The rally in equity markets is beginning to slow down amid growing fears that the Fed may still take advantage of the situation and continue raising rates because of high inflation. According to the latest data, Dow lost its previous gains, while the S&P 500 and Nasdaq moved into negative territory. Positive sentiment is also decreasing in Europe and Asia, while dollar and Treasury yields show growth.

The recently-released jobless claims data in the US, albeit lower than expected, indicated an increase against the previous value, which probably convinced market players that the Fed will not miss a chance to continue actively raising interest rates. San Francisco Fed President Mary Daly said it is still necessary to raise rates in September, not by 0.25%, but by 0.50% or even 0.75%.

This is why market players should closely follow the economic statistics coming in today, as that could signal what can be expected next week. There is a huge chance that dollar will resume growth, while the stock markets will end their rally.

Forecasts for today:

EUR/USD

The pair is trading above 1.0300. Increased selling pressure will push the quote to 1.0210.

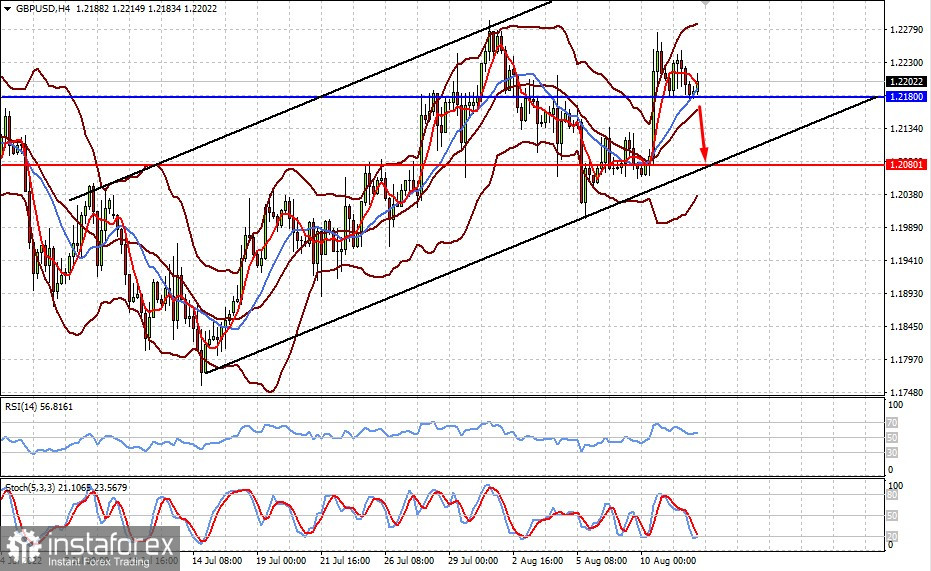

GBP/USD

Although the pair is trading above 0.7100, an increase in selling pressure will bring the quote to 1.2080.