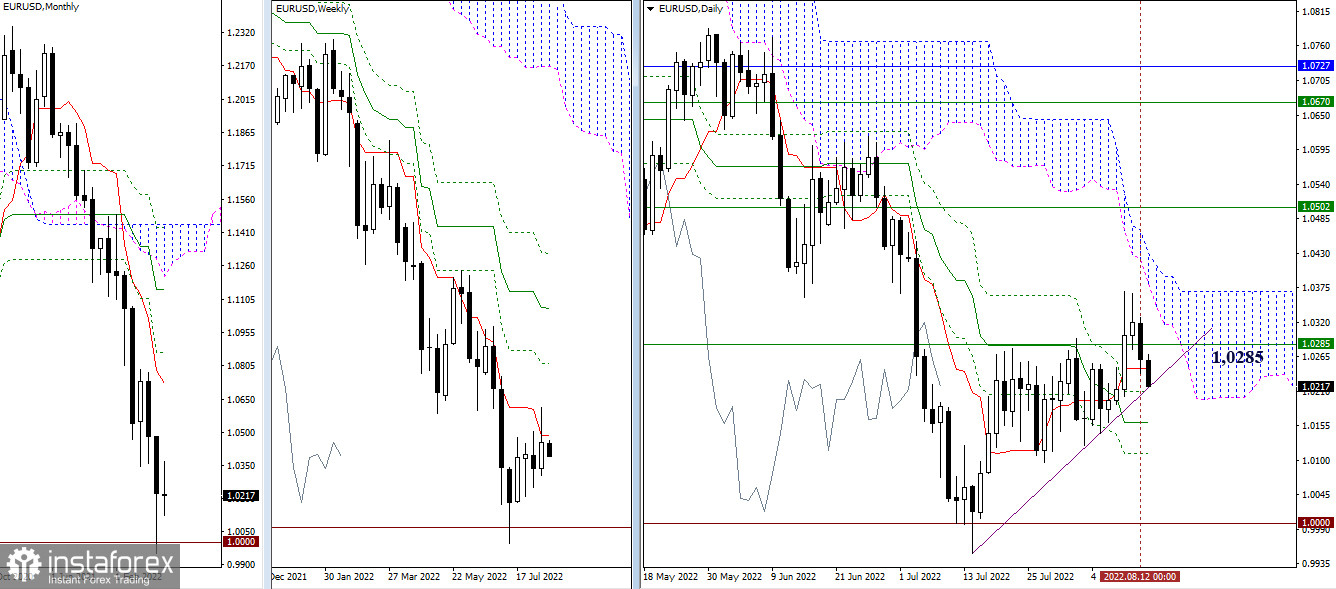

EUR/USD

Higher timeframes

Bulls failed to stay above the tested weekly short-term trend (1.0285) at the close of last week. As a result, there are now favorable opportunities to break through the correction trend line and continue the rebound formation. From the immediate supports today, we can note the levels of the daily Ichimoku cross (1.0210 – 1.0160 – 1.0111). Liquidation of the daily golden cross will confirm and develop a rebound from the weekly short-term trend (1.0285).

