeting raised the rate by 100 points at once. But in general, the Fed was at the forefront of events in this regard, thereby supporting the US currency.

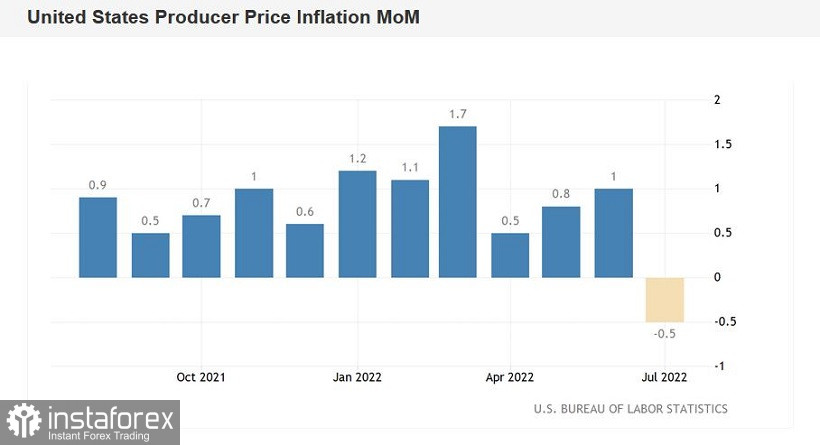

However, the latest release of data on the growth of the consumer price index significantly changed the situation. Market participants saw the first signs of slowing inflation in the US, after which the dollar came under a wave of sales. The situation for the greenback worsened on Thursday, as in addition to the disappointing CPI, an equally disappointing report on the growth of the producer price index was published. EUR/USD bulls were revived again and resumed the upward movement, reaching the middle of the 3rd figure. The fact that the pair's bulls are holding their positions above the 1.0300 mark already speaks volumes. After all, the pair has been trading in a certain price range for almost three weeks, the scope of which was limited to 1.0130-1.0280. EUR/USD traders have not left this price range for almost three weeks, alternately starting from its borders.

But market participants sooner or later had to make a choice: either they go back to the parity area and test the support level of 1.0000, or they go to the area of the 3rd figure, using this springboard to jump to the resistance level of 1.0450 (the upper limit of the Kumo cloud on the D1 timeframe). Disappointing inflation releases resolved this dilemma: the choice of traders was made in favor of growth.

A report on the growth of the producer price index in the United States was published on Thursday. As you know, this indicator signals a change in inflationary trends. According to the forecasts of most experts, this index was supposed to reflect a slowdown in inflation. The de facto result turned out to be worse than forecasts. Moreover, both the general index and the core index demonstrated negative dynamics. The general producer price index on a monthly basis in July collapsed into negative territory, reaching -0.5%. This is the weakest result since May 2020. In annual terms, the indicator slowed down to 9.8% (the worst result since December 2021). Excluding food and energy prices, the producer price index also slowed its growth – both on an annual and monthly basis. In particular, on a monthly basis, the indicator fell to 0.2%, which is the weakest result since September last year.

In other words, Thursday's inflation release eloquently complemented Wednesday's report on the growth of the consumer price index, thereby forming a negative fundamental picture for the US currency.

Let me remind you that the overall consumer price index on a monthly basis came out at zero. This is the weakest result since June 2020, when the indicator was in the negative area. In annual terms, the overall CPI slowed to 8.5%, with a slowdown forecast to 8.7%. Despite the fact that in June this component reached a 40-year high (9.1%). As for the dynamics of the core consumer price index, the picture here is also very sad for dollar bulls. In annual terms, the core CPI came out at around 5.9% (with growth forecast to 6.1%), and on a monthly basis it slowed down to 0.3%.

After the release of the above reports, the market began to suggest that US inflation reached its peak values in June. Such conclusions inevitably lead to other thoughts, already regarding the pace of tightening of the Fed's monetary policy. In the face of strong Non-farms, experts started talking about the fact that the Fed will still decide on another 75-point rate hike in September. However, disappointing inflation reports make it possible for members of the US central bank to implement a more moderate policy. At least at the moment, the basic scenario of the September meeting assumes a 50-point rate hike.

Thus, the EUR/USD pair retains the potential for the development of corrective growth. However, given the vulnerability of the European currency, long positions should be treated with great caution. The first and so far the main goal of the upward movement is the 1.0380 mark – the lower limit of the Kumo cloud on the daily chart.