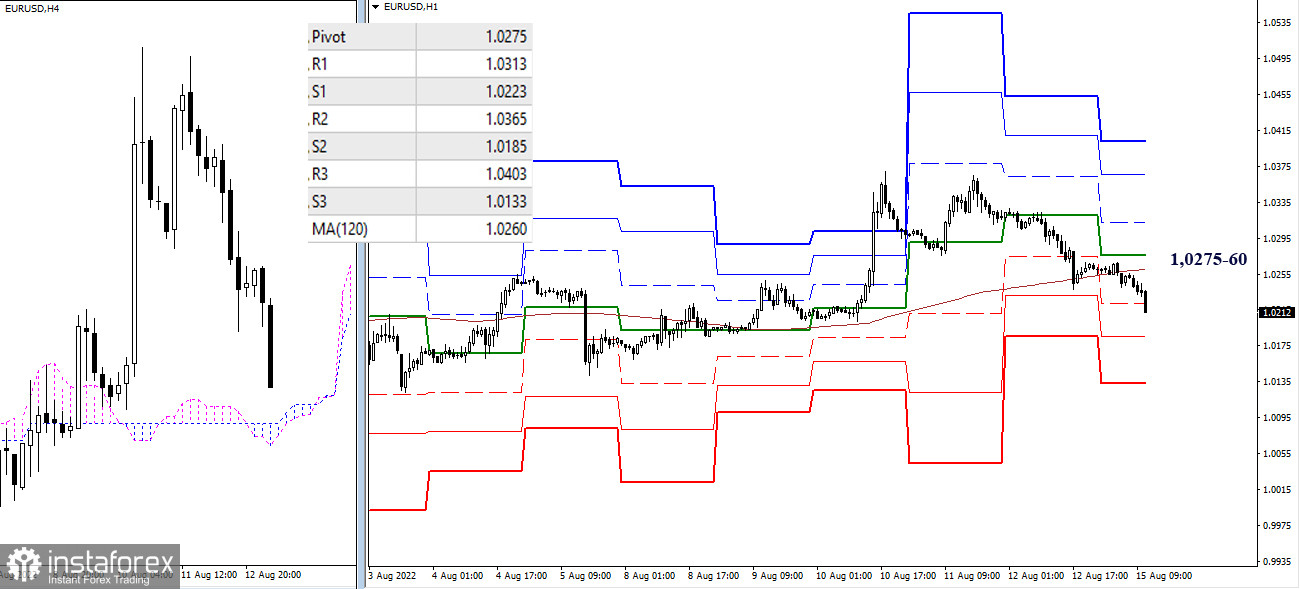

H4 – H1

The advantage of lower timeframes has shifted to the side of the bears, who have overcome key supports and are now developing a decline. Bearish targets within the day in the current situation can be noted at 1.0185 (S2) and 1.0133 (S3). Key levels today play the role of resistance, located at the boundaries of 1.0275–60 (central pivot point + weekly long-term trend).

***

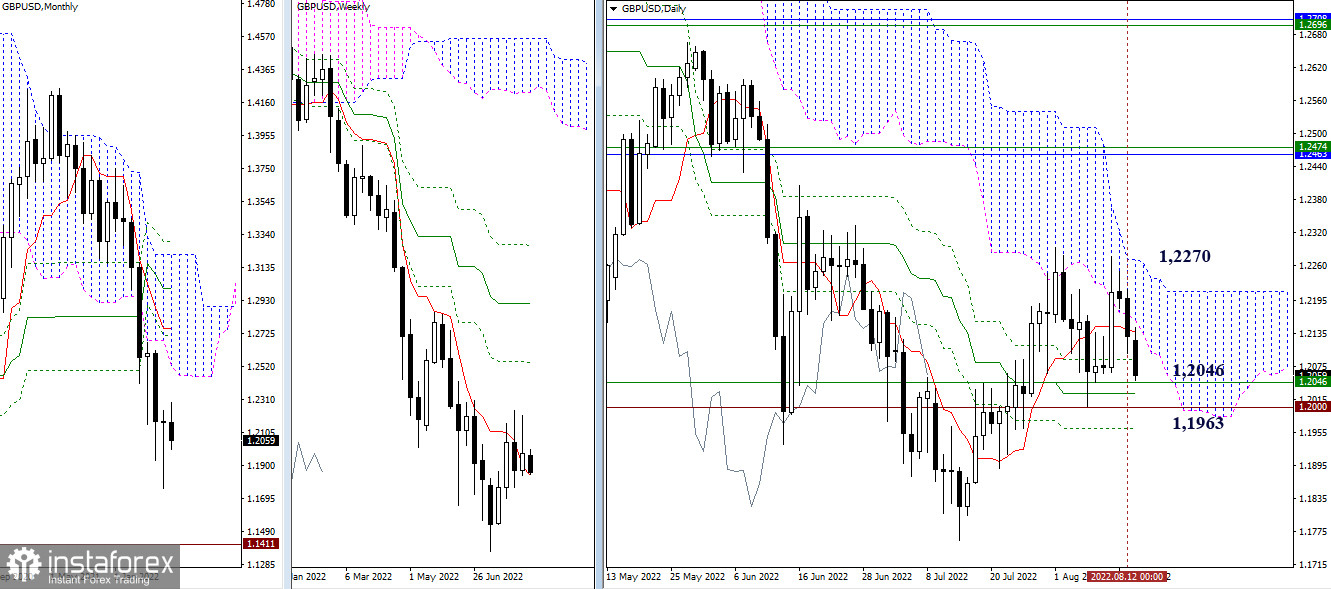

GBP/USD

Higher timeframes

Bulls failed to remain optimistic, marking a fairly long upper shadow at the close of last week. To strengthen bearish sentiment in this area, it is necessary to overcome the current support zone 1.2046 – 1.2026 – 1.2000 – 1.1963 (levels of the daily cross + weekly short-term trend + psychological level). Reliable consolidation below will allow us to consider new bearish prospects.

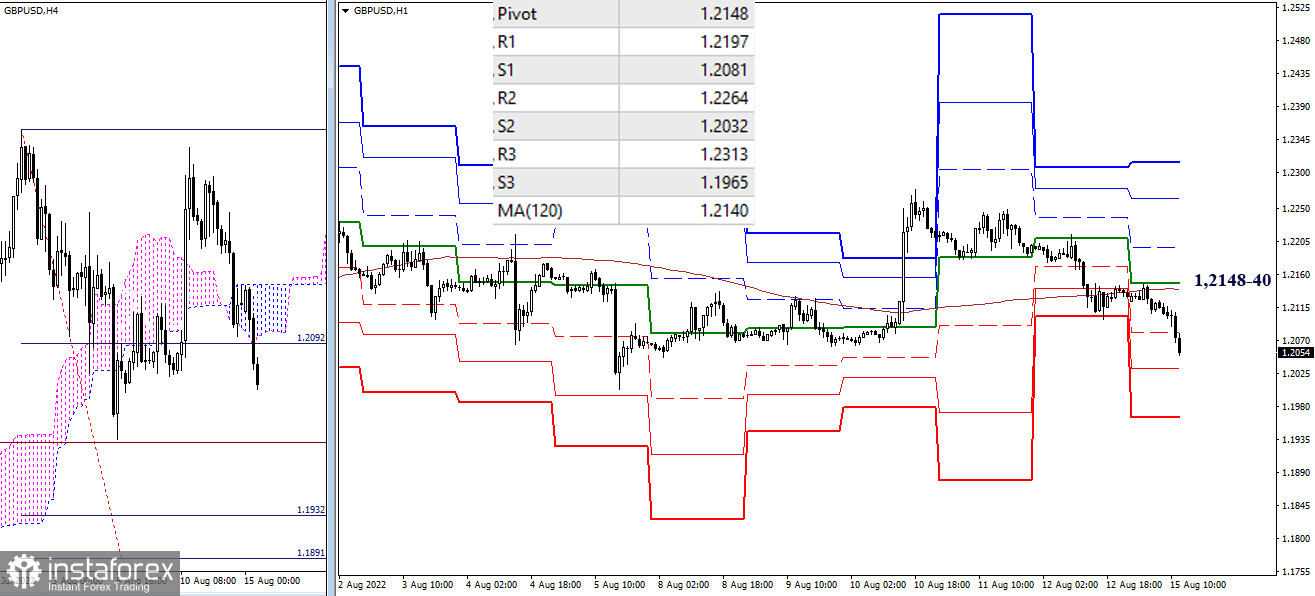

H4 – H1

At the moment, the advantage is on the side of the bears. They are developing a decline, and among the downward reference points in the lower timeframes, we can now note 1.2032 and 1.1965 (classic pivot points) and 1.1932 – 1.1891 (target for the breakdown of the H4 cloud). If the situation changes and the activity is on the side of the bulls, then their main task will be to consolidate above the key levels of the lower timeframes 1.2148–40 (weekly long-term trend + the central pivot point of the day) and further rise to the resistance of the classic pivot points (1.2197 – 1.2264 – 1.2313).

***

In the technical analysis of the situation, the following are used:

higher timeframes – Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